Disclosure regarding our editorial content standards.

In addition to the experience you gain and the work you do, one of the best parts of a job is the benefits. Benefits are perks a job offers to employees, such as health insurance, paid time off and sick days. Though exact benefits differ from company to company, being a full-time employee means you get to enjoy these perks and other workplace advantages.

But if you’re looking to move on to a new position, facing a layoff or looking at retirement, you may be wondering—what happens to your benefits when you leave your job? Just like benefits themselves, the answer differs from company to company and is based on your exact circumstances.

Remember that benefits are important, especially when it comes to health insurance and health savings accounts (which run the risk of ruining your credit if you can’t afford them). Read on to learn more about what you can expect to happen to your benefits when you leave your job for any reason, or skip to the infographic below for this information at a glance.

What happens to employee benefits?

Whether you hand in your two-week resignation, are terminated or are unfortunately laid off, you may wonder what becomes of your employee benefits after your employment ends. But first, let’s dive into exactly what benefits may be of concern.

Every employer offers various benefits and perks for employees beyond their income, such as a career development budget, retirement plans, two weeks (or more) of paid vacation time and others. The biggest, and likely most important, benefit is health insurance. This includes dental, vision and general health insurance that can help make medical bills more affordable.

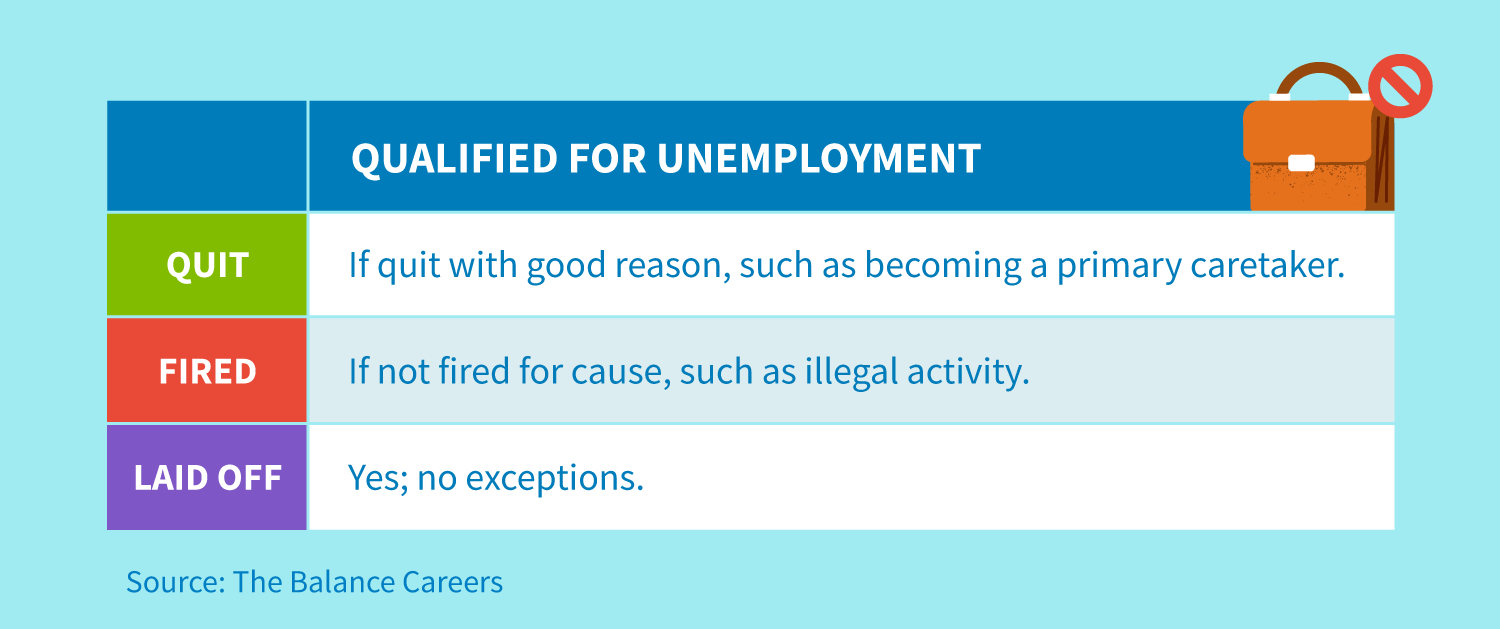

When you leave your job, you’ll want to be prepared for what will happen to these benefits. Regardless of what happens, if you’re left without a job, you’ll want to make sure you’re qualified for and then file for unemployment benefits as soon as you can. This helps support you and your loved ones in the interim while you search for a new position.

Read on for more information about what happens to your benefits in every scenario, from you leaving voluntarily to you being furloughed.

When you quit

Except for those that have found their dream job, everyone will likely turn in a two weeks’ notice at one point. Generally, when you leave your job you do so of your own volition, whether you found a new opportunity, you’re retiring, you’re relocating or you aren’t enjoying the work anymore. Especially if you don’t have another position with benefits lined up after your resignation goes into effect, you may wonder what happens to your benefits after leaving.

Luckily, you have a few options when it comes to your benefits, particularly health insurance—but more on that later. When you quit, some of your benefits (including dental and vision insurance) will end either on your last day or continue through the end of your final month.

Pension and retirement plans

After quitting, ask your human resources representative if you’re eligible to receive pension and retirement benefits after quitting. If you’re enrolled in a 401(k) or other contribution-sharing program, some plans may provide for a lump-sum distribution of your earned retirement money after you leave. If you’re enrolled in a defined-benefit plan that starts at retirement, your benefits kick in once you retire, regardless of where you were employed before retiring.

If your pension was paid by your employer, see what their options are for continued payments. Some companies will continue to pay you, either in a lump sum paid once or staggered payments paid out over time, known as an annuity.

How long do you have health insurance after leaving a job?

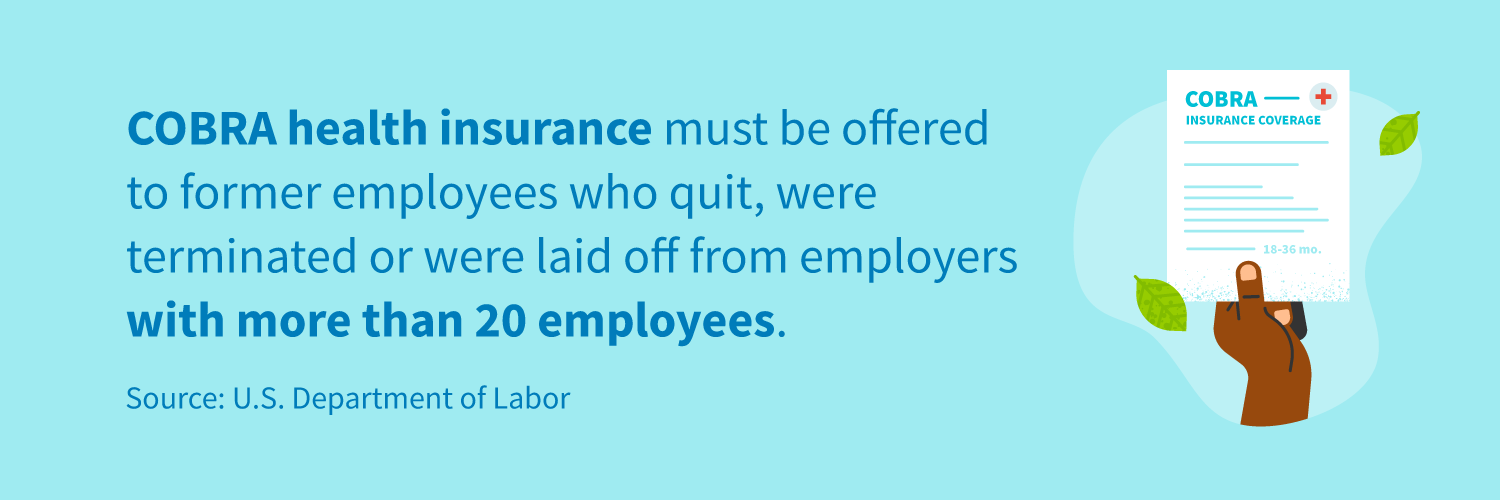

If you quit your job without another one with benefits lined up, it’s worth wondering how long you have health insurance after you resign. After leaving a job, you can have health insurance for up to 36 months with the COBRA health insurance option.

COBRA health insurance

Otherwise known as the Consolidated Omnibus Budget Reconciliation Act, COBRA insurance allows qualified employees to maintain their current health insurance plan for 18 to 36 months if the company has more than 20 employees. COBRA is available to every qualified employee, regardless if they quit, were fired or were laid off.

You must opt in to COBRA within 60 days of leaving, and coverage is retroactive—meaning regardless of when you opt in, it will apply back to the date you lost your benefits.

COBRA helps you keep your current doctor and covered prescriptions, though users will be responsible for covering their entire health insurance premium. COBRA rates also include a two percent administrative fee on top of the premium fees. This is a good option to consider for employees who aren’t immediately returning to work, who had to quit for an outside reason or who are entering retirement.

When you’re fired

Sometimes a job isn’t a good fit or you don’t click with your superiors. As much as getting fired can sting, keep in mind that it happens to the best of us—and it could open you up to a new opportunity that’s a much better fit for you.

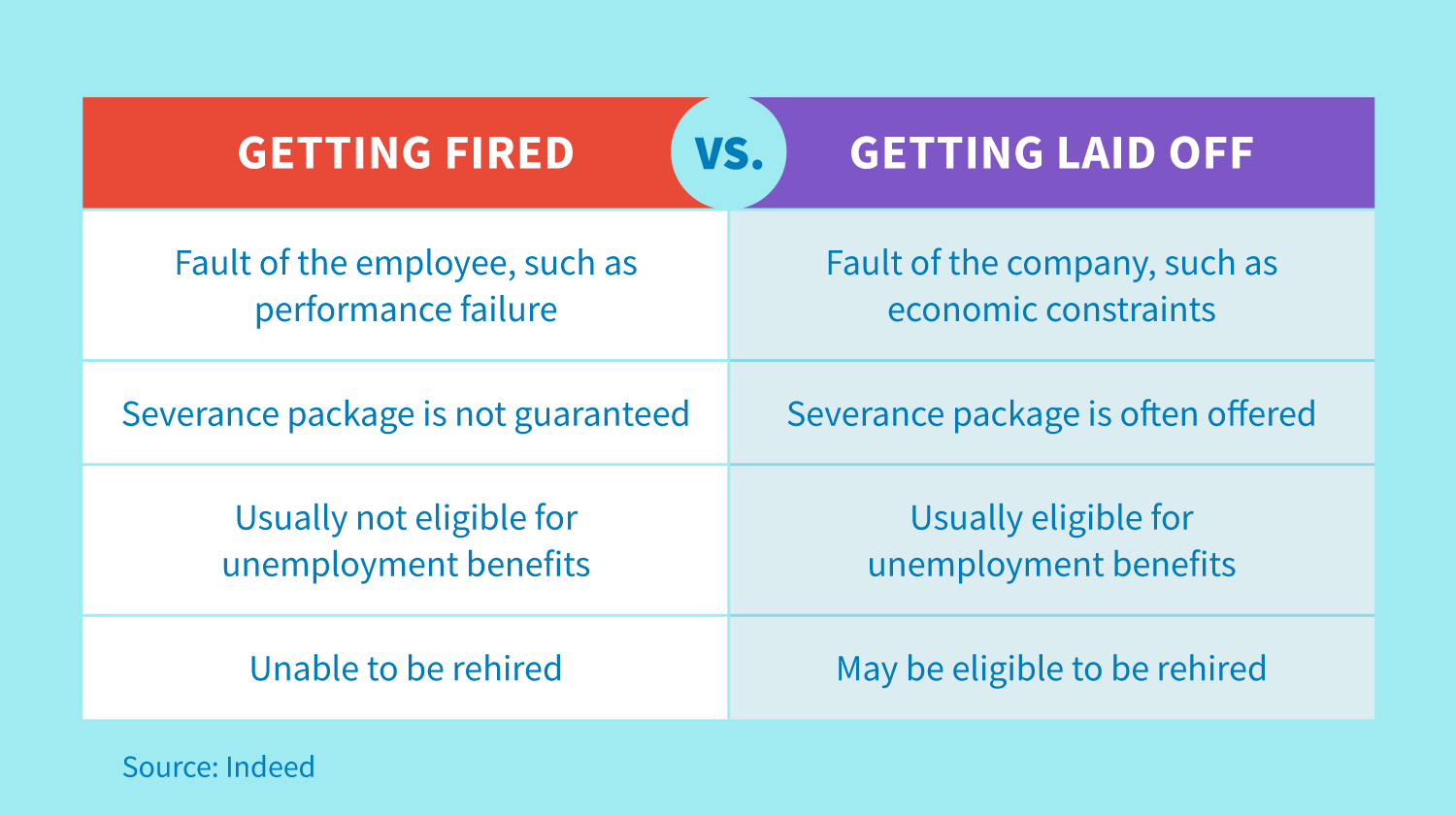

As long as you weren’t fired for bad or unlawful acts (such as stealing or violence), you’re entitled to certain unemployment benefits. These benefits differ state to state, so check to see if you meet your state’s unemployment benefit criteria.

Additionally, some employers may offer a severance package to ease the transition, though this is not required. This could look like additional pay and access to your benefits for a set number of weeks or months. Every employer with more than 20 employees is required to offer COBRA insurance to terminated employees for up to 18 months. Coverage of premiums is not included in COBRA, though it could be negotiated as part of a severance package.

When you’re furloughed

A furlough is a temporary, unpaid leave of employees due to circumstances beyond the control of the company, usually economic conditions. Furlough can be mandatory, or employees can offer to be furloughed to prevent other coworkers from losing their pay. A prominent example of this is the airline industry in 2020, which had to furlough thousands of employees due to COVID-19 affecting air travel.

Being furloughed doesn’t mean you’ve been let go or fired. This means that the company cannot afford to pay you, but they are not terminating your employment. However, whether or not you still have access to your benefits is completely up to your individual company. Some employers will suspend your paycheck but continue to pay for healthcare costs, but others will stop paying for both your paychecks and your benefits.

After you’ve been furloughed, ask your human resources representative whether your benefits are still available. If they are, then you can cease worrying, but if they aren’t, ask your representative how long they expect you to be furloughed. If you have preexisting conditions and need health insurance, then you’ll likely want to find another insurance option for the interim.

When you’re laid off

Getting laid off differs from being fired or terminated. Your employment with a company is still ending, but it’s through no fault of your own. Usually, a company will lay employees off due to economic crises, budget cuts or other scenarios where they need to preserve some money by reducing the number of salaries they need to pay.

Though this doesn’t make getting laid off hurt any less, knowing that your benefits are protected should help ease you into the transition of job hunting. With a layoff, employers will usually offer a severance package where you’ll continue getting paid for a set number of pay periods.

You also have several options when it comes to protecting the more important benefits, like health insurance and your retirement plan. Generally, you’ll have the same access to COBRA health insurance and your pension after getting laid off that you do when you quit your job.

COBRA health insurance

COBRA is a great option if you’re laid off unexpectedly and won’t have another insurance policy picked out for a while. This way, you and your family are protected while you shop around for insurance with the best coverage options.

Pension and retirement plans

If your position had a dedicated pension plan, you have a few options when it comes to negotiating your severance package. Since they’ll continue paying you for a set number of weeks or months, you can choose to either take the pension amount in one lump sum or receive an annuity.

How job loss may impact your credit

Leaving or losing a job can be scary, especially if it happened without warning. Being left to file unemployment and find a new job can be overwhelming, but you can rest easy knowing that for the most part, job loss or unemployment won’t directly impact your credit. In fact, credit bureaus won’t know you lost your job unless you let them know.

However, there are some ways that job loss can indirectly affect your credit score. For example, losing your main source of income can impact your ability to pay your credit card bill or pay for things outright, meaning you may need to purchase things like groceries or gas with credit cards. Here are some ways job loss may impact your credit score, as well as some advice on how to make sure that doesn’t happen.

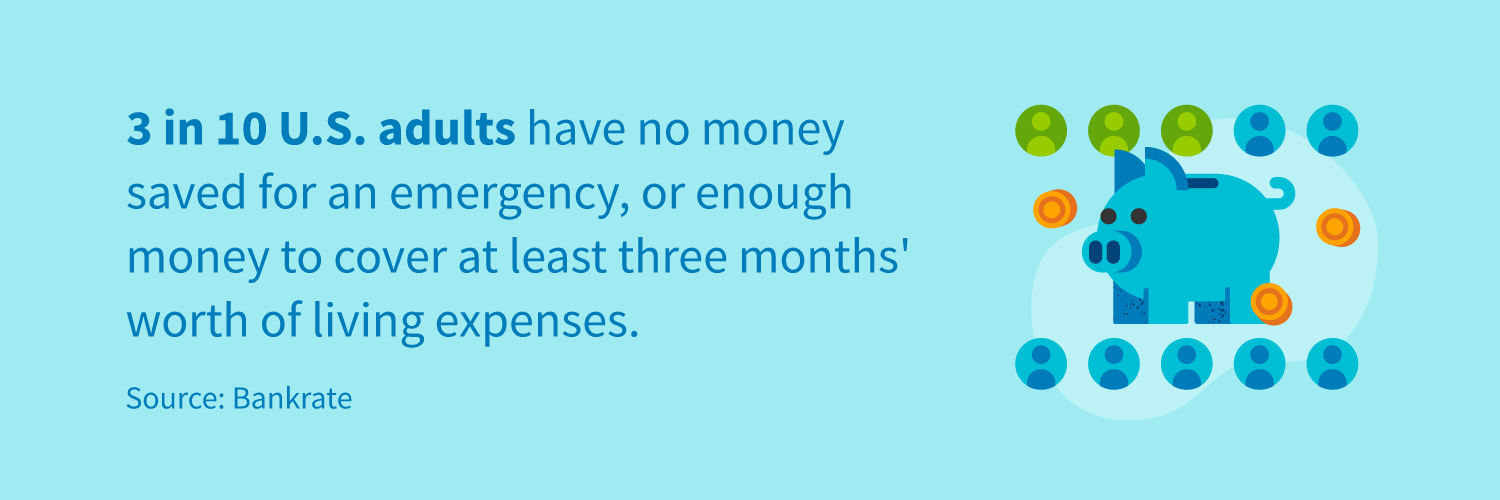

1. Failing to pay your bill

If you need to resign very suddenly or are unexpectedly laid off, you may not have had time to plan for being out of work—especially when it comes to having an emergency fund or backup plan. When balancing bills, rent, food and other payments without a salary, you may need to make a tough decision and put your credit card or loan payments on hold (or fail to pay them altogether).

Consistently late payments will reflect poorly in your payment history, which is one of the five factors used to compose your credit score. Payments over 30 days late get reported to credit bureaus, so the good news is that you won’t be penalized if you’re only a few days behind.

Advice: Reach out to your creditors and let them know what’s going on. They may have a hardship option, or they may give you the opportunity to defer payments or lower copayment amounts until you’re in a position to make regular payments.

2. Opening up new accounts

When you unexpectedly find yourself without a reliable salary, it can be tempting to open up new accounts or take out new loans to have quick access to money, and worry about paying it all back (or cancel the card altogether) at a later time.

However, opening new lines of credit, especially multiple ones at the same time, can harm your credit in a few ways:

- Credit report inquiries, which account for 10 percent of your overall credit score, will lower your score, especially if you open several new accounts at once.

- Credit age, which makes up 15 percent of your credit score, will be lowered when you open a new account.

Advice: Have an emergency credit card ready to go for circumstances like this. Though you should still be wary about financing a lot of things on one credit card, having a dedicated card you’ve already signed up for (and know you can afford) can help alleviate the financial stress of this situation.

3. Increasing your balance

Another option many suddenly unemployed people turn to is increasing their credit limit. After all, it’s not opening up a new account, and it shows your creditor you’re interested in continuing to spend—could it really hurt your credit?

Unfortunately, higher credit balances can in turn lead to higher debt amounts. Considering that level of debt makes up 30 percent of your credit score, you should be cautious about raising your credit limit to have more money to spend and make ends meet.

Advice: Have an emergency fund that you regularly contribute to just in case something like this happens. This differs from a traditional savings account in that it’s used strictly to give you some financial security in the event of an emergency, such as job loss, an accident or another event that threatens your finances.

Leaving your job (whether by choice or not) can be an overwhelming time, especially if you don’t have another position picked out quite yet. Luckily, you can take these steps and more to ensure that your benefits are protected and your family won’t need to finance your next moves on credit alone.