Disclosure regarding our editorial content standards.

Texas is one of the states that allows filers to choose whether to use the state exemptions or the federal exemptions. As a result, filing for bankruptcy in Texas is a little different from filing in many other jurisdictions. Here are the basic steps you need to take to file for bankruptcy in the Lone Star State.

If your finances are stressing you out, you have the option of filing for bankruptcy. Keep reading to learn what bankruptcy is, find out about the differences between Chapter 7 and Chapter 13 bankruptcy and learn what steps you need to take to file bankruptcy in Texas.

What is bankruptcy?

Bankruptcy is a legal process that helps people who are struggling to pay their debts. When you decide to file for bankruptcy in Texas, you file a petition with a federal bankruptcy court. The petition provides information about your income, assets, expenses and debts. It also indicates whether you want to file a Chapter 7 bankruptcy or Chapter 13 bankruptcy.

Chapter 7 bankruptcy

In a Chapter 7 bankruptcy, the trustee collects any property that isn’t exempt, sells it and uses the proceeds to pay your creditors. To qualify for this type of bankruptcy, you must pass a means test, which determines whether you have enough disposable income to repay your debts.

Chapter 13 bankruptcy

Some people have too much disposable income to file for Chapter 7 bankruptcy. If you’re one of them, you may be able to file for Chapter 13 bankruptcy instead. Chapter 13 allows you to set up a plan for repaying some or all of your debts. Depending on how much you earn, your repayment plan may last for three to five years, during which time you’ll make payments to your creditors.

One of the benefits of filing for Chapter 13 bankruptcy is that it gives you an opportunity to catch up on missed mortgage payments, which may help you prevent foreclosure. You may also be able to lower your monthly payments on other debts.

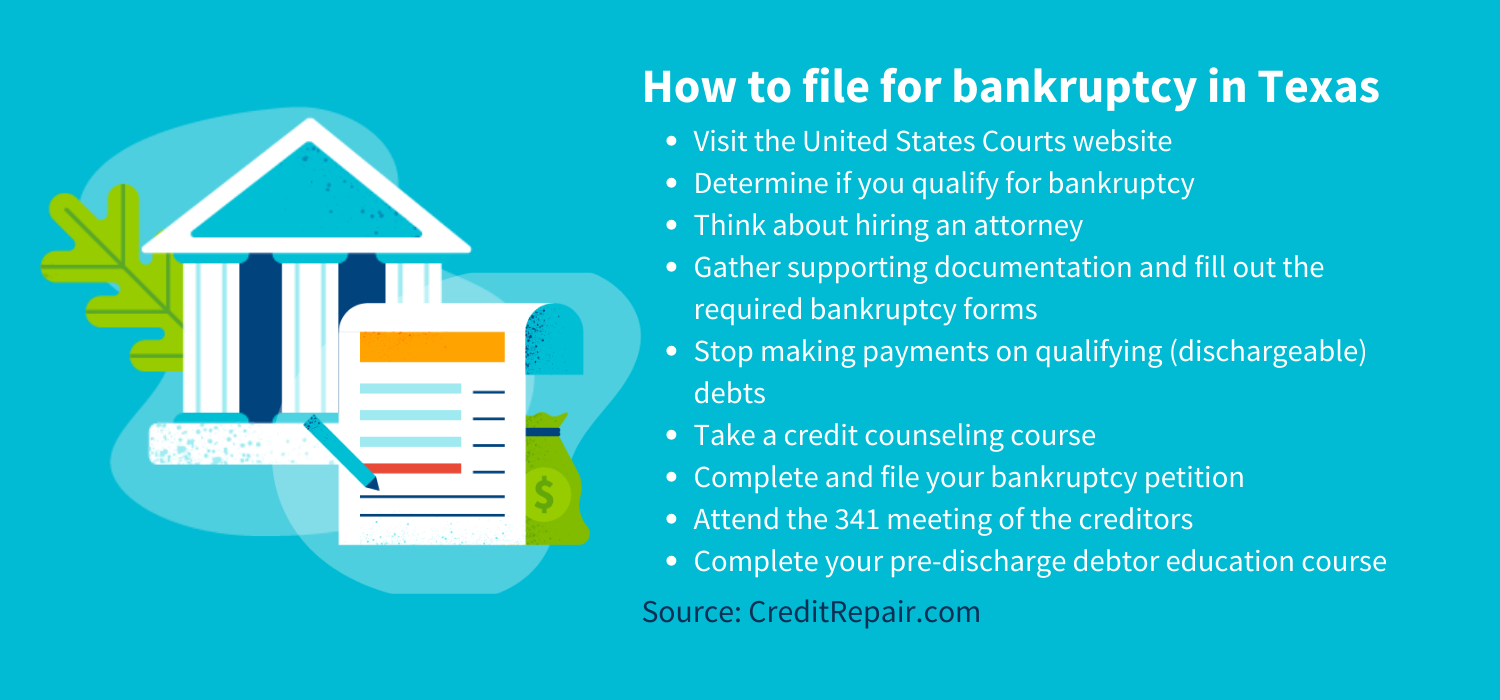

How to file for bankruptcy in Texas

The bankruptcy rules are outlined in Title 11 of the U.S. Code, so bankruptcy is a federal matter. That said, Texas is one of the states that allows filers to choose whether to use the state exemptions or the federal exemptions. As a result, filing for bankruptcy in Texas is a little different from filing in many other jurisdictions. Here are the basic steps you need to take to file for bankruptcy in the Lone Star State.

- Visit the United States Courts website to learn more about bankruptcy.

- Determine if you qualify for bankruptcy. For both Chapter 7 and Chapter 13, you can’t file if you had a bankruptcy dismissed within the previous 180 days due to your failure to comply with the court’s instructions or appear before the court when required. The 180-day rule also applies if your bankruptcy was voluntarily dismissed because your creditors asked the court to grant them relief related to certain assets.

- Think about hiring an attorney. Bankruptcy is a complex process, and your case could be dismissed if you make a mistake on your petition or any other forms you file. An attorney can advise you on whether bankruptcy is the best option for your situation, help you determine if you qualify for Chapter 7 or Chapter 13 and guide you through the process from beginning to end.

- Gather supporting documentation and fill out the required bankruptcy forms. You’ll need documents related to your income, expenses, assets and debts, so look for tax returns, pay stubs, 1099 forms, copies of your monthly bills, bank statements, credit card statements, loan agreements and other related paperwork.

- Stop making payments on qualifying (dischargeable) debts. Since those debts are going to be discharged anyway, it doesn’t make sense to keep paying them when you could use the money to pay debts that don’t qualify for discharge. An attorney can advise you on which debts qualify for discharge so you don’t stop making payments on the wrong accounts.

- Take a credit counseling course. All filers are required to participate in credit counseling, regardless of whether they file for individual bankruptcy or business bankruptcy.

- Complete and file your bankruptcy petition, along with all the supporting documents required to verify that you qualify.

- Attend the 341 meeting of the creditors. During this meeting, the bankruptcy trustee asks you questions about your petition and supporting documents. Your creditors also have an opportunity to attend the meeting and ask questions related to your case.

- Complete your pre-discharge debtor education course, file your course certificate and receive your debt discharge.

What are the Texas bankruptcy exemptions?

Bankruptcy exemptions allow you to protect certain property from your creditors. In Texas, some of the state exemptions are more favorable to filers than the federal exemptions, making it wise to discuss your situation with an attorney and determine which set of exemptions to use.

- Texas homestead exemption: Texas allows most filers to exempt the full value of their homes in a bankruptcy. This applies to residences on 10 acres or less in a city or 100 acres or less in the country.

- Texas motor vehicle exemption: Under Texas law, you can exempt the full value of one vehicle per licensed household member.

Texas also allows filers to exempt some of their personal property. For a single individual, personal property is exempted if it has a total market value of no more than $50,000. If personal property is provided for a family, then it’s exempt as long as it has a total market value of no more than $100,000.

Wages, health aids prescribed by a doctor, religious books/texts and alimony/support payments are exempt, but they’re not included in the market value limits above.

You should also be aware of the following personal property exemptions:

- Tools and vehicles used for farming or ranching

- Home furnishings

- Clothing

- Jewelry up to a certain limit

- Tools, books and equipment used for a job or trade

- Athletic equipment/sporting goods

- Two firearms

- Certain animals for consumption (e.g., 120 fowl, 12 head of cattle); exemption includes food for the animals

- Household pets

- Ingredients and equipment used to prepare meals/items for consumption

Will filing for bankruptcy in Texas erase your debt?

Chapter 7 bankruptcy wipes away most of your unsecured debt, giving you a fresh start. Unsecured debts are debts that aren’t secured by any collateral, such as credit cards, past-due utility bills, medical bills, personal loans and collection agency accounts.

Chapter 7 bankruptcy doesn’t eliminate spousal support or child support payments, court fines, criminal restitution, debts to government agencies and certain other types of debts. Chapter 13 bankruptcy doesn’t erase your debt; it just allows you to set up a repayment plan with your creditors.

What property will you get to keep after filing?

You should be able to keep anything that’s considered exempt, such as your home, clothing, home furnishings and tools you use for your job.

If you have personal property with a market value above the exemption limit ($50,000 for individuals and $100,000 for families), the trustee may sell some of the excess property and use the funds to repay your creditors. It all depends on which type of bankruptcy you file, what kind of property you own and other factors.

Is bankruptcy the right choice for you?

Again, it depends on your situation. If you have a lot of unsecured debt and don’t own your own home, bankruptcy may be a good option, as your unsecured debt will be wiped away and you won’t have to worry about finding a new place to live.

Even if you do own a home, bankruptcy may be right for you if most of your debts are dischargeable and you want to stop the calls from collection agencies or prevent your creditors from taking legal action against you. If most of your debt isn’t the kind that can be discharged in a bankruptcy, however, you may want to explore other options.

Bankruptcy has a big impact on your credit score, so think carefully before you decide to file. A credit repair company can help you determine the right course of action.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263