Disclosure regarding our editorial content standards.

You probably know that a good credit score opens doors when it comes to loan and credit card approvals. It helps you get better terms and can even help you save money on auto insurance or get a new job. But many people don’t know exactly where credit scores come from. Discover more about length of credit history below, which is one of the five major factors that impact your credit score.

What Is Credit History?

Credit history is just the record of your credit and debt. It includes what accounts you have, whether they’re open or closed, how much of the balance you’re using and whether you make payments on time. Your credit history starts once a lender begins reporting the first account to one of the three credit bureaus.

How Is My Length of Credit History Calculated?

Length of credit refers in general to the age of your credit history. But it’s not simply how long you’ve had any type of credit at all. The FICO Score model takes three factors into account when considering your length of credit history.

First, your FICO Score weighs the overall age of your credit. (That’s the average age of all your accounts, as well as how old your oldest and newest accounts are.) Second, it considers how long specific accounts, such as credit cards, have been open. And third, it considers how long it’s been since you used those accounts.

How Much Does My Length of Credit History Matter?

The age of your credit is not the most important factor in your credit score. It accounts for around 15 percent of your total score.

Whether you pay your bills on time is more important, accounting for around 35 percent of your score. How much of your credit balances you use accounts for around 30 percent, and the rest is made up by recent inquiries and whether you have a good mix of credit types.

Even though length of credit history only accounts for 15 percent, it’s still important. That slice of the pie can make the difference between just good credit and excellent credit that lets you access the best rates, rewards and loan offers.

Where Can I Find My Credit History?

You can find your credit history on your credit report. The three major credit bureaus all receive information separately from lenders, so your credit history might differ slightly with each.

You can typically order one free credit report from each of the three bureaus each year through AnnualCreditReport.com. Because of financial concerns caused by COVID-19, the bureaus are now offering free credit reports weekly through the site.

What Is Considered a Good Length of Credit History?

Seven years is a good length of credit history, especially considering closed and negative items tend to fall off your report by that time. But longer is better, and if you can demonstrate that you’ve managed the same credit card account for 10 or more years without problems, that might be attractive to potential lenders.

One of the main reasons to have a credit history is so you have a—hopefully good—credit score. Under the FICO Score model, you need at least six months of credit history with at least one account reporting in the past six months to have a score.

Should I Leave Old Credit Accounts Open?

One way to extend your length of credit history is to leave old revolving accounts open. For example, you might pay off a credit card and decide not to use it anymore because you now qualify for another card with much better rates. But if you leave that old credit card open without using it, it could help increase your credit age. If you close it, it could fall off your credit history, making it appear as if you have managed credit for less time than you have.

However, if you aren’t sure you have the willpower not to run up a balance on the card, you might want to go ahead and close it anyway. Credit utilization, after all, is a much bigger factor in your score.

Is There Anything I Can Do to Help My Credit History?

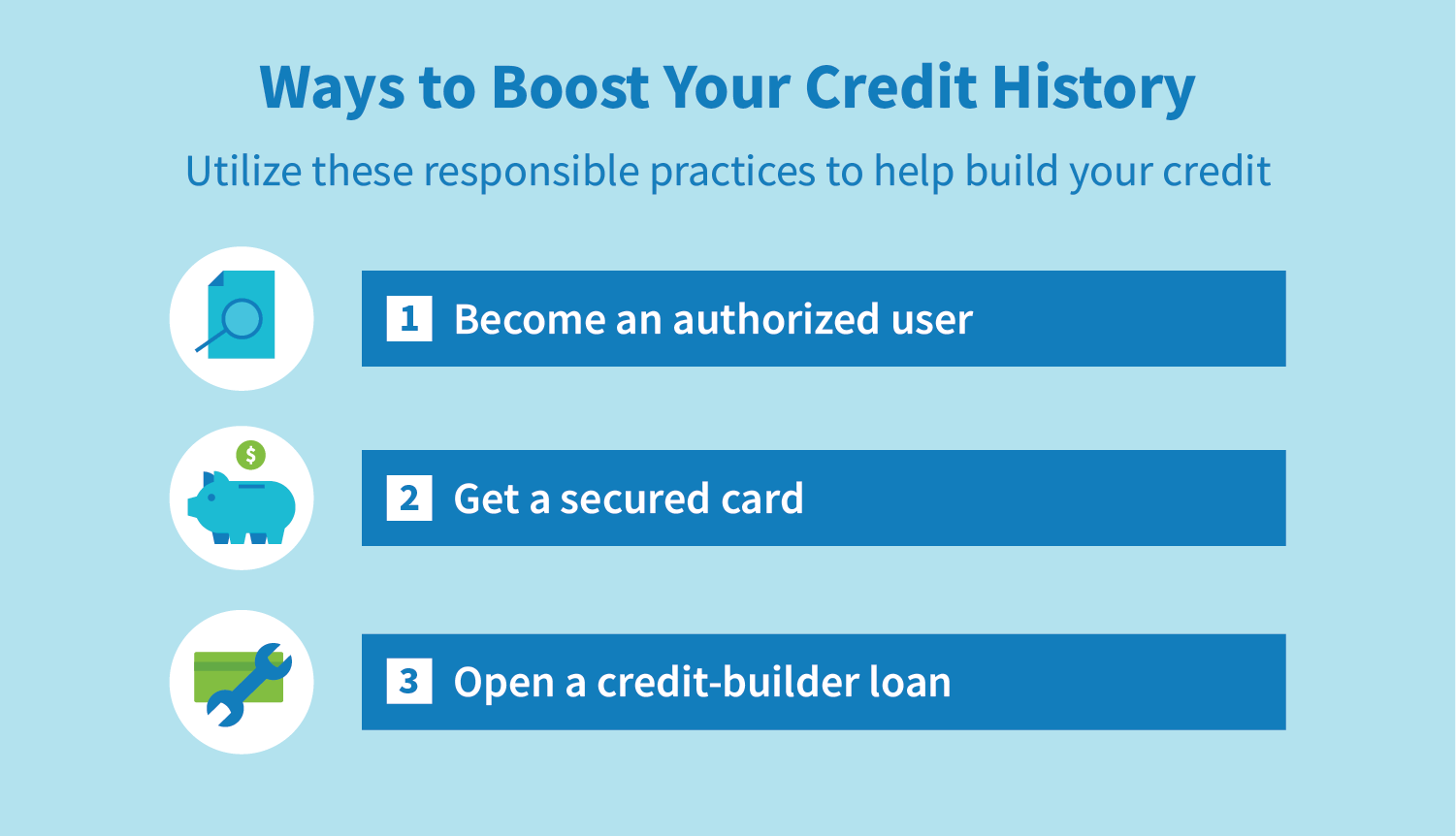

What if you’re new to credit and trying to build credit history? Without a credit score, it might be more difficult for you to get credit so you can demonstrate that you’re responsible with it. Here are some things you might consider.

Become an Authorized User

Someone who already has credit and a credit card can add you as an authorized user on their account. Make sure that the credit card in question does report to the authorized user’s credit card account. Then, you get the benefit of positive payment activity on the account.

Just make sure that you ask someone who manages their card responsibly and pays bills in a timely manner. Otherwise, you could see negative items reported to your credit history, which doesn’t do any good for your score.

Get a Secured Card

Get your own secured credit card. These are cards that are often available to people with no or bad credit. You put a deposit down to secure your credit line. Because the credit line is secured, the lender is more willing to take a chance on an unknown borrower.

You get your security deposit back typically anytime you pay off the balance and ask for it, and in many cases, you can receive a growing, unsecured credit limit just by managing your card responsibly.

When considering secured credit cards, look at factors such as annual fees and rates and choose the best terms available to you. You should also make sure the card reports to all three credit bureaus.

Open a Credit-Builder Loan

You can also work on building credit without a credit card. One way is to open a credit-builder loan. This usually involves making a deposit that’s held in a savings account for you. You pay the loan off as agreed upon, and then you get the deposit back. You end up paying interest, so the loan does cost you money. But it might be worth considering if you need to create a credit history. Once you have a credit history, keep an eye on it. Even if you’re doing everything you can to manage finances responsibly, your credit score can take a hit if inaccurate negative items are reported. If that happens, visit CreditRepair.com to find out how to dispute the information and protect your hard-won credit history.