Budgeting is very simple, at least in theory. We decide how much we can afford to spend, and then we don’t spend more than that. So, why are so many people in debt?

Though it sounds easy, creating and using a budget is hard. Like any skill, budgeting requires consistent practice, and many people don’t learn how to do it.

Luckily, learning to budget is something you can do at any age. The cash envelope system is one great strategy that can help adults take control of their spending. It is also easy to adapt to teach kids good spending habits.

We’ve broken down the basics of the cash envelope system, answered some common questions about the strategy, and included a range of printables that adults and kids can use to get started.

Contents:

- What Is the Cash Envelope System?

- How to Organize Your Budget with Cash Envelopes in 5 Simple Steps

- Cash Envelopes for Kids

- Cash Envelopes for Gift-Giving

- Cash Envelopes for Vacation

- Cash Envelopes for Weddings

- Cash Envelopes for Party Planning

- Cash Envelopes for Back to School

What Is the Cash Envelope System?

The cash envelope system is a budgeting strategy that asks the spender to withdraw all of the cash they intend to spend for the month and separate it into different budget categories, each contained in an envelope.

The spender only uses the cash in their budget envelopes to make any purchases in a given category, which prevents accidental overspending and ideally helps the spender slow down or avoid any impulse purchases by forcing them to be more conscious of how soon they’ll “run out” of cash.

Research has shown that people naturally spend less when they use cash. More importantly, cash envelope users are forced to look at their budget every time they make a purchase. This forms what psychologists call a behavioral “trigger” that reinforces the habit of checking one’s budget before making a purchase.

The other powerful quality of the cash envelope system is that it is updated instantly — after a purchase, the envelope automatically shrinks. The budgeter doesn’t need to update and check a document in order to see how much cash they have left; they can just look in their envelope. When the envelope is empty, the budget is spent.

How to Organize Your Budget in 5 Simple Steps with Cash Envelopes

The first step to setting up your cash envelope system is creating your budget. You can do this using your own budgeting method or you can download our free budget template that’s designed for cash envelopes.

Step 1: Calculate your after-tax income.

This is the maximum you can spend in a month.

Step 2: Write down your fixed expenses.

Fixed expenses are the things you pay the same amount for every month, like rent. Your fixed expenses don’t need a cash envelope since it’s the same each month and a place where you’re not likely to overspend.

Step 3: Set aside your savings.

Professionals recommend saving about 20 percent of your income, if you’re able.

Step 4: Choose your cash envelope categories.

Make a list of other expenses like groceries, clothes, personal care, etc., and decide how much you want to spend in each one.

Step 5: Create your cash envelopes.

Once you’ve set your budget and chosen your cash envelope categories, it’s time to create the envelopes you’ll use. With these templates, all you need to do is print, fold and tape or glue along the tabs.

You can carry the envelopes on their own or get creative with your accessories. Many people carry their envelopes in expandable coupon organizers, while others opt for specially-made wallets with built-in envelopes that are designed for use with this system.

Cash Envelope Printable (General)

Food/Grocery Envelope Printable

Entertainment Envelope Printable

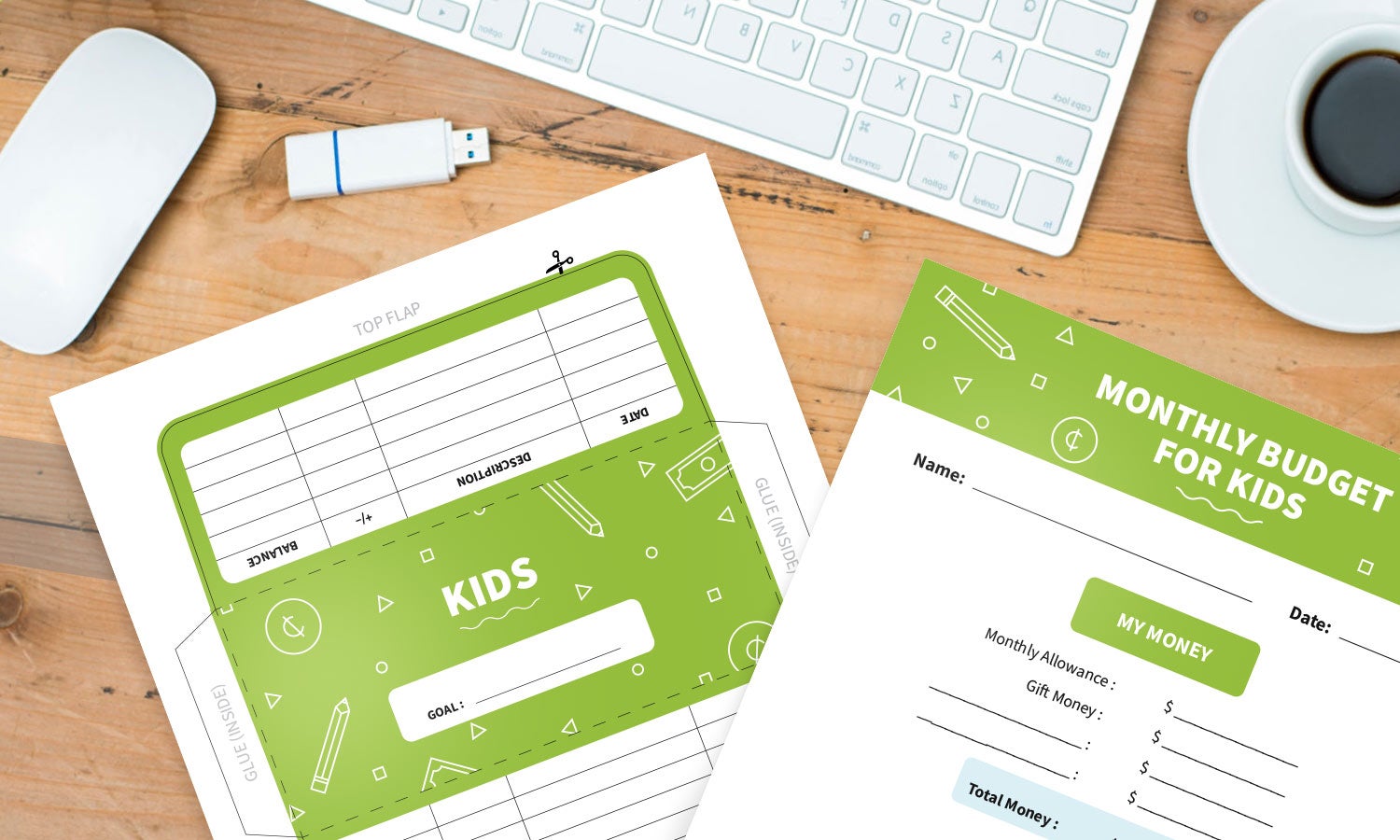

Cash Envelopes for Kids

Even though younger children don’t have any real expenses, it’s never too early to ingrain them with good saving habits. You can use cash envelopes to teach kids to organize funds they receive through allowance, gifts or payment for chores.

Cash Envelopes for Gift-Giving

The holidays can be a difficult time, especially if you’re tempted to overspend. Using a cash envelope budget can ensure your holiday spirit doesn’t break the bank.

Cash Envelopes for Vacation

Most Americans overspend while traveling. One 2017 survey found that 74 percent went into debt to pay for a vacation, and the average amount was over $1,100. Cash envelopes are one way to keep yourself in check on your next adventure.

Cash Envelopes for Weddings

Your wedding requires careful planning in order to make sure it’s perfect. That includes budgeting for all the details.

Cash envelopes aren’t helpful for things like booking a venue, since you’ll probably just write a check. But for things like wedding party gifts, guest favors, decorations for the reception, etc., cash envelopes can be a great way to keep yourself in line.

Cash Envelopes for Party Planning

Whether it’s a dinner party or a company gala, parties can get expensive and it’s easy to get carried away when planning it.

You don’t want to overspend on decorations and find you can’t afford the cake, so take the time to set up cash envelopes and make sure you can cover all your party expenses.

Cash Envelopes for Back to School

Whether you’re a parent, teacher or student, back to school shopping can be stressful. It can be difficult to afford books, supplies, lunch boxes, clothes, backpacks and everything else you need for the upcoming year.

Keeping cash envelopes can take the stress out of back to school shopping, so you can focus on gearing up for academic success.

Back to School Budget Template

Cash Envelopes Can Help Anyone Become a Budget Pro

Whether you’re teaching your child about finances or you’re looking for a new way to budget, the cash envelope system is a simple, effective way to accomplish your goals. If you’re struggling with debt, it’s essential to identify where you overspend and find a way to limit it.

Cash envelopes are one DIY strategy for gaining control over your finances, which can also help your credit. If you need help though, don’t be ashamed to ask for it. A credit advisor can help you fix mistakes on your credit report, which can lead you to a brighter financial future. With the right tools and support, good financial health is always in reach.