Disclosure regarding our editorial content standards.

For many people, college is the first time they’re left alone as a young adult to learn, grow and make big decisions. In addition to deciding what classes to take, what major to pursue and what internships to apply for, many college students may need to decide whether or not to sign up for a credit card, especially if they have no credit score.

Though there are many credit cards specifically designed for college students and young adults, the decision of whether or not to sign up for one can be daunting. Having a credit card is a big responsibility, and there can be many serious repercussions, such as lifelong debt, if your card isn’t paid off in a reasonable time frame.

This can be a tough decision to make, which is why being fully informed is important. Here are 48 statistics on college student credit card debt to help the college student in your life make the most educated credit decision possible.

Be sure to check out the infographic for more information on how to financially survive your first year of college.

Table of contents:

College student credit card debt at a glance

Undergraduate student credit card debt

Additional college student credit card debt statistics

How to set yourself up for smart credit card use

College student credit card debt at a glance

Here are some statistics that help set the scene for what sort of debt college students are facing.

1. Of college students with credit cards, 36 percent have $1,000 or more in credit card debt (EVERFI).

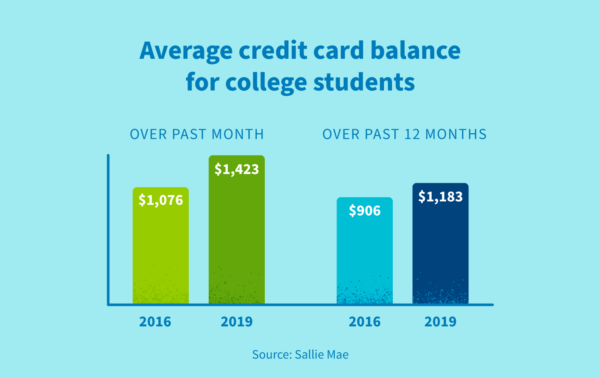

2. Over the course of 12 months, the average credit card balance for a student is just over $1,180 (Sallie Mae).

3. On average, the monthly credit card balance for a college student is around $1,420 (Sallie Mae).

4. The average number of credit cards owned by millennials is 3 (The Ascent).

5. The average college student credit card balance over 12 months increased by $277 from 2016 to 2019, from $906 to $1,183 (Sallie Mae).

6. The average monthly balance for college students with credit cards increased $347 from 2016 to 2019, from $1,076 to $1,423 (Sallie Mae).

7. The median credit limit for millennials is $7,500 (The Ascent).

8. 50 percent of millennials have maxed out their credit limit at least once (The Ascent).

9. 18 percent of college students have used credit cards to pay for college expenses (The Ohio State University).

10. Just over 51 percent of college students with credit cards have plans to pay their credit card bill down in full (EVERFI).

11. About 33 percent of millennials have been a victim of credit card fraud or identity theft (The Ascent).

12. 23 percent of college students use credit cards to pay for big-ticket items to pay off over time (Sallie Mae).

Undergraduate college student credit card statistics

Many undergraduate students sign up for a credit card for a variety of reasons, whether that’s to establish credit for the first time or to help ease the cost of day-to-day necessities. Read on for more information on what sort of credit card debt undergraduate students (typically freshmen to seniors in college) are carrying.

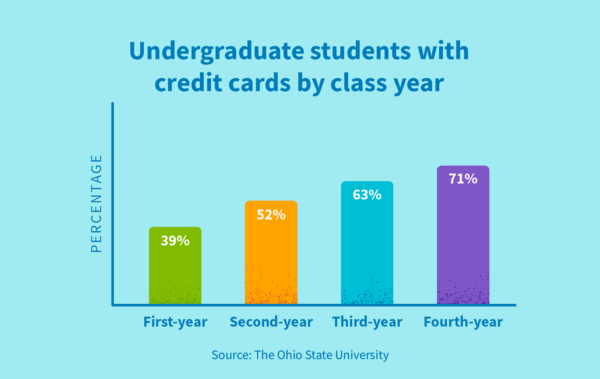

13. When broken up by class year, the following percentage of students have credit cards (The Ohio State University):

- First-year undergraduate: 39 percent

- Second-year: 52 percent

- Third-year: 63 percent

- Fourth-year: 71 percent

14. 53 percent of undergraduate college students pay the full balance on a credit card bill, while 32 percent make at least the minimum payment but not the full balance (The Ohio State University).

15. College students who reported feeling very stressed about their finances accumulate the most credit card debt, at approximately $4,000 (College Finance).

16. The same study found that college students who are stressed about their finances incur around $3,000 more in debt than their peers that do not report feeling stressed about their finances (College Finance).

17. Over 55 percent of recent college graduates admit to not using a budget during college (College Finance).

18. Recent college graduates that did use a budget while in college ended their college career with approximately $7,000 less in debt than those who did not budget (College Finance).

19. 14 percent of undergraduates admit someone else pays their credit card bill, and two percent pay less than the minimum monthly payment (The Ohio State University).

20. 42 percent of recent college graduates who were stressed about their college finances say they incurred too much debt while in college (College Finance).

Additional college student credit card statistics

Beyond debt figures, it’s important to know other statistics surrounding college student credit card use—including how many have credit cards, why they signed up for credit cards, why they use them and more. Knowing these things will help you make more informed decisions on whether or not a credit card is right for you.

How many college students have credit cards?

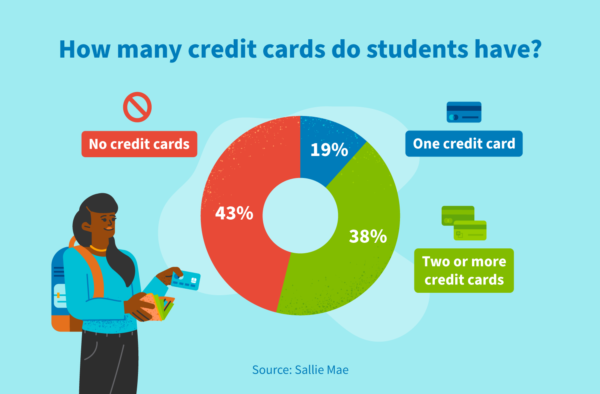

21. 38 percent of college students have two or more credit cards, 19 percent have one card and 43 percent do not have a credit card (Sallie Mae).

22. About eight percent of college students have four or more credit cards (The Ohio State University).

23. 61 percent of college students acquired their first credit card at 18 or younger, suggesting that many students choose to begin building credit as they transition to higher education (EVERFI).

24. 57 percent of college students have and regularly use a credit card, while 85 percent have and regularly use a debit card (Sallie Mae).

25. The most popular type of credit cards for college students are the following: (Sallie Mae)

- Independent card in own name: 64 percent of students

- Secured credit card: 28 percent

- Authorized user for parent: 25 percent

- Card with a cosigner: 17 percent

26. 34 percent of college students have a credit card their first year in college, while 65 percent have a credit card by the end of their senior year (EVERFI).

Why do college students sign up for credit cards?

27. 58 percent of college students signed up for their first credit card to start building credit, while 29 percent wanted an easier way to order things online and 25 percent were interested in earning credit card rewards (Sallie Mae).

28. Almost 74 percent of college students receive financial advice from parents or guardians, while 61 percent attribute their money management skills to lessons learned from parents or guardians (The Ohio State University).

29. When it came to choosing their first credit card, 35 percent of college students went with the card recommended by a parent or guardian, while 34 percent chose a card with easy approval (Sallie Mae).

30. 46 percent of college students signed up for an additional credit card to improve their credit score, 40 percent wanted to earn new or different rewards and 29 percent wanted to increase their credit limit (Sallie Mae).

31. On average, college students were 17 years old when they were first added to a parent credit card and 19 when they obtained their own card without a cosigner (Sallie Mae).

How do college students use their credit cards?

32. 45 percent of college students who have credit cards alternate between two separate cards (EVERFI).

33. Only 11 percent of college students say their credit card is only used for emergencies (Sallie Mae).

34. 44 percent of students admit to using their credit card for everyday purchases on a regular basis (Sallie Mae).

35. Students are more likely to use their credit cards over other forms of payment when buying out-of-home entertainment (31 percent), making in-store purchases more than $20 (32 percent) and online purchases greater than $20 (34 percent) (Sallie Mae).

36. 50 percent of students use their credit cards for online purchases, while 32 percent use their credit cards for recurring bills (Sallie Mae).

37. College students own a median of two credit cards (Sallie Mae).

38. Card card use by college students increased by 1 percent from 2016 to 2019 (Sallie Mae).

How do college students feel about their credit cards and financial readiness?

39. 74 percent of college students either agreed or strongly agreed that their personal finances were a source of stress (The Ohio State University).

40. 55 percent of college students with credit cards agreed it is easier to balance their budget when using a debit card rather than a credit card (Sallie Mae).

41. 63 percent of people aged 18 to 34 report high levels of financial anxiety, the highest amongst survey respondents (U.S. Financial Capability).

42. Nearly one-third of recent college graduates stated they were either completely unprepared or mostly unprepared to handle finances while in college (College Finance).

43. 65 percent of college students are optimistic about their financial futures (The Ohio State University).

44. 39 percent of college students self-identified their money management skill levels as “good,” while 32 percent ranked themselves as “average” and 20 percent self-identified as “excellent” (Sallie Mae).

45. 59 percent of students with credit cards self-identified their money management skills as good or excellent, while 32 percent of students ranked their skills as average (Sallie Mae).

46. 24 percent of college students do not know their FICO score, while 19 percent do not have one (Sallie Mae).

47. Over half of students taking out student loans report having some worry regarding their debts (EVERFI).

48. Only 35 percent of students report having ever taken a personal finance class throughout their high school education (EVERFI).

How to set yourself up for smart credit card use

Going to college is all about learning and growing, and much of that growth happens financially. To help you start on the right path for smart credit card usage and avoid a bad credit score, here are 10 tips and resources to get you started.

- How to cancel a credit card

- How to pay your credit card bill

- How to read a credit report

- How to start building credit when you turn 18

- What credit score do you start with?

- What is a good credit score?

- What is a line of credit?

- What is credit history?

- Understanding the credit score range

- Understanding how your credit score is calculated

These statistics make it clear that signing up for a credit card in college is not a decision to be taken lightly. Hopefully, you or the college student in your life can use these debt statistics to carefully weigh whether or not signing up for a credit card right now is a good move. You can even use these as inspiration to create an actionable repayment plan to prevent debt from piling up and leading to worse consequences, like needing to fix your credit down the line.

In addition to knowing what sort of company you’ll be in as a college student, it’s also important to know how to make smart decisions related to your finances in college. Our visual below covers how students can both survive and thrive when it comes to managing money in college.