Disclosure regarding our editorial content standards.

A credit score is a number from 300 to 850 that depicts a consumer’s creditworthiness. A FICO Score is a specific type of credit score that uses a different scoring model based on data in your credit report.

If you’ve ever applied for a credit card, an auto loan or a mortgage, you know that one of the main requirements in the process is to share your credit score. Lenders require a credit score because it tells them about your creditworthiness, or how likely you are to pay back a loan based on your credit history in your credit report.

Given the variety of credit scores available, there is often confusion around which score to use. Lenders most frequently use Your FICO® Score. In fact, 90 percent of top lenders use FICO Scores to make loan decisions.

Keep reading to learn more about FICO Scores vs. credit scores, as well as how to improve your score so you can look promising to lenders.

Quick review: what is a credit score?

A credit score is a number ranging from 300 to 850 that depicts a consumer’s creditworthiness. Basically, a credit score predicts how likely you are to pay back a loan on time.

A higher credit score often indicates that you borrow and repay your debts on time—which is a good sign to lenders. On the other hand, a lower credit score may signal to lenders that you are having problems managing your debt.

Your credit score is calculated in a variety of methods, which is why it may appear differently from one source to another. That’s where credit scoring models come in, one of the most popular being FICO Scores.

What is a FICO Score?

A FICO Score is a type of credit score that is based on the data in your credit report. The company that created this scoring methodology is known as Fair Isaac Corporation, or FICO.

This score is frequently used for significant loans, including home mortgages and auto loans, but it’s also common for background checks or rental property applications.

How are FICO Scores calculated?

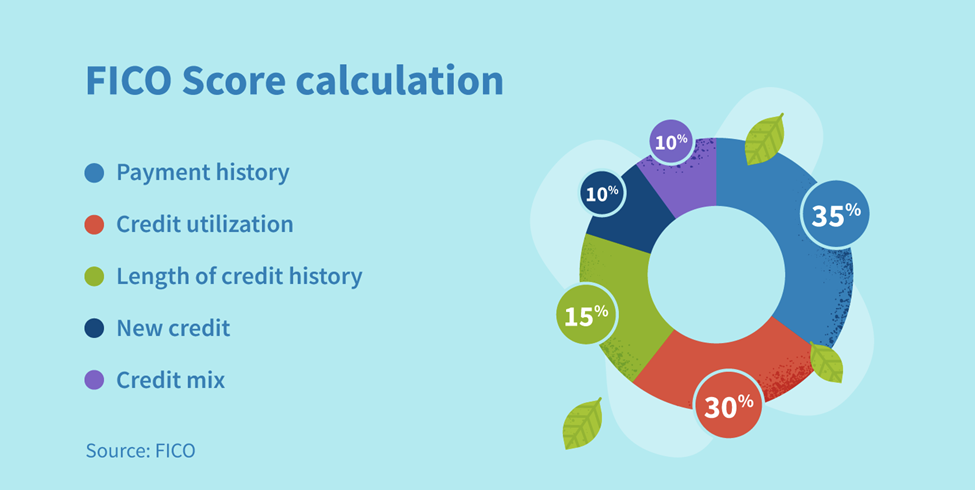

How is a FICO Score determined, then? FICO uses five different categories to calculate your score.

Here’s a breakdown by percent:

- Payment history (35 percent): Your track record of timely and full debt repayment (which is important to stay on top of so you don’t harm your score)

- Credit utilization (30 percent): Your debt-to-available-credit ratio (lower percentages are better)

- Length of credit history (15 percent): How long you’ve had active credit accounts

- New credit (10 percent): How much new credit you’ve applied for

- Credit mix (10 percent): Your credit mix, including your credit cards, auto loans, student loans, etc.

It is always in your best interest to make all of your payments on time and in full as payment history has the most impact on a FICO Score.

What is a good FICO Score?

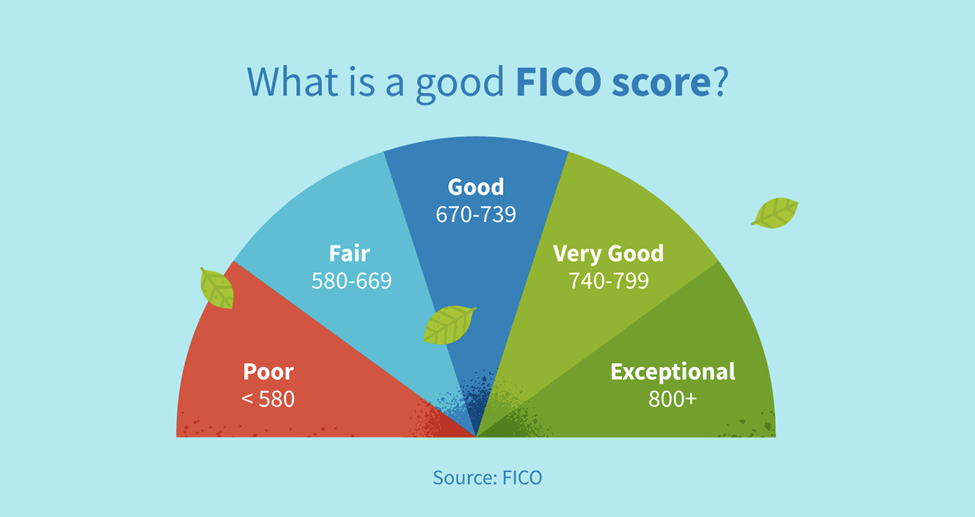

A good FICO Score is generally at least 670.

A FICO Score ranges from 300 to 850, with 300 indicating a “poor” or low score and 850 indicating an “excellent” or high score.

A FICO Score of at least 670 is generally regarded as good. If your score falls above this number, you may be eligible for loans with fair or even low interest rates.

On the other hand, a credit score below 670 is regarded as fair or poor and makes it more difficult to obtain a competitive interest rate. If your score is extremely low—typically at or below 580—you can potentially be turned down for a loan.

FICO Score vs. credit score: what’s the difference + which is better?

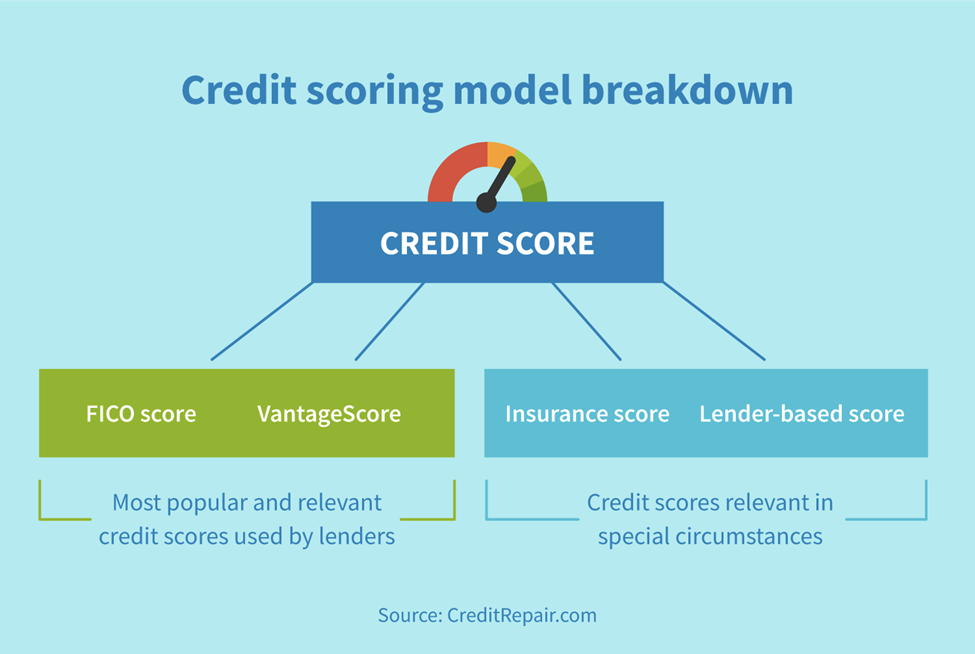

So, is a FICO Score the same as a credit score? Essentially, a FICO Score is a type of credit score. The main difference between a FICO Score and other credit scores is how they are calculated.

When determining which credit score is better, it really depends on how the scores are being calculated and what they are being used for. Like mentioned before, FICO Scores emphasize payment history, credit utilization, credit age, credit mix and credit inquiries to help lenders determine your likelihood of repaying loans. Other credit scoring models, such as VantageScores, consider different factors to make the same determination.

Similar to FICO Scores, VantageScores have a range of 300 to 850, but the weighting factors differ slightly from FICO:

- Payment history (32 percent)

- Credit utilization (23 percent)

- Balances (5 percent)

- Depth of credit (13 percent)

- Recent credit (10 percent)

- Available credit (7 percent)

In order to determine whether a borrower will be likely to repay their debt, a lender may choose to use VantageScores if they are more concerned with credit use and debt levels.

Really, the score you use depends on the lender’s preference, but you can’t go wrong by using your FICO credit score or VantageScore. There are other alternative credit scores such as insurance and lender-based scores, but those are only relevant in special circumstances. Read our post on the different types of credit scores to learn more.

FICO Score vs. credit score: FAQ

Is a FICO Score the same as a credit score?

A FICO Score is essentially a kind of credit score. A FICO Score and other credit scores are calculated differently, which is the fundamental distinction between them.

Is a FICO Score better than a credit score?

What matters most when deciding which credit score is better is what they are used for.

Lenders may choose to use FICO ratings over other scores to assess a borrower’s likelihood of repaying their debt. However, if credit utilization and debt levels are more important to them, they might decide to use VantageScores.

Why do I have different FICO Scores?

Your credit score may differ from one source to another because it is calculated differently depending on which scoring model you use.

How can I improve my FICO Score?

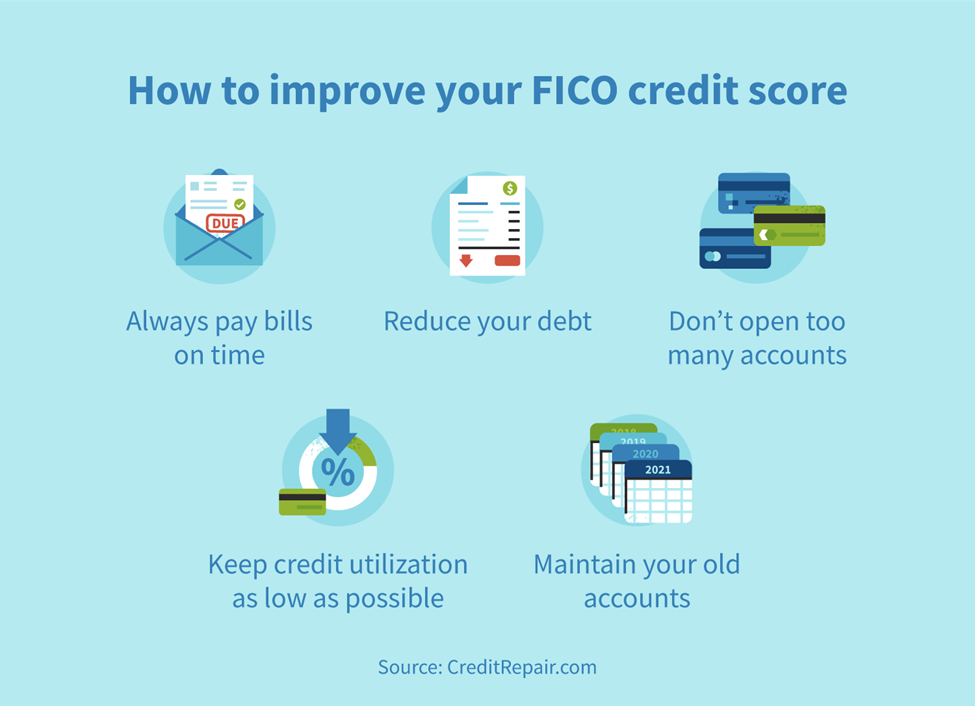

If you discover you have a poor FICO Score, don’t fret. It’s never too late to make improvements.

Here are some actions you may take to improve your credit score:

- Always pay bills on time: To prevent late payments, sign up for online payments and, if your bank or lender offers it, enroll in automatic reminders.

- Reduce your debt: Make sure to pay off your debts with the highest interest rates first, and only the minimal amount on your debts with lower interest rates. Try to pay off revolving debt as well, such as credit card debt, to demonstrate your ability to make the same payment each month.

- Don’t open too many accounts: Even though your credit mix affects your score, acquiring too many credit accounts too quickly will make you appear risky. Only open a credit card if you need it.

- Keep credit utilization as low as possible: Spend no more than 30 percent of your total credit limit, ideally less, on any one account.

- Maintain your oldest accounts: Even if you aren’t using your accounts, keep them open to maintain the age of your credit.

Lenders can use FICO credit scores and other credit scores as a forecast tool to assess your capacity and resolve to repay debt. No matter the credit scoring model lenders use, it’s critical to think about how you can obtain the highest score possible.

Don’t be discouraged if you’re looking through your credit report and you don’t like what you see. Create financial objectives for yourself to help you better your credit over time. If you need assistance with your credit, CreditRepair.com will help you in disputing errors and monitoring your credit on your behalf.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263