Disclosure regarding our editorial content standards.

As parents, there are many important life lessons that you should teach your kids to help them succeed as adults. Arguably one of the most crucial lessons is how credit works, since finances will be a constant in their lives for years to come—and, not to mention, financial responsibility can be difficult for even adults to master.

Teaching kids about credit early will help them build a foundation for responsible budgeting and spending, and help them learn about the financial burdens that can come with misusing credit. Read on or skip to our printable credit card lessons to discover simple tips for teaching kids about credit.

Lesson 1: Credit Basics

When teaching your kids about credit, it’s best to start with the basics. Get the conversation started by explaining how credit cards are borrowed money you can use to make purchases. Adults use them if they don’t have the exact amount when buying something; credit cards are also used to make large purchases and build overall creditworthiness.

Since you’re borrowing the money on the credit card, you need to pay it back as soon as possible.

There are also several terms that are associated with credit cards that you should teach your kids. Be sure to go over the following terms with your kids to ensure they understand the basics of credit, loans and debt:

Help your kids understand that when a money lender, such as a bank, gives you a credit card, they will tell you how much you’re allowed to borrow—this is called credit. The more responsible you are with your credit card, the more they will lend you. If you show that you’re financially irresponsible by borrowing too much or not paying back the borrowed money on time, you may have to pay a late fee on top of paying back what you’ve borrowed.

These late fees are called interest and will increase until you completely pay back the borrowed money.

Teaching tip: Start small

Don’t worry about teaching them everything there is to know about credit yet. Help them get a general idea of the concept to start, which will help you teach them more as they grow older.

Lesson 2: Credit Cards Are Not Free Money

Kids often grow up thinking that credit cards are magic cards filled with free money. The truth can be a tough pill to swallow. So, it’s important to teach your children that credit is borrowed money that always needs to be paid back. The longer it takes to pay back, the more it will cost.

An easy way to frame this is to use an example of a library book:

- A librarian allows you to check out a library book and trusts you to return it on time.

- If you return it by its due date, you won’t have to pay a late fee and can check out another book.

- If you return the book late, the library will charge you late fees until the book is returned.

- If you forget to return the book or turn it in late, a librarian may be wary of lending you a book in the future and may not give one to you—even if you really need to check out a book.

This is the same for credit and credit cards. A credit lender trusts people to borrow money using credit cards and expects the money to be paid back by the payment due date. Similar to a library book, help your kids understand that if the money borrowed is not repaid on time, a creditor will add late fees or interest to the monthly bill.

Late payments may also make creditors feel uncomfortable lending money to people in the future if they feel like the borrower can’t be relied on to pay back the money they borrow.

Teaching kids to budget and always pay off debts on time is an important lesson along with learning that credit cards are not free.

Teaching tip: Discuss wants and needs

Help kids understand that credit cards are not free money and should only be used for needs or emergencies, instead of for things they want, so they can better maintain their financial health and creditworthiness in the long term.

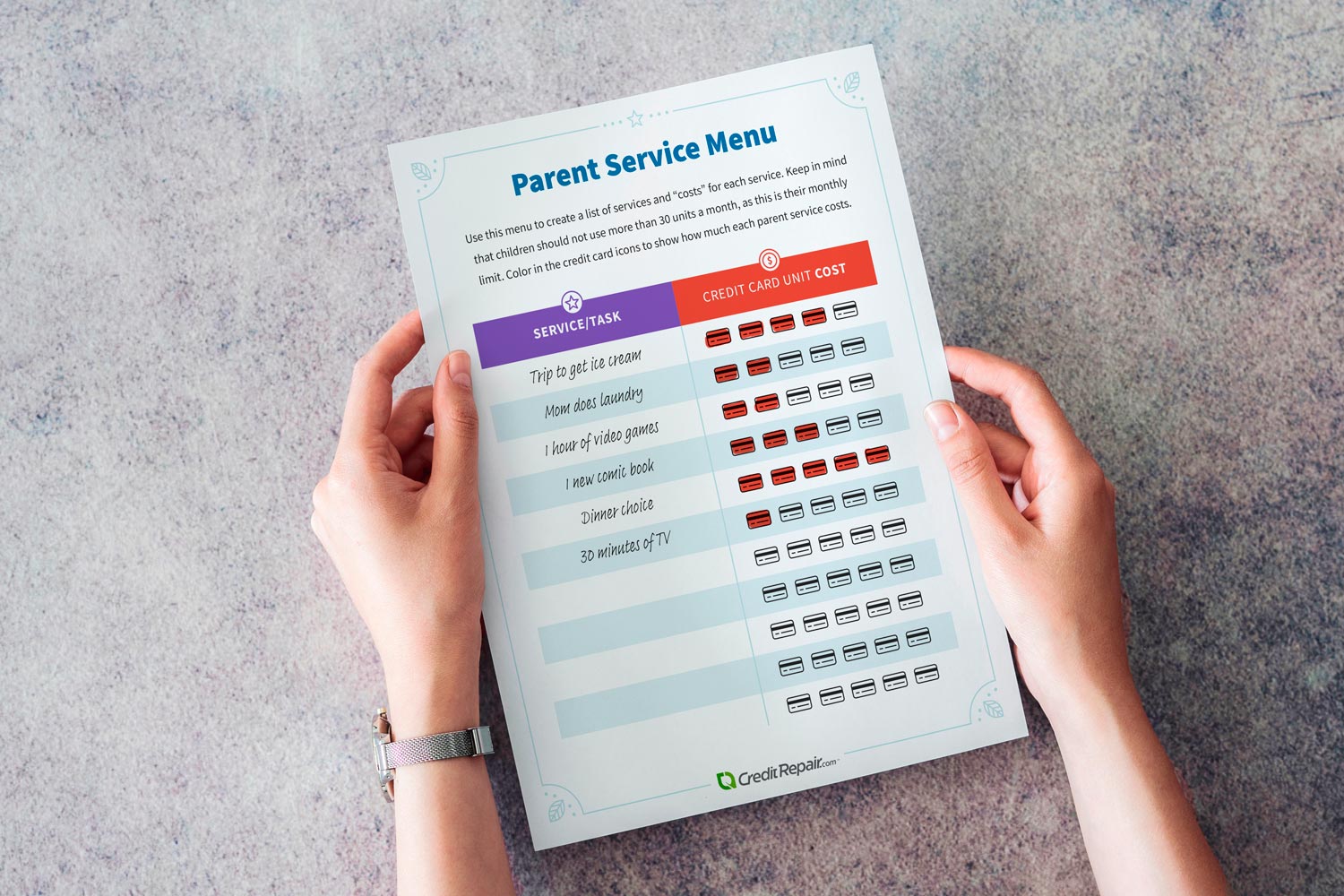

The printable activity above is designed to help kids budget their money each month. However, instead of money, you’ll use “credit card units.” Print and cut out the play credit card from above. Have your kids use the play credit card to pay for “parent services,” such as doing their laundry; driving them to a friend’s house or to an extracurricular activity; or to pay you back for toys, treats or birthday gifts.

Costs and payments will all be in “credit card units” to represent credit instead of cash.

You can decide how many credit card units each service that you perform costs, depending on the difficulty of the service. For example, laundry might be one credit card unit, while driving your child to the movies could be two or three units. But keep in mind that each service should be fairly priced, as children can’t spend more than 10 credit card units each month (similar to a credit limit).

Lesson 3: There’s a Limit to What You Can Buy

When teaching your children about credit limits, simply explain that there is a certain amount that the bank or lender is willing to let a user borrow. The more responsible a customer is with their credit card and payments, the more credit the lender will be willing to offer in the future.

Make sure your child understands that even if you have a lot of credit to spend, racking up big balances is risky because you may run out of credit and not have any more to spend before you pay all of your borrowed money back. Don’t forget to let them know that once you reach your limit, it’s also hard to get more—even if it’s an emergency.

Teaching tip: Be patient

Understanding credit cards and credit can be difficult even for adults, so try to be patient when explaining credit to your children. It may take multiple lessons or several explanations for them to fully understand how credit cards work.

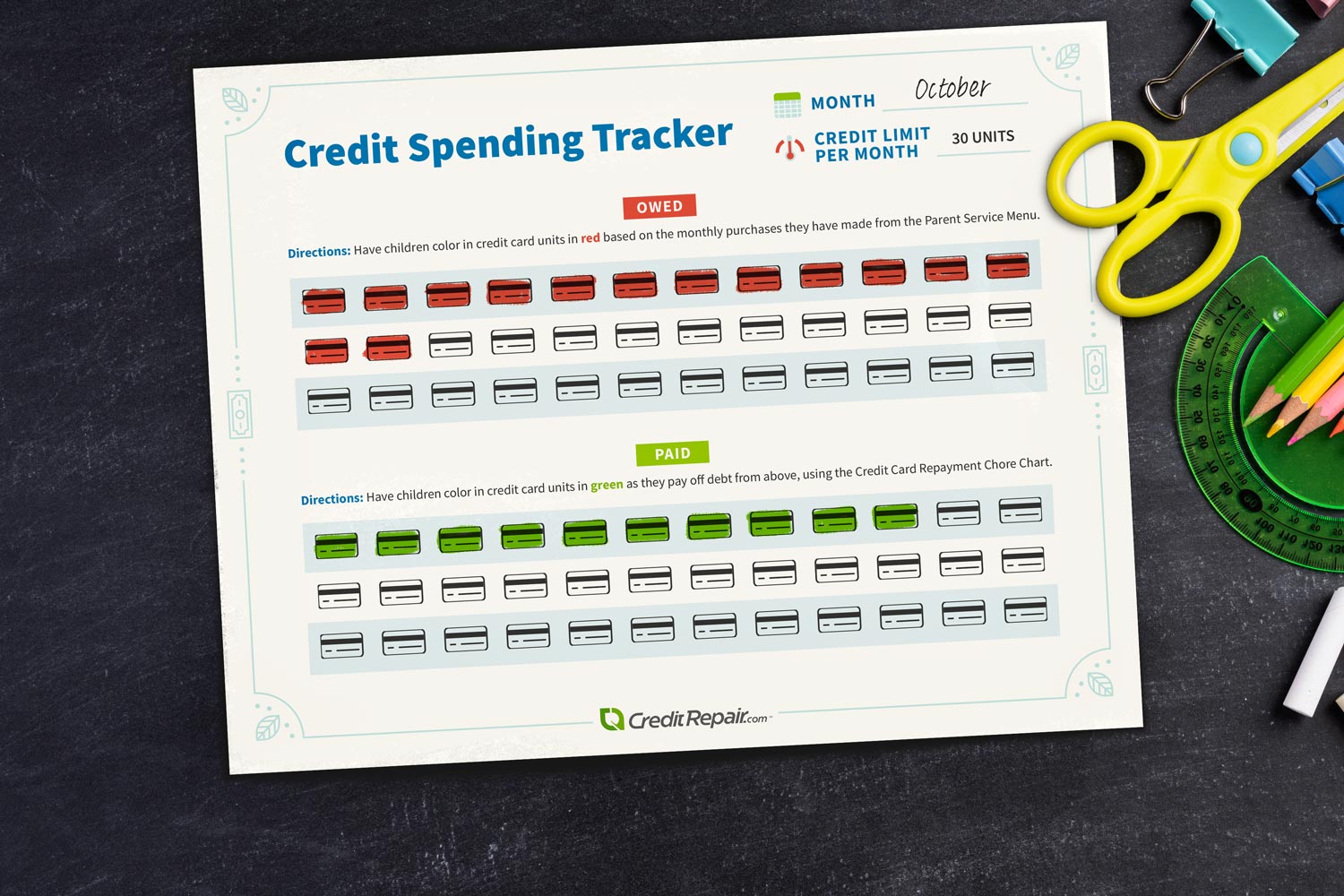

The activity above is designed to help your child understand credit and credit debt. Each time your child makes a “purchase” using their play credit card, have them log their spending activity with the printable tracker and color in how much they have spent. For example, if they purchased a laundry service from you that cost one credit card unit, have them color in one credit card unit in the tracker.

Children should keep spent credit card units under 10 every month, teaching them that there is a limit to what they can spend each month and encouraging them to choose their purchases wisely.

Lesson 4: Your Credit Card Activity Is Being Graded

Like a report card, credit card usage is measured on a scale from 300 to 850. Having a score of 850 is like an A+, so the closer your score is to 850, the better your grade. Responsible credit behavior will result in a better grade.

Explain the importance of a good credit score to your child. Let them know that a higher score will help them with big purchases, like buying a car with better interest rates, getting a low-interest loan to buy a house or getting approved on other credit applications needed for important purchases or rentals.

Teaching tip: Focus on the positives

Explaining that good credit can be both easy to maintain and a very valuable tool when used responsibly will help make the lessons more impactful and encouraging.

Lesson 5: Credit Score Matters

Make sure you emphasize the importance of credit scores with your children and help them picture what types of hardships come with bad credit. For instance, when it’s time for them to get a loan for a car or house, they may not be able to do so due to poor credit decisions that they’ve made in the past.

Once your child first gets a credit card of their own, it’s a good idea to check in with them or check their credit scores every now and then to make sure they’re on track for good creditworthiness.

Teaching tip: Help children form good habits early

Teaching your children early on to be careful with their money, save for things that they want and pay back loans or debts right away will help them establish good financial habits for the future.

Lesson 6: Only Use a Credit Card If You Can Pay It Back

One of the biggest mistakes that people make is spending credit that they can’t pay back. Make sure your child understands that making charges that can’t be paid back can spiral into other credit card problems such as missed payments, late fees, high interest rates and a low credit score. Get your child in the habit of only borrowing money that they know can pay back, since failing to do so could burden them for years to come.

Teaching tip: Be an example To help your child understand that credit card purchases need to be paid back as soon as possible, walk your child through your own repayment process each month.

By the end of each month, have children “pay off” any pretend credit card purchases that they have made by doing household chores. We’ve created the chore chart above that you can fill in and personalize based on the specific chores you want them to complete to pay off their credit card purchases. After you have filled out the sheet with chores that can be done to repay the monthly credit card debt, color in the credit card icons to show how much each chore is worth, depending on the difficulty of the task.

Once they have completed a task, have them color in the amount of earned credit card units on their credit spending tracker.

Lesson 7: Debit vs. Credit

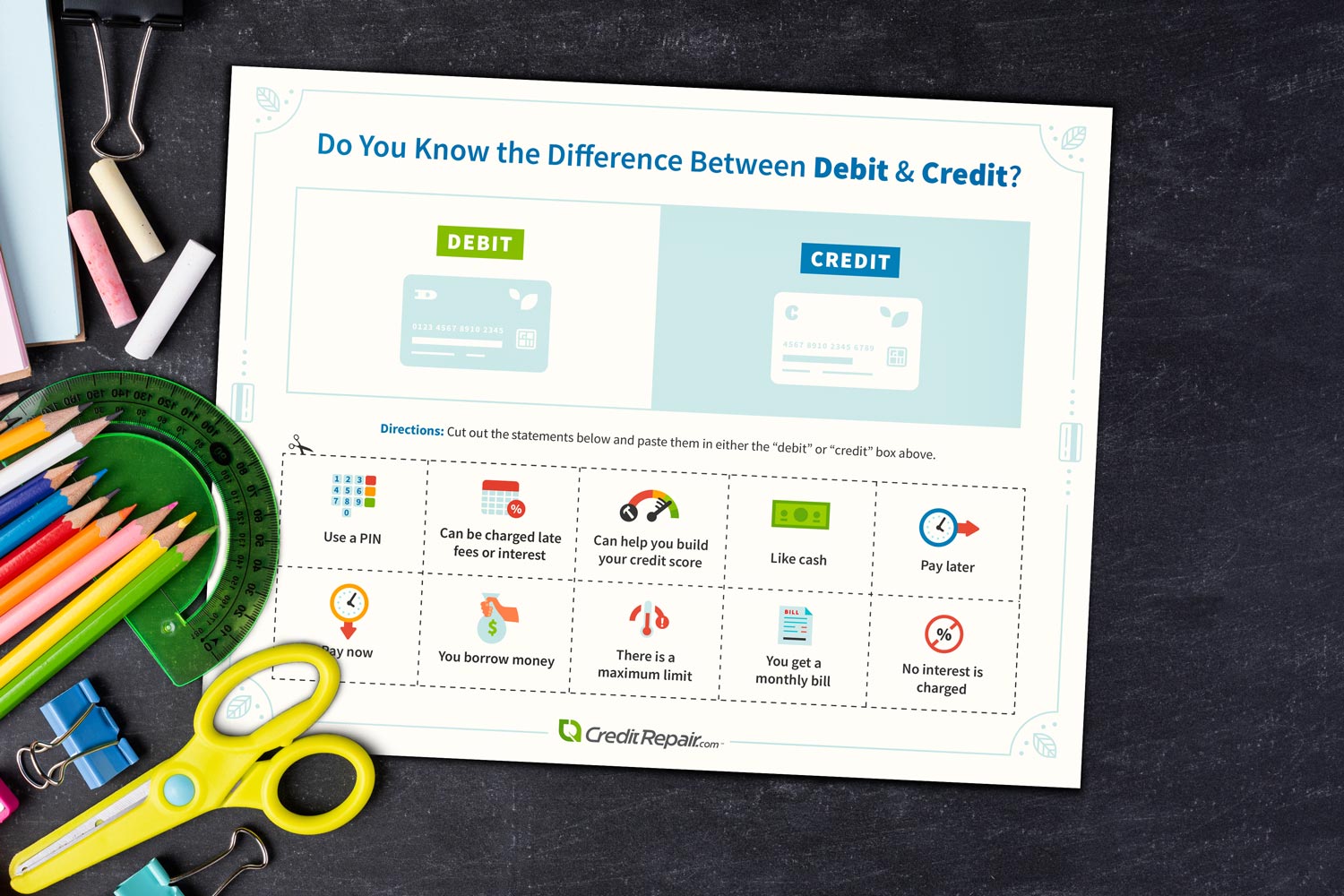

Now that your child knows about credit cards, it’s important that they understand the difference between debit and credit.

A simple way to differentiate between debit and credit is to explain the following:

- A debit card is used to store cash that you have earned. It goes in the bank so that you don’t have to carry bills around with you.

- When you use a debit card to make a purchase it will come directly out of your bank account.

- A credit card allows you to buy now and pay later.

Teaching tip: Take breaks There is a lot that goes into credit and creditworthiness, so make sure you take breaks to not overwhelm your children. Taking time in between lessons to allow information to sink in and for your children to think of questions they might have can be more effective when learning new things.

Work with your child to complete the cut and paste worksheet designed to show the differences between debit and credit. Have them cut out each statement and glue them in either the debit box or credit box, based on which type of card the statement describes.

Getting Your Teen Ready for Financial Independence

When your teen has a job or is otherwise ready to have their own spending power, consider starting them off with their own credit card account or a joint account where they are an authorized user. This way you can monitor their activity and make sure repayments are made every month, until they’re ready for full financial independence and responsibility.

Some banks have an age requirement or require a cosigner from a parent or guardian in order for minors to get a credit card. Do your research to ensure you can meet application requirements before applying to a bank or lender.

Once your child has an account, discuss what the credit card should be used for, such as things they’ve already budgeted and saved for—like gas for their car or school lunches. If you’re on the fence about giving your child the responsibility of a credit card, a debit card could also be a good first step to teach them budgeting and how to manage their own money.

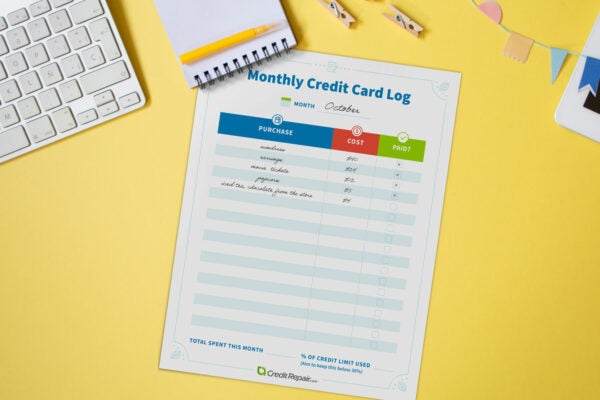

If your child has a credit card, have them use the printable credit card log below to keep track of purchases and payments.

Here are a few additional tips to ensure your teen maintains good credit once they have their own credit card:

- Work with them to set up automatic payments to make payments on time

- Have them pay more than the minimum payment each month or the full debt owed, if possible

- Encourage them to log payments so that they don’t hit their credit limit (keeping credit usage below 30 percent of the credit limit is best)

- Have a joint account where you can monitor your child’s purchases and repayments until they’re ready to handle a credit card on their own

- Reiterate that credit mistakes can impact their financial health for years to come

Having your children learn financial responsibility and work toward building credit sooner rather than later can be extremely beneficial as they look to make important purchases or apply for necessary loans once they’re on their own. If you have questions about making the right credit decisions for you or your child, consider a consultation with a credit repair advisor.