Disclosure regarding our editorial content standards

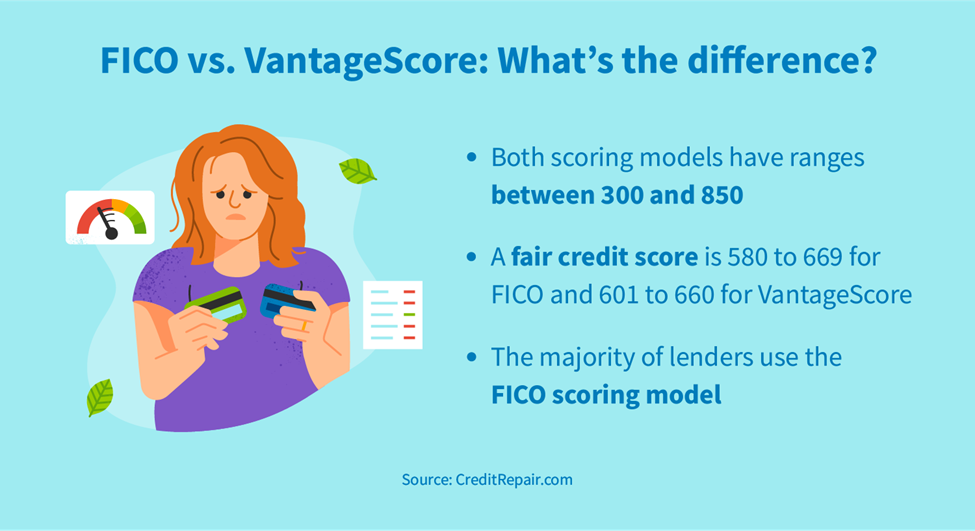

A fair credit score is any FICO Score that falls within the range of 580 to 669. While FICO is the most popular scoring model, the fair range can vary when looking at other models like VantageScore, which considers 601 to 660 fair.

Knowing your credit score is the first step toward repairing and improving your credit. Scores range from very poor to exceptional, so what’s a fair credit score? A fair score is the second-lowest range, just above very poor using the FICO® scoring model, and according to Experian®, approximately 17 percent of people fall within this range.

With a fair credit score, you’ll be subject to subprime loans, which means that you’ll have to pay high interest rates. For those trying to save money, this isn’t ideal, so what can you do? Here, we’ll break down what this score means, the other negative effects in addition to high interest rates and what you can do to reach the best credit score possible.

What is considered a fair credit score?

A fair credit score is slightly different depending on which credit scores you’re looking at. Different lenders and companies may use different scoring models. While FICO is the scoring model used the most, some may check your VantageScore®. Here’s the difference:

- FICO considers a score between 580 and 669 points as fair

- A fair VantageScore falls between 601 and 660

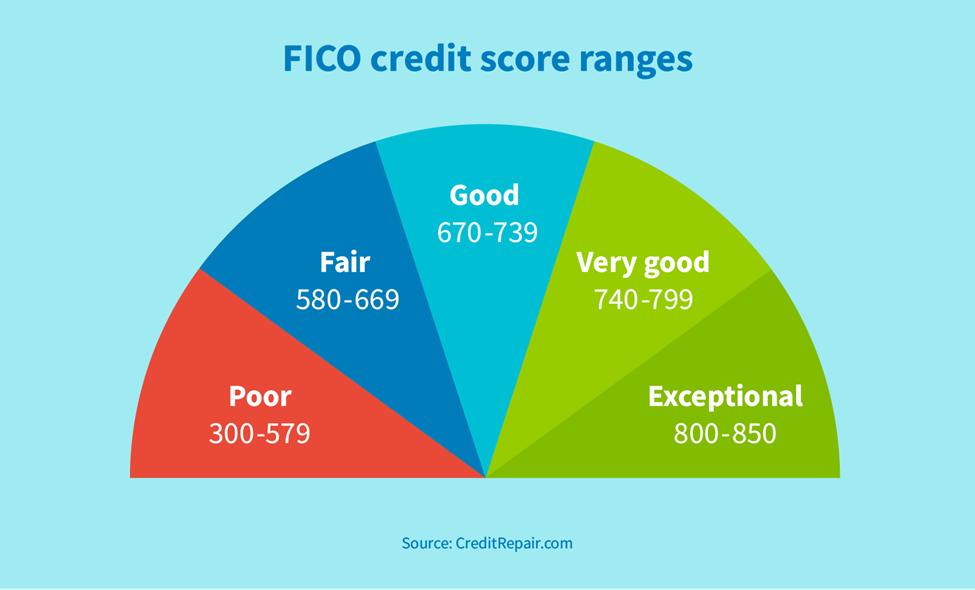

Understanding credit score ranges

The entirety of the FICO credit scale starts at 300 and goes up to a maximum of 850. Within the scale, there are different credit score ranges. Ideally, you’ll get to the very good or even the exceptional range. If you have a low credit score, don’t worry. You can fix your credit, but it starts with understanding what these different ranges mean.

FICO score ranges:

- Poor (300 to 579): In the poor range you may be denied on credit applications and even when applying to rent a home. Typically this score means you have derogatory marks like collections or late payments.

- Fair (580 to 669): A fair credit score is below average, but you can work with this. This score means you may have higher interest rates and bigger deposits, but you’re more likely to get approved.

- Good (670 to 739): Once you hit the good range, more lenders are willing to give you loans. This score lets lenders know that although you’re not perfect, you pay lenders back.

- Very good (740 to 799): This range is above average and gets you better terms on your loan, which means you have more room to negotiate interest rates.

- Exceptional (800 to 850): If you manage to reach this level of credit status, you’ll receive the best interest rates and save on deposits. In order to reach this score, you’ll need a long history of credit, so it can take some time.

VantageScore ranges:

Although the VantageScore ranges are different, the ranges are similar to FICO when trying to understand how lenders view your score. You may notice some differences between FICO and VantageScore. One of the main differences is that FICO has a “good” and “very good” range, but VantageScore has a “poor” and “very poor” range instead. It’s also important to note that a fair credit score range with VantageScore starts at 601 and starts lower at 580 for FICO.

- Very poor: 300 to 499

- Poor: 500 to 600

- Fair: 601 to 660

- Good: 661 to 780

- Excellent: 781 to 850

What is a good FICO credit score vs. a fair one?

While you can still get credit cards and loans with a fair credit score, there are some benefits to having a good credit score. As you’ve learned, a good FICO score is between 670 and 739.

Let’s discuss some of the benefits of a good credit score, so you know what you’re working toward.

- Better interest rates

- Lower down payments

- Smaller or waived security deposits

- More accessibility to lines of credit

- Approval for better credit cards with more perks

Something many people are unaware of is the fact that some auto insurance companies use your credit score as a factor for your rate. Unless you live in select states like California, Washington or a few others where this isn’t permitted, a fair credit score may be adding to the price of your insurance premium.

Can I get lines of credit with a fair credit score?

If you have a fair credit score, you can still get lines of credit. This means that you can get credit cards, auto loans and personal loans. And did you know you can even purchase a house with a fair credit score?

Although a fair credit score provides you with access to various types of credit and loans, it’s helpful to remember the benefits of getting into the good range. Continuing to work on your credit score is going to save you money and improve your financial well-being. For example, fixing your credit before buying a house is going to lower your down payment and get you a much better interest rate.

How to improve a fair credit score

Moving from a fair credit score to a good credit score and beyond can take some time, depending on your personal credit situation. Regardless of what’s going on with your credit, there are some steps you can take today to improve your score.

- Avoid missing payments: Your payment history is the primary factor affecting your credit score. With the FICO scoring model, your payment history is 35 percent of your score. Setting up auto payments is the easiest way to never miss a payment.

- Reduce your utilization rate: Credit utilization, the ratio of your outstanding balance to your overall credit limit, is worth 30 percent of your score. Keeping your balance as low as possible is ideal and will help raise your score.

- Limit new credit applications: In order to build credit, you need credit, but applying for too many credit cards in a short time frame can actually hurt your score. New credit is worth 10 percent of your score, so try to limit applications to once every six months.

- Check your score regularly: One of the best things you can do is keep an eye on your credit score. This will help educate you on what helps and what hurts your score. Developing this habit can also help you catch identity theft early if it happens.

- Dispute errors on your credit report: Sometimes, errors happen on your credit report. Without realizing it, your report may show late or missed payments that you paid. Filing a dispute for an error can boost your score if you have the proper documentation.

How to get into the good credit score range and beyond

Now you know what a fair credit score is and why it’s beneficial to work toward getting within the good range. If you finish reading this and jump into fixing your credit, you may see an error on your report. Errors on your report can decrease your score drastically, and sometimes, the best thing you can do is get professional help.

CreditRepair.com has credit professionals who can help you through the dispute process if you have errors on your report. If you’re not sure where to start with fixing your credit or just need some additional financial help, we can assist you with these as well. We provide a variety of services like helping you dispute errors as well as credit monitoring and credit education services. Sign up today and learn more about our proven process for helping people repair their credit.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263