Disclosure regarding our editorial content standards.

The Financial Independence, Retire Early (FIRE) movement calls for frugal living and aggressive saving in order to retire well before the traditional retirement age of 65 years old. The movement is popular among many people, but especially high-earning individuals in their 20s, 30s and 40s. While the FIRE movement contains some solid financial advice, it may not work for everyone—or even be desirable.

The appeal of the FIRE movement is strong. After all, who wouldn’t want to be free to pursue their passions without worrying about a paycheck? Some of the associated sacrifices, however, may not be so desirable—not everyone is willing to live frugally for 10 or 15 years, even if it means early retirement.

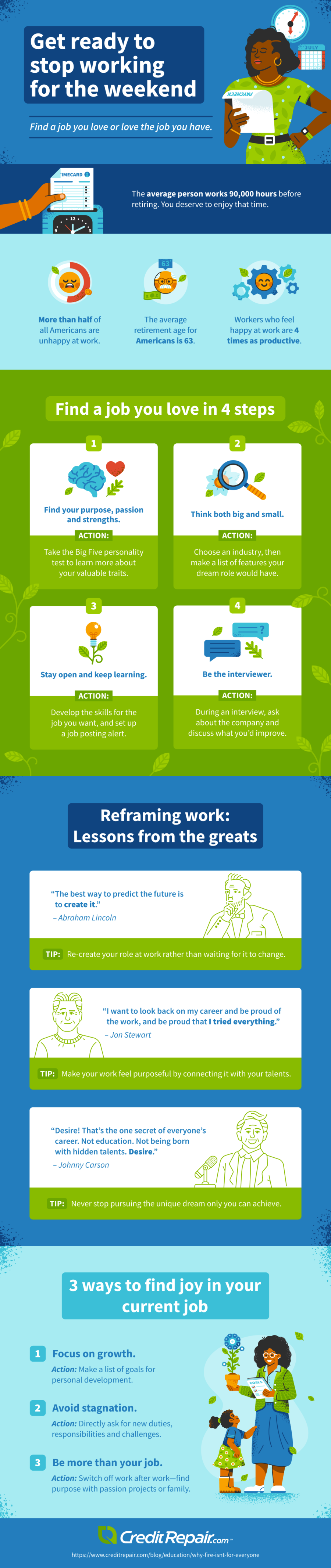

Below, we took some time to learn more about the FIRE movement, the reasons it may not work for everyone and the lessons you can learn from FIRE—even if you don’t plan to retire early. Don’t forget to check out the infographic below with additional tips to stop working for the weekend.

What is the FIRE movement? 3 basic principles

The FIRE movement is a financial philosophy that encourages people to increase their incomes and save aggressively so that they can reach financial independence and retire early.

Essentially, the principle behind the movement comes down to simple math: if you can save around 25 times your annual spending needs, you can withdraw money from your investment portfolio every year and it will continue to grow. Saving that amount in a short period of time requires intense saving—usually between 50 and 75 percent of your income.

The reality, of course, is a bit more complicated, since everyone’s situation is different and the market can be unpredictable.

Still, the ideas behind the FIRE movement are easy to understand.

1. Save as much as you can

By saving 75 percent of your income—for example, $45,000 a year on a $60,000 annual salary—supporters of the movement suggest you could be financially independent after just seven years.

2. Increase your income

Any additional income can in turn boost your savings as long as you avoid “lifestyle creep”—which means you can’t let your expenses increase along with your income.

3. Generate at least 25 times your annual retirement needs

With this amount saved, you can withdraw 4 percent of your investments each year, assuming the market continues to grow at around 5 percent. For example, to withdraw $40,000 each year, you’d need to save $1 million in your investment account.

The FIRE movement is based on solid financial principles, but there are no guarantees. Your income, living situation or the market could change significantly, affecting your results. Furthermore, extreme frugality can be more challenging in reality than it looks on paper: can you actually live on just 25 percent of what you take home?

Nonetheless, the movement has become incredibly popular, with thousands of books, blogs, podcasts and publications covering the topic. Across the country, millions of people strive for financial independence and early retirement by following the principles above and adapting to their particular circumstances.

However, enthusiasm for FIRE sometimes leads to unrealistic expectations—the truth is that the FIRE movement may not work for everyone.

5 reasons FIRE may not work for everyone

Although the FIRE movement’s ideas about saving and investing have a solid financial basis, the reality of financial independence is difficult for many people for a variety of reasons.

Here are some of the ways that your journey may make early retirement a challenge.

1. You need to have a substantial income

Achieving financial independence requires an income significant enough to cover normal expenses while still saving. Individuals who have lower incomes and costly expenses like housing, food or healthcare may have no means of saving at the rate required to retire early.

Although poverty has decreased in recent years, the U.S. Census Bureau estimated in 2019 that 12.3 percent of the population lived below the poverty line. That’s nearly 40 million people who are struggling to take care of basic needs—so the idea of financial independence is nowhere in sight.

Even the median income in the United States—$68,703 in 2019—is likely not enough to cover expenses while saving enough to achieve financial independence, which means that FIRE is out of reach for at least half of Americans. Someone earning the median income would need to save around half their income for 20 years to retire early, but living on $35,000 can prove difficult for many reasons.

2. You may end up with “frugal burnout”

The FIRE movement calls for a clinical evaluation of your expenses to cut out anything unnecessary in pursuit of a higher savings rate. At first, this can be an exciting task, as a collection of small expenses can lead to huge savings. Supporters of the movement often avoid costly cell phone plans, streaming services, gym memberships, daily coffee shop stops, new cars and restaurants in an attempt to achieve a frugal lifestyle.

Still, adhering rigorously to this lifestyle can lead to frugal burnout. Can you give up going out to eat, taking vacations or buying luxury items for 10 or 15 years? If you focus only on your financial goals for the future, you may miss out on some of the joys in the present. While some people may find that the end result justifies the frugality along the way, others may prefer to spend a bit more now—even if it means delaying retirement.

3. Your results depend on market returns

Everyone’s retirement prospects depend at least in part on investment returns. However, a market adage tends to favor traditional retirement over early retirement: time in the market rather than timing the market.

Over a long period of time, the market tends to go up, so you’re likely to be better off at the end of your working years than the beginning if you invest throughout your career. In a short period of time, though, the market is much more volatile—if you’re planning to retire in 10 years, the market may not cooperate.

With investment returns, there are never any guarantees. So while you may find many people who say you can assume 5 percent market returns after inflation as you pursue financial independence, the market may not do what you need it to.

4. You may suffer unexpected setbacks

Even with the best-laid financial plans, you may experience obstacles and setbacks that interfere with your goal to retire early. For example, you may face a sudden expense—like a hospital visit or home repair—that decimates your annual savings goal. Other major life events—like a disabling injury, a forced career change or a cross-country move—could change your living situation and, in turn, your finances.

Supporters of the FIRE movement tend to assume that everything will stay the same or get better, but life frequently throws curveballs that push us in the opposite direction. Setbacks both small and large, such as a modest rent increase or a costly identity theft, can derail plans for financial independence. A longer-term retirement plan may leave you a bit more ready to roll with the punches than the quick approach encouraged by FIRE.

5. Your family arrangement may not be compatible

Simply put, FIRE is a lot easier for married people without children. When you’re married, your joint income can increase while some expenses can be shared, enabling you to save more money. If both spouses are working—especially if they’re working high-paying jobs—the potential to quickly and efficiently save toward financial independence is increased.

Couples or single people with children increase their expenses without a corresponding increase in income. Although having children may qualify you for certain tax credits, it’s unlikely that these credits will outweigh the estimated $233,610 that the USDA estimates it costs to raise a child through age 17. Ultimately, the FIRE movement is about choosing your priorities: For those who desire children, the idea of early retirement may be out of reach without an extraordinarily high income.

Still, even for people who don’t follow FIRE principles to the letter, there are several important lessons to take away.

3 lessons to take away from FIRE

Even if financial independence and early retirement are not possible for you, some of the lessons from FIRE are still applicable.

Keep some of these ideas in mind as you continue to plan your career and your financial future.

1. Find purpose in your work

One of the main motivations for supporters of the FIRE movement is to find freedom from work that feels like drudgery. Feeling like a minion to a job that doesn’t motivate you can be a crushing experience day to day. Even after achieving financial independence, some FIRE supporters continue to work—just focusing instead on passion projects or volunteering.

Takeaway: You don’t need to wait until you’re financially independent to find meaning and joy in your job. Look for a job that gives you a sense of accomplishment and purpose, or try to carve out a new role within your current job that engages some of your personal talents and passions.

2. Diversify your investments and income

People who are working toward FIRE are savvy investors and money-makers. By diversifying their investments—among tax-free retirement accounts, high-yield savings accounts and traditional investments—they aim to mitigate their risks while promoting growth. Another strategy involves diversifying your income: rather than simply relying on one paycheck from one employer, try to find side hustles and other revenue streams that help protect you if you lose your job.

Takeaway: Even if you aren’t looking to retire early, having a steady inflow of cash from several sources can help you ride the waves of your career. Also, investing in tax-free retirement accounts—like an IRA or a 401(k)—as well as other index funds can provide you with a diversified portfolio that grows as you approach retirement. Just as you focus on growth in your investments, also work on developing a growth mindset more generally.

3. Live within your means

The most extreme version of FIRE calls for radical frugality and an extremely high savings rate. Underneath this lifestyle is a simple truth: you can’t save money unless you live within your means. While saving high percentages of income may be difficult for some people, almost everyone can put away some money each month by being careful to distinguish between needs and wants.

Takeaway: Do a personal financial audit to assess your necessary expenses as well as your discretionary spending. You may find places to cut back and save toward your retirement. Also, make sure to avoid using credit cards for items you can’t truly afford.

If you have put yourself in a tough situation with credit card debt, it is definitely possible to get back on top of your finances. Start by making a plan to pay back your debt, but also make sure to prioritize fixing your credit—that way when you’re ready to take on a car loan or a house payment, your score will work for you.