Disclosure regarding our editorial content standards

Picture this: The phone rings with a call from a relative. After exchanging niceties, they cut to the chase: They need a loan of $400, as soon as you can send it. What’s your next move?

Chances are, this will put you in a tight spot. You don’t want to leave your family member high and dry, but you also don’t want to become the Unofficial Bank of Family Loans, LLC. In situations like these, it’s important to know how to say “no” directly and firmly, while setting up boundaries for both your financial and personal life.

Along with the mental and emotional stress of doing something you’re uncomfortable with, being too generous with your hard-earned money could lead to a financial issue you’ll be left to shoulder—including bankruptcy, bad credit or worse.

Read on for more information on saying “no” like you mean it when family members ask you for money, or skip down to the infographic for more tips on setting and enforcing boundaries with loved ones.

How to say “no”

As uncomfortable as these conversations can be, they’re more common than you may think. A 2020 survey found that around 53 percent of Americans have either borrowed or given money to a family member within the last year. Though these numbers are likely higher than in past years due to the economic impacts of the COVID-19 pandemic, people are turning to their family increasingly often for last-minute loans.

This makes it all the more important to learn how to tell family “no” in a clear but understanding way. Luckily, we’ve outlined some tools that you can use to perfect the art of saying “no” to avoid the consequences of being too generous with your funds, like needing to rebuild credit if it takes a hit.

1. Be succinct and clear

Learning how to say “no” effectively and directly is something that takes a little practice. When saying “no” (especially around something as sensitive as money), be direct and don’t beat around the bush. It can be uncomfortable to outright tell a family member no, but it’s much better in the long run to give a clear answer.

Try this by practicing saying “no” in the mirror or with a friend. Especially if you like to help people, it can be awkward to be in a position where you have to let someone down. By being direct, saying “no” and not making any false promises, you’ll be better at turning people down in future scenarios.

DO SAY: “I’m sorry, but I’m not in a position to lend you money right now.”

DON’T SAY: “Maybe, I don’t know. I’ll let you know.

2. Take your time

If you weren’t expecting a family member to ask you for money, you may not even know where to begin when it comes to turning them down. You shouldn’t feel pressured to answer immediately, and you can just say you’ll get back to them with an answer by a certain time or date.

Use this time to practice what you’ll say with a friend, and have them run through different scenarios so you’re prepared no matter what happens. This could include an angry, emotional or hurt response, so the better prepared you are to say “no,” the easier the conversation should be. Don’t say you’ll get back to them with an answer if you don’t intend to, as this is likely a stressful time for your family member. Not getting back to them could lead to embarrassment and/or hurt feelings.

DO SAY: “I need a bit more time to think this over. Can I get back to you on Friday?”

DON’T SAY: “I’ll think about it.”

3. Don’t always offer an explanation

It can be tempting to over-explain when telling someone “no,” especially if you aren’t used to turning your loved ones down. Resist the urge to over-explain why you’re saying no, and instead focus on setting those important boundaries and protecting yourself and your finances. Even if they are family, they aren’t owed anything—be it time, finances or an explanation.

However, if you do feel compelled to offer reasoning behind you saying “no,” be sure to keep it brief and don’t go into too much detail (especially around your financial situation). Telling your family that you’re uncomfortable giving them a loan, you aren’t in a position to or that you just can’t should be enough explanation. If they keep pressing for a reason why or don’t respect your decision, remember that it’s fine to end the conversation.

DO SAY: “Thank you for asking, but unfortunately I can’t lend you money right now.”

DON’T SAY: “Well I would, but I just got laid off and have a lot of student loan debt to pay off, and my credit card bill is through the roof, and….”

4. Make a policy and stick to it

Whether you have a small family or a large one, it’s important to stick to the same policy when someone asks you for a loan. The last thing you want is to hurt another family member when they learn you made an exception for someone else, especially if you informed them of your policy before. It’s likewise unfair for you to ask the family member you gave a loan to not to tell the one you didn’t—that could open up a can of worms.

When it comes to enforcing your policy, don’t feel like you need to apologize or explain why you have that boundary. Remember that you should do what makes you feel comfortable and that your family should respect your boundaries, not push or question them.

DO SAY: “My personal policy is to not lend anyone money outside of gifts for birthdays.”

DON’T SAY: “I’ll make an exception for you, but Aunt Rachel also asked me for an auto loan and I told her no, so don’t tell her I’m giving you one.”

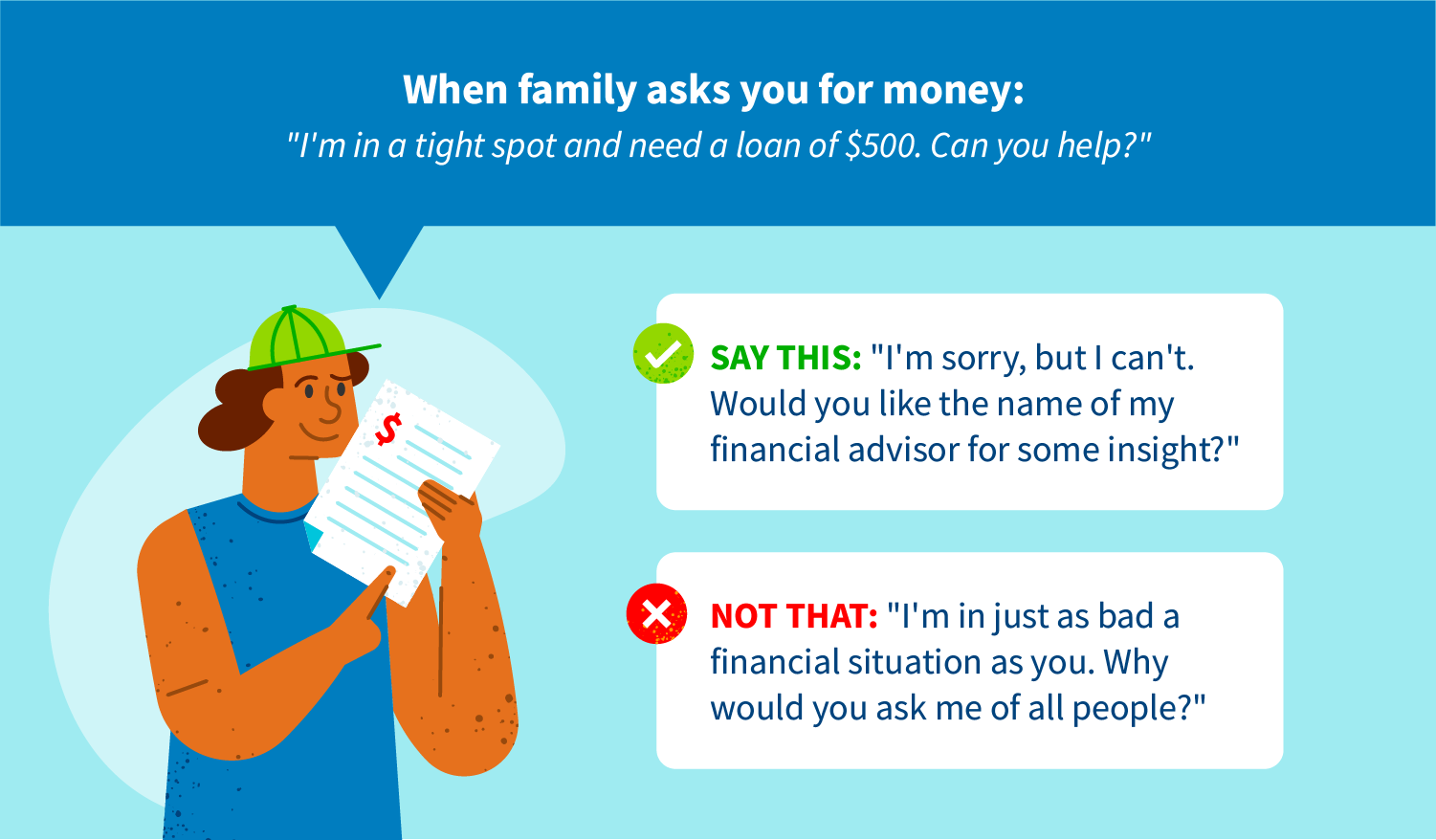

5. Offer help in other ways

If you’re uncomfortable with giving a flat-out “no,” see if there are any additional ways you can offer help. Consider reviewing their plan for rebuilding their credit score, helping them plan to ask for a loan, finding areas of spending they could cut down on or advising whether or not they should cancel a credit card.

However, only offer additional help if this is something you both feel comfortable doing and can follow through with. It’s fine to say “no” and leave it at that, and if you’re at capacity mentally and can’t take anything else on, be sure to communicate that. If you can’t help personally but know someone who can, see if you can connect your family member to someone who might be better-suited (or have more time and energy) to help.

DO SAY: “I’m uncomfortable giving out a loan right now, but my friend is a credit counselor and could give you some financial advice. Would you like her information?”

DON’T SAY: “I can’t help you and I don’t know why you’re asking me.”

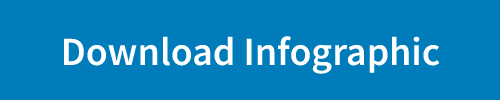

6. Save it for gifts

Gifts for the holidays, birthdays and other special occasions are made that much more special because they only happen once a year. If you want to make money more of a gift than a loan, then save it for special occasions like these.

If your family hits you up for money on repeat occasions outside of these celebratory days, remind them that they can expect a monetary gift for their birthday and the holidays. Be careful not to use these gifts as a bargaining chip, either. The chances are that the family member asking you for money is in a very vulnerable position, and you don’t want to make things more difficult for either of you.

DO SAY: “You can expect a check for your birthday and the holidays, but I’m not comfortable loaning money during other times of the year.”

DON’T SAY: “If you keep asking me for money you won’t get a check for your birthday this year.

How to set up boundaries with family

As important as it is to be able to help your family when needed, you should also set up strong boundaries when it comes to lending your family money, energy and time. These can help you establish a firm line with your family members that they should respect when asking you for something.

If you need a little help setting up and enforcing your boundaries, we’re here to help. Use these next steps as guides when it comes to getting your family to both understand and respect the boundaries you’ve put in place.

1. Be direct

Enforcing boundaries with family isn’t easy. Some family members may believe that the boundaries don’t apply to them, while others will knowingly cross lines just to see what your response is.

To ensure that everyone is on the same page when it comes to your financial, emotional or mental boundary, be as succinct and direct as you can while telling them. This doesn’t have to be an emotional or prepared statement, it can be as simple as you telling them what you would and wouldn’t like to do. Use the conversation starter below as a guide.

TRY SAYING: “I would really like to not discuss my finances with you unless I initiate the conversation. Can you respect that?”

2. Reinforce when necessary

Not everyone is going to understand your boundary the first time around, especially if this is your first time setting a hard and fast boundary. Don’t be afraid to reinforce your boundary when you need to—it isn’t being rude, it’s reminding others of the needs you have communicated that they should respect.

If you need some help or a starting point to reinforce your boundaries, use our conversation starter below.

TRY SAYING: “I think we’ve discussed this before, but as a reminder, I’d like to not be asked for my time during working hours. Do you understand?”

3. Set clear expectations and consequences

Try as you might, not everyone is going to understand or respect the guidelines you put in place. While an occasional memory lapse or misunderstanding is expected, repeat or continual disrespect of your wants is something that should be addressed, sooner rather than later.

If a family member is continually violating your boundaries, let them know what your expectations are and what the consequences will be if they don’t respect that.

These consequences could look like not having conversations around that topic with them, not spending time with them on a regular basis or even cutting conversation ties with them altogether. It’s up to you to decide what the consequences will be that come with not respecting your wishes.

TRY SAYING: “I’ve let you know that I’m uncomfortable with discussing lending you money. If you can’t respect that, I can’t have conversations about money with you. Do you understand?”

4. Understand your needs are important

Especially if you have a large family, it can be easy to wrap yourself up in the needs and wants of others. This can make saying “no” harder, as you may feel like you’re ignoring your family’s needs for your own. In situations where you need to enforce your boundaries, remember that your needs are just as important as the needs of your family.

If you feel guilty putting yourself first, just remind yourself why you’re saying “no” and enforcing these boundaries. If your family asks you for money when you’re saving up for something, picture how good it will feel to make that purchase. If you prioritize your own time over your family’s, you’ll see how nice it is to have some uninterrupted “you” time. Prioritize your needs and never feel guilty for doing so.

TRY SAYING: “This topic is mentally draining for me and I don’t have the emotional capacity for this conversation right now.”

Going back to the scenario posed earlier, you should feel better prepared to answer when a family member asks you for money. Though saying no can be awkward, especially when it’s around something as sensitive as money, you’re ensuring that your credit score and finances won’t take a hit due to someone else. This is something you shouldn’t feel the need to apologize for.