Like the name suggests, a guarantor’s main function is to guarantee something. A guarantor on a loan will cover the loan payments if the borrower defaults. Think of this person as a safety net: If you take out a loan and something happens that results in you being unable to pay it back, a guarantor will front the loan instead.

Being a guarantor or having a guarantor on a loan comes with a host of considerations, an important one being how it affects your credit score. This guide will go over what it means to be a guarantor on a loan, specific qualifications to become a guarantor and the benefits and pitfalls of having and being a guarantor.

What does it mean to be a guarantor on a loan?

A guarantor on a loan acts as insurance in case the primary borrower defaults. This person will have to front loan repayment plus the loan interest if the borrower cannot. This is a huge financial obligation, and one that shouldn’t be taken lightly.

When you become a guarantor, you’re required to pledge your own assets that could be seized in the event the person borrowing defaults. And if you don’t have the means to repay that loan, then your car, house or other collateral could be repossessed by the lender.

This is a scenario you don’t want to find yourself in. So before you promise to become a guarantor, examine this decision like you’re the one actually taking out the loan. Understand the loan contract and your financial bandwidth, and limit emotional decision-making, which might cloud the situation.

Despite the financial responsibility of being a guarantor, it’s a generosity that could help the borrower tremendously, especially if they’re a close friend or relative. People often need a guarantor if they have a short credit history or if a lender deems a borrower too risky because of bad credit or previous defaults on a loan. In these scenarios, getting a guarantor may be the best way to secure a loan.

Who can qualify as a guarantor?

Signing up to be a guarantor takes some legwork. There are some requirements put in place to ensure the lender gets paid back. Mainly, these are indicators of financial responsibility, including your credit score. Here are the most common requirements necessary to become a guarantor on a loan in the United States:

- Age requirement. You must be 21 years of age or older in the United States to qualify as a guarantor.

- Proof of citizenship. In order to be a guarantor in the United States, you need to show proof of citizenship.

- Good credit history. To ensure you’re financially responsible, you must have a good credit score (somewhere in the range of 670 or above). You can easily check your credit score to understand if you’d meet this requirement.

- Financial stability. To show you’re financially stable, you must have a steady job or source of income.

- No prior default on a loan. If you’re considering becoming a guarantor, most of your financial history will be unearthed, and any prior defaults are alarming red flags that will likely disqualify you from being a guarantor.

You’ll want to have discussions with the loan provider to note any particular requirements, but generally, these are the boxes you must check to become a guarantor on a loan.

What is the difference between a cosigner, an authorized user and a guarantor?

Terms on a loan can be confusing, so it’s extra important that you understand what you’re getting into as a guarantor.

Cosigners, authorized users and guarantors are all supporters on a loan and can help aid the primary borrower, but when you get into specifics, you’ll see that they play very different roles.

Guarantor vs. cosigner

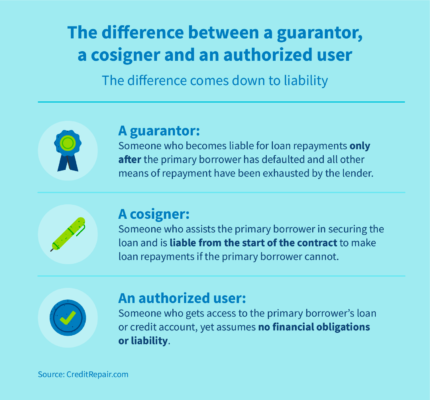

Similar to a guarantor, a cosigner helps the primary borrower pay off the loan if they aren’t financially able to. However, the difference between the two comes down to the liability.

A cosigner is liable for the repayment as soon as they sign onto the loan with the primary borrower. In contrast, a guarantor only becomes liable after the lender has exhausted all other efforts of getting the primary borrower to make payments.

For example, let’s say you’re the primary borrower on a loan and you have a cosigner and a guarantor on the loan as well. You make the loan payments, and at this point, only you and the cosigner are liable for the loan. But if you default and neither you nor your cosigner can make the payments, then the lender will have to contact the guarantor. It’s only at this point, when all other means have been exhausted, that the guarantor becomes liable for loan repayments.

Guarantor vs. authorized user

A close cousin to these two roles is an authorized user. An authorized user is allowed access to the primary borrower’s loan or their credit account. However, this person isn’t responsible for any repayments or other financial obligations. Usually, a person becomes an authorized user as a way to build their own credit score.

The pros and cons of a guarantor

Having a guarantor on a loan can be a good thing and a bad thing, depending on your situation. It can be good to help out a family member and also build your own credit score, but it could put you at a lot of risk too. Here’s a list of the benefits and pitfalls of both being a guarantor on a loan and having a guarantor on a loan.

Benefits of a guarantor

- You have a better chance of successful loan application. Having a backup plan is a great way to assure a lender that they will get their money back. This reassurance will better your chances of actually receiving the loan.

- It could boost your credit score. If you’re a guarantor and you make these repayments on time and in full, it can be a great opportunity to boost your own credit score.

- You can lend a helping hand. Usually, guarantors are required in cases of bad or short credit histories. So if you opt to be a guarantor for someone, not only will you help them out tremendously by helping them secure a loan, but they’ll also get an opportunity to boost their credit score.

Drawbacks of a guarantor

- Your assets are at risk of being seized or repossessed. If you become a guarantor and the primary borrower defaults, you become legally responsible for loan payments. That means if you can’t make those payments, the lender might be able to seize your assets, repossess property or take you to court, depending on the contract.

- Your credit score could be at risk. If you’re a guarantor and fail to make loan repayments, your own credit score could be at risk of serious damage. This will make it hard to apply for loans in the future.

- You risk damaging a personal relationship. If you bring on a guarantor to your loan as a gesture of confidence to the lender, but you actually end up defaulting and having to tap your guarantor to pay the loan, it could burn some bridges. Ensure you have transparent and frequent communication with a potential guarantor to make sure they’re comfortable every step of the way.

In the end, deciding to become a guarantor or asking to have a guarantor on a loan depends on the situation. The most important thing to remember is to make the expectations for all parties (lender, borrower, guarantor, etc.) clear.

How to get a guarantor for a loan

Finding and asking someone to be a guarantor isn’t as easy as texting them. Being a guarantor is a big responsibility, and it may be difficult to find someone up for the task.

And even when you do find a willing guarantor, it’s a multi-step process to get that person legally on the loan. Below we’ve outlined the steps you need to follow to get a guarantor on a loan.

- Find a willing guarantor. Start by tapping into your immediate network. Also, consider what type of loan you’re taking out. If it’s for a business venture, consider asking your business partner to be a guarantor. However, if it’s personal, find someone in your family or friend group who is financially able to help.

- Have a conversation with this person. It’s essential to have a conversation with whomever you’re asking to be a guarantor. Talk to them about why you need this loan, what the role of being a guarantor entails and what it might mean for them financially. This transparency is worthwhile and will set up the loan for success.

- Compare loan options. Vet your loan options and look for those with lower interest rates. You might find an option that doesn’t require a guarantor or a deal that will make it easier for you to pay back your loan more quickly. By doing this due diligence, you can assure that whatever loan you’re taking out is the best one for your situation.

- Make sure you meet the qualifications. Ensure that both you and your guarantor meet the lender’s criteria. Read back through the qualifications of becoming a guarantor to understand this criteria and also discuss it with the lender.

- Apply for the loan. Now, it’s time for the paperwork. Complete all necessary documents with your guarantor and apply for the loan.

Does having a guarantor affect credit?

The short answer is yes, both having a guarantor and being a guarantor on a loan can affect your credit.

If you have a guarantor on your loan, it can help balance out your credit score during the loan application process. It could be a way of securing a loan, even with bad credit, and using that loan repayment as an opportunity to build your credit rating. However, if you can’t repay the loan, not only will it hurt your credit score, but it might also damage your relationship with the guarantor if they have to step in and make those payments.

Being a guarantor can be a double-edged sword. If the primary borrower defaults and you need to assume the responsibility of the loan, your repayment timeliness will affect your credit. If you do hit those payments, then it can build your credit, but on the other hand, it can be damaging if you miss one or can’t pay back the loan as a whole. So if you sign up to be a guarantor, factor that into your financial equation. If you do happen to pay the loan, you’ll want to be equipped to do so.

Having or being a guarantor on a loan is a big responsibility, especially if the loan is a sizable one. But it can also be the difference between getting a necessary loan and not getting one. If you’re in a tough place where you have a bad credit score or short financial track record and don’t want to find a guarantor, don’t worry—there are other ways you can fix your credit score.