Disclosure regarding our editorial content standards.

To cancel your credit card, pay off the balance first. Then, call your credit card company to close the account and request a zero balance letter. After you’ve closed the account, destroy your card and monitor your credit score for changes.

Picture this: You just moved out, and to celebrate your newfound independence, you go out to buy a chic mid-century bed frame. You start having second thoughts when you see the price tag. Then the salesperson tells you about their credit card with deferred interest for 12 months. The bed frame goes home with you that day.

Unfortunately, you didn’t read the terms. A year later, you haven’t yet paid the bed frame off and find out you’re now responsible for a 25 percent interest rate. The smart thing to do is pay it off ASAP and close the high-interest account, right?

Maybe—but you also may be better off keeping that card in your sock drawer instead. Depending on your financial profile and spending habits, it’s worth considering the implications of your credit score in either case.

We’ll help you decide which option is right for you and show you how to cancel a credit card by following the steps below:

- How to cancel a credit card in five steps

- Is it bad to close a credit card?

- Should I close my credit card?

- FAQ

How to cancel a credit card in five steps

To cancel a credit card, you should first pay off the account in its entirety so you have a balance of zero. Next, call your credit card company and get a zero balance letter for your records. Finally, you should cut up your card and continue checking your credit score to confirm the issuer reported the cancellation.

Before closing the account, it’s important to understand that closing it may affect your credit (more on that later). But if you’re ready to cut the cord (and the card), here’s how.

Step 1: Pay your balance down to zero

The first step, and arguably the most important, is paying your credit card balance in full. Check your statement or contact your issuer to confirm the final balance amount including outstanding fees and interest payments. If you don’t pay the entire amount, the interest and fees can continue to accumulate.

If you have a rewards card, make sure you’ve collected all redeemable rewards. Rules will vary by program, and in some instances, you may be able to transfer rewards balances. If not, use any remaining cash-back rewards or points before canceling your credit card.

What to do if you can’t pay your full balance

If closing a credit card with zero balance isn’t an option right now, consider freezing the card until you can pay the total amount, or transfer the balance to another credit card with better terms. Make sure there are no automatic payments linked to the credit card and that all authorized users are aware the account is being closed.

Step 2: Call your credit card company

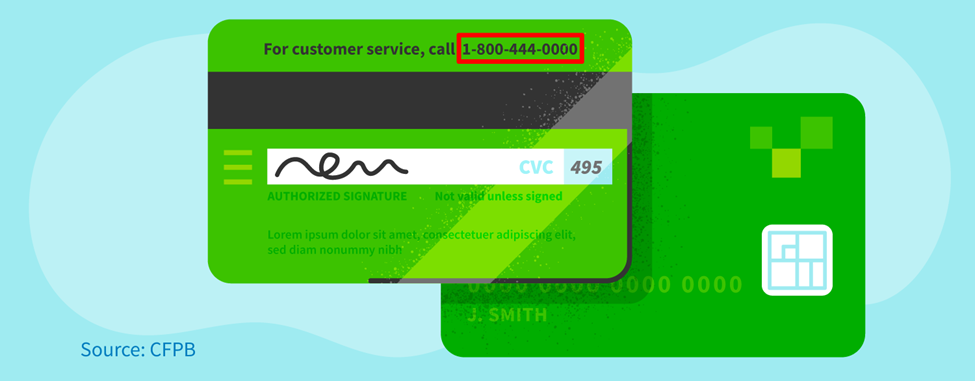

Next, find the customer service number of your issuer on the back of your credit card and speak to a representative. Let them know you want to close your account, and be prepared for them to try to talk you out of it with promotions and offers.

Make note of the date and time you made the call—you’ll need that information for the next step.

Step 3: Get a zero balance letter

Even though the card issuer’s representative should close the account in question during your phone call, it’s a good idea to get the confirmation in writing.

To request written confirmation, check your statement or visit the issuer’s contact page online to find their address. Then, send a letter with the following information:

- Your details: Include your name, address, phone number and account number.

- Details about the call with the customer service rep: Note the representative’s name along with the date and time of the call.

- Payment verification: Attach a confirmation receipt that your final balance has been paid in full and include it with the letter.

- Your request: Include the action you want the bank to complete. You want your credit report to state that the account was closed at your request.

Make a copy of your letter, save it and send a copy to your issuer via certified mail. Doing so will provide clarity and proof of the request in case of any future credit report discrepancies.

Step 4: Destroy your credit card

Once you’re sure you’ve closed the account, this simple but important step helps protect your personal information. Simply cut it into pieces with scissors or send it on a one-way trip through a shredding machine.

How to destroy a metal credit card

You can destroy a metal credit card by:

- Using a saw with a metal-grade blade

- Cutting it with tin snips

- Scorching it with a torch or in a fire

- Drilling holes through it

- Bringing it to one of the issuer’s local branches

- Mailing it back to the issuer

Step 5: Monitor your credit

The full effect of canceling your credit card may not immediately appear on your credit score. After a few weeks, check your credit report to make sure it accurately reflects the account closure. If you’re not seeing the update, contact the credit card company. If all else fails, file a dispute with the credit bureau.

Is it bad to close a credit card?

It isn’t bad to cancel a credit card if leaving it open may lead you to borrow more than you can afford to repay, if you can’t afford annual fees or if you need to simplify your finances. However, you should be cautious about doing this, as it may negatively impact important credit scoring factors.

What happens when you close a credit card

When you close a credit card, the card issuer will report the closure to credit bureaus. Keep in mind that closed accounts can remain on your credit report unless you take action to remove them.

It’s possible that your credit score will drop shortly after from increased credit utilization, a reduction in your credit mix and/or a reduction in your credit history. This drop may prove to be temporary if you continue to take strides to improve your credit.

Credit utilization

Credit utilization is a factor that measures your available credit limit against how much you spend. The closer you are to spending the entirety of your credit limit, the higher your utilization rate will be. A high credit utilization translates to a negative impact on your credit score.

Example: If you have two cards with a limit of $1,000 each and have a balance of $500 on one, canceling one of your credit cards will adjust your credit utilization from 25 percent to 50 percent.

Credit mix

Lenders will consider variety of loan types when determining a responsible borrower. If you close your only credit card and your only remaining loan is a mortgage, you’re effectively removing all revolving credit (credit lines you can use over and over again), which will negatively impact your score.

Credit history

The longevity of your credit is a major factor in your score. Credit lenders view a longer credit history as more credible, or dare we say, creditable, as they consider this a telltale sign of a responsible borrower. Canceling the credit card that you’ve had the longest may have an adverse impact on your overall score.

Should I close my credit card?

Typically, it’s best to keep credit cards open in order to maintain a high average account age and available credit amount, as these factor into your credit score. However, there are a few situations in which it may be advantageous to close your card.

Maybe, if: you can’t control your spending

An unpaid balance on a loan may negatively impact your credit score as much as, if not more than, closing a credit account. If you continuously overspend on a credit account and you can’t keep up with the monthly payments, it may be time to cancel your credit card.

Maybe, if: you can’t afford your annual fee

If you have a high annual fee you can’t afford or that’s simply not worth the rewards, it may be worth transferring the balance to a card with terms that fit your budget and lifestyle better. Make sure to use any remaining rewards points before closing the account.

Maybe, if: you need to simplify finances

If you’re a joint account holder and you need to part ways, you can’t necessarily remove the other person from the account like you would if they were labeled an authorized user. Simplifying your open accounts by canceling the credit card may also help you track outstanding bills and alleviate the need to pay the balance of purchases you didn’t make.

In summary

Although there are plenty of alternatives to closing credit cards, you should still understand how to cancel a credit card the right way. In the event that you need to close your account, you should do so in a way that has the least impact on your credit and monitor your credit closely for the next few months.

Is it better to cancel a credit card or let it close?

Canceling a credit card can hurt your credit, so it may be beneficial to your credit to leave your card open even if you don’t plan to use it. Issuers may close inactive credit cards without notice, so even using your credit card sparingly to keep it open can help maintain your credit age and available credit.

Does closing a credit card hurt your credit?

Closing a credit card is likely to hurt your credit, as this will increase your credit utilization rate by cutting down your available credit. If you’ve had the card for a long time, it can also reduce the average age of your credit, which can factor into your score.

What happens if you don’t use your credit card?

Your credit card’s issuer may close your account if you don’t use it. It may also leave you more susceptible to identity theft, as you likely will pay less attention to an account you aren’t actively using.

Can you reopen a closed credit card?

You may be able to reopen a closed credit card—particularly if you voluntarily closed the account while in good standing. Some issuers may ask you to re-apply for a new card, however, so you will need to contact customer service to find out for sure.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263