Disclosure regarding our editorial content standards

If you bring up the topic of allowances with a group of parents, odds are you’ll get a mix of perspectives. Some parents have expected weekly allowances, while others prefer to reward their kids when they do something, not have it be anticipated. Other parents still are against the idea of financial rewards altogether, and prefer to treat their children for a job well done with something other than cash.

These three schools of thought generally cover parents’ attitudes toward allowances as a whole. Some parents want to reward their children for jobs or chores well done, but it may not be an option financially. While allowances can teach kids important lessons about credit and finances, they may not be viable for families looking to save money or fix their credit.

If you’re a parent looking for allowance alternatives for your kids, we’ve got you covered. Read on for 10 different paid and unpaid options to reward your child for helping out, without it being an expected payout. We’ve also included tips on setting allowances and rewards with peace of mind.

Paid allowance alternatives

If you’re a parent who wants your kids to understand the value of an earned dollar, then paid allowance alternatives may be the best option for your family as long as it makes sense financially.

These alternatives differ from traditional allowances in that the money must be earned, not given on a regular schedule. Below are five suggestions of paid allowance alternatives, ranging from paid chores to investing in a bank account for your child.

1. Paid chores

Suggested age group: 2–13 years old

To inspire your little one to help out around the house more, try rewarding them for completing chores. Decide together what each chore should be worth—this will help them understand that while some tasks may be harder than others, they’re often worth more.

If you need help deciding which chores are appropriate for your child to complete, here are some ideas.

- Ages 2–3 (with supervision): Put toys away, help make the bed, dust, put dirty laundry in the laundry basket, fill up pet water and food bowls.

- Ages 4–5 (with supervision and assistance): Pick up and put away toys, set and clear the table, sort laundry by color, match socks, clean rooms.

- Ages 6–7: Make the bed, empty indoor trash cans, vacuum, fold and put away laundry, help load and put away dishes, assist with mopping.

- Ages 8–11: Wash dishes, wash the family car, rake leaves, collect and take the trash to the curb, clean the bathroom, learn to use the washer and dryer.

- Ages 12–13: Babysit when needed, change light bulbs, assist with yard work, clean entire rooms, clean mirrors.

2. “Budget” management

Suggested age group: 7–10 years old

Another alternative allowance method that both teaches kids responsibility and lets them handle money is to have them manage a “budget” with your supervision and input. By teaching your children the value of having enough money to spend, save and share, you’re setting them up to have positive spending habits later in life.

Try a simple at-home budget using clear mason jars or bottles marked with “spend,” “save” and “share.” Using coins or small bills, have them decide what to do with their allowance or other saved money with your input.

Use the “spend, save, share” printables below to easily label your jars, and use the ledger to mark down how much money is in each jar. See if you can further illustrate the importance of saving with a savings challenge using the jars!

3. Bank investments

Suggested age group: 2–13 years old

Another way to reward your child financially is to invest in a bank account for them. Though this is different from handing them money for helping out around the house, it helps teach them valuable skills about investing and saving.

You can start investing in this account as early as their birth, and then have a discussion about what it’s used for once they’re old enough—whether that’s to save up to buy a car, help them with student loans or just to help them have a strong savings account. This can also help teach children about banks, credit and the importance of saving, so once they’re old enough they can begin building credit with ease.

4. Shopping trip

Suggested age group: 8–13 years old

To reward your child for good grades, helping out around the house or something else worthy of a treat, take them on a shopping trip with a reasonable budget. Don’t let them pick anything they want, though—use this as an opportunity to help them understand that certain things can add up.

Let your child choose where they want to go: a bookstore, clothing store, toy store or elsewhere, and then agree upon a budget together (try and stay somewhere between $30–$50). Together, shop around and see how much your cart adds up to be. This can teach an important lesson about overspending and how to stay on-budget. You can also consider using cash envelopes to show the importance of saving and keeping a budget for a certain purpose, like a shopping trip.

5. Rewards tracker

Suggested age group: 4–10 years old

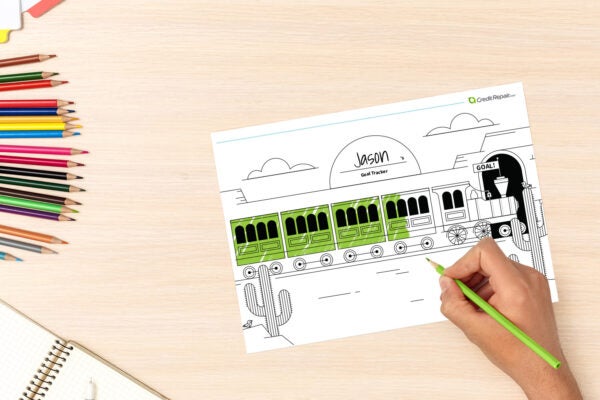

A rewards tracker is another way to reward your child for jobs well done, good grades, being especially helpful around the house or another reason worth celebrating. Using a rewards tracker (like the printable one below), track worthy behavior, chores, grades and other metrics until you reach an agreed-upon reward.

This reward could be financial, or your child could pick a reward themselves. This could be one on this list (a shopping trip), or something not financial altogether (like a special dinner). This type of rewards system is a great opportunity for your child to flex some autonomy and decision-making skills.

Use our fill-in-the-blank printable rewards tracker below to get started on tracking your child’s progress. Use stickers, markers or even dry erase markers to keep track of their progress. Remember to collaborate with your child to decide what their rewards could look like—keeping them in the loop and letting them make decisions is great practice for the future!

Unpaid allowance alternatives

Allowances aren’t a viable option for many families, whether they need to prioritize their credit card debt, are paying off surprise medical bills or just don’t believe in rewarding their children with money.

If you’re a parent who still wants to honor their little one for a job well done, unpaid allowance alternatives might be the best route for you. These are rewards that don’t pay your child outright for a job well done, but still show your child that good work can earn them a reward. Read on for five unpaid allowance alternatives to show appreciation for your child.

6. Extra screen time

Suggested age group: 6–13 years old

Chances are, your child usually begs you for extra screen time any chance they get. It’s recommended to limit screen time for kids, whether they watch the family television or have devices of their own.

However, one money-free way to reward children for doing their chores, getting good grades or being helpful is with extra screen time. Don’t make it unlimited or give them free rein; try extending their usual screen time by 15 minutes to an hour, depending on how much of a treat they’ve earned. This way, they’re getting rewarded for a job well done while getting to do something they already do, just for longer.

7. Special activities

Every child is different, and no reward will be a one-size-fits-all approach. If you want to be a bit more open-ended with treats (and make them a bit more of an experience vs. a physical item), plan a special activity to complete with your child when they’ve earned it.

This could be anything, ranging from big activities to smaller ones. This can be something really special (like a trip to an amusement park) or something a bit more low-key (like a slumber party at the end of the school year). Choose this activity together with your child, but make sure it’s financially viable for your family.

To help them visualize their progress toward their reward, download our tracker to help your child follow their progress toward their special activity. You can color this in or laminate it and use dry-erase markers to make it reusable. Hang it in your child’s room or common area, and see how fast it fills up!

8. Later bedtime

Suggested age group: 5–10 years old

Another way to treat your kids for a job well done without cash is to push back their bedtime. Again, it’s a good idea to be reasonable with this—try pushing it back 30 minutes to an hour, depending on how much of a reward they’ve earned.

Try and implement this on a weekend or over a holiday, so they aren’t losing sleep on a school night. It’s also a good idea to extend their bedtime while finishing a movie, game night or completing some other activity, so there is something to fill the free time before bed.

9. Edible treats

Suggested age group: 4–13 years old

Most kids have a big sweet tooth or cravings for sugary foods that aren’t healthy to eat on a regular basis. However, treating your child to an edible reward every once in a while doesn’t hurt, and helps them see that indulging because of a job well done is good.

To ensure that a treat doesn’t become weekly or otherwise expected, try to surprise your child instead of promising them after they complete a task or get a good grade. Having the reward come out of the blue will make it that much more special, and they won’t be doing something just to get a treat.

If you need some inspiration, here are some ideas of affordable, edible rewards to share with your child after a job well done. We’ve coupled these edible rewards with activities to make the treat even more special, and organized these from most cost-effective to those that are a bit more of a splurge.

- Cupcakes, cookies or a cake you bake and decorate together

- Movie theater concessions (soda, popcorn and boxed candy) for an at-home movie night

- An ice cream sundae bar and tea party

- Their favorite takeout for a backyard picnic

- A special dinner at a restaurant to get dressed up for

10. Choice of reward

Suggested age group: 6–13 years old

If you’ve raised a fairly independent child, or want them to have more autonomy with choosing their rewards, you can implement a choose-your-own-rewards system (within reason).

Using our printable rewards tracker, have a conversation with your child about what they feel a reasonable reward is for each task: for completing all their chores, it could be 10 extra minutes of screentime; for getting an A on a report, it could be an at-home movie night with the family. Getting your child involved in these decisions instead of making the decisions for them will help them see what reasonable rewards are for jobs well done.

If your child gets analysis paralysis or they want smaller rewards for smaller tasks, try having a “treasure chest” with stickers, small candies, magnets or other small treats they can pick through when they’ve earned a reward. Not only does this still let them choose what they’ve earned, it makes earning rewards much easier—they can earn a treasure chest treat after something as small as putting their laundry away.

How to set rewards that will motivate your child

Setting rewards as a parent can be tricky. You want to be sure you’re rewarding your child for doing something right, but don’t want rewards (monetary or otherwise) to become expected parts of their childhood.

Below, we’ve listed some suggestions on how to set rewards for your child so that they’re fun, unexpected treats when your child does something well, but aren’t expected.

Brainstorm rewards together

One way to ensure you’re setting achievable, desirable rewards for your child is to brainstorm what their reward will be together. This lets your little one have input into what they’ll be earning, which helps them develop positive decision-making skills.

There are several ways to brainstorm with your child. You can have an open conversation and jot down ideas together; you can make a list and have them choose their top few rewards; or they can come up with ideas and you can agree or disagree.

Be sure to encourage your child to come up with ideas, and be careful not to shoot all of their ideas down—instead, explain why that may not be the best reward, and always try to offer an alternative.

Make allowances rewards, not expected

One of the biggest struggles parents face when deciding how to implement allowances for their children is that they want their children to understand the value of getting paid or rewarded for hard work. While weekly allowances are a great option for some families, many want to reward their child for a job well done—not hand them money each week, regardless of chores, behavior or grades.

One simple way to make an allowance (whether paid or unpaid) a reward rather than expected is to avoid handing out treats on a regular schedule. Abide by a tracker if that’s the system used in your home, but if not, try to give out treats randomly. Getting a treat out of the blue, without it being anticipated, will make the treat that much better for your little one.

To make getting allowances or rewards even more special, use our printable notes to let your child know when they’ve earned a treat. This could be for a good grade, a week of good behavior, being especially helpful around the house or doing chores without complaint. Tape these notes on your child’s door, leave them on their pillow or slip them into their lunches to let them know when they’ve earned a treat!

Ensure the amount or reward is sustainable

No matter what sort of allowance you choose, you’ll want to ensure it’s sustainable enough for you to keep up throughout your child’s life. The last thing any parent wants is to go into debt over their child’s allowance.

Don’t promise a $30 allowance each week if that’s not financially possible for your family, and don’t set up a rewards tracker with rewards you won’t be able to provide (like a trip to Disneyland for straight As). This is when brainstorming rewards with your child comes in handy—kids are often happier with smaller things than parents may give them credit for. You may think they want an extravagant treat, when in reality they’d be happy with a family dinner and movie night.

No matter what rewards you settle on be sure they’re sustainable, financially or otherwise. However, if a financial emergency arises and you need to adjust their reward, be sure to communicate with your child early about their reward not being what was agreed upon. If possible, try and reach a compromise about a suitable replacement.

Paid allowances can cause a lot of stress, but never fear: there are allowance alternatives that don’t require money. There’s no need to go into debt—or need help fixing your credit score—because of your child’s allowance. With unpaid allowance alternatives like a later bedtime or edible treat, you can reward your child for a good grade, good behavior or chores well done with peace of mind.