Disclosure regarding our editorial content standards.

Table of contents:

- Key takeaways

- Average monthly car payments

- Average car loan length

- Auto loan rates

- Auto loans by credit score

- Auto loans by age

Purchasing a car isn’t cheap—for many Americans, it’s a significant expense that often comes with a heavy financial burden. But for most, access to a car is necessary to carrying out many of life’s essential activities, such as getting to and from work and buying groceries.

Car ownership requires most consumers to take on debt in order to afford such a hefty price tag. The past year has revealed that Americans are taking out more auto loans than ever, and while interest rates have decreased, the overall cost of auto loans has risen. For a full picture of the most recent auto loan trends across the U.S. in 2022, take a look at the auto loan statistics below.

Key takeaways

Auto loan debt is the third-largest component of household debt, following student loan debt and mortgages. The amount Americans owe in auto loan debt has steadily grown at a rate of six percent over the past decade, and auto loan originations reached a record $202 billion in the second quarter of 2021. Overall, these statistics reveal how the auto loan bubble continues to grow.

- U.S. consumers owed a combined $1.44 trillion in auto loan balances in the third quarter of 2021. [New York Federal Reserve]

- The overall cost of auto loan debt in the U.S. increased 100 percent between 2011 and 2021. [New York Federal Reserve]

- Auto loan debt accounted for 9.4 percent of all consumer debt in 2021. [New York Federal Reserve]

- Auto loan balances increased by $28 billion in the third quarter of 2021. [New York Federal Reserve]

- The average cost of a new car is more than $45,000 and over $29,000 for a used car. [CNBC]

- 24 percent of all new vehicles were leased in the third quarter of 2021. [Experian]

- The average loan term for a new car in 2021 was 69.47 months. [Experian]

- The average cost to finance a new car was $39,071 at the end of 2021. [CNBC]

- 40.73 percent of new vehicle purchases were financed in the third quarter of 2021. [Experian]

- 59.27 percent of all used vehicle purchases were financed in the third quarter of 2021. [Experian]

- Electric vehicles made up 2.25 percent of all new auto financing in 2020. [Experian]

- Hybrid vehicles made up 4.47 percent of all new auto financing in 2020.[Experian]

Total Auto Loan Debt in the U.S.

| Total auto loan debt in the United States | |||

|---|---|---|---|

| 2020 | 2021 | Annual change | |

| Total loan balance | $1.36 trillion | $1.44 trillion | +$80 billion (6%) |

Source: New York Federal Reserve, Experian

Average monthly car payments

Even with today’s lower interest rates and longer loan terms for vehicle financing, the overall cost of auto loans has increased. The average monthly payment for a car is $609 for a new vehicle, $465 for a used vehicle and $497 for a leased vehicle.

13. The average monthly car payment for all vehicles was $645 in the third quarter of 2021, compared to $530 in 2019. [Experian]

14. The average monthly car payment for a standard gas-fueled vehicle is $524. [Experian]

15. The average monthly car payment for a diesel-fueled vehicle is $860. [Experian]

16. The average monthly car payment for a hybrid vehicle is $529. [Experian]

17. The average monthly car payment for an electric vehicle is $689. [Experian]

Average car loan length

Auto loan terms steadily increased in the lower consumer credit categories in 2021 while prime and super prime borrowers experienced shorter terms than in the previous year.

18. The average auto loan term for all vehicles was 63.94 months for super prime consumers in 2021. [Experian]

19. The average auto loan term for all vehicles was 70.97 months for prime consumers in 2021. [Experian]

20. The average auto loan term for all vehicles was 74.13 months for near prime consumers in 2021. [Experian]

21. The average auto loan term for all vehicles was 73.50 months for subprime consumers in 2021. [Experian]

22. The average auto loan term for all vehicles was 72.19 months for deep subprime consumers in 2021. [Experian]

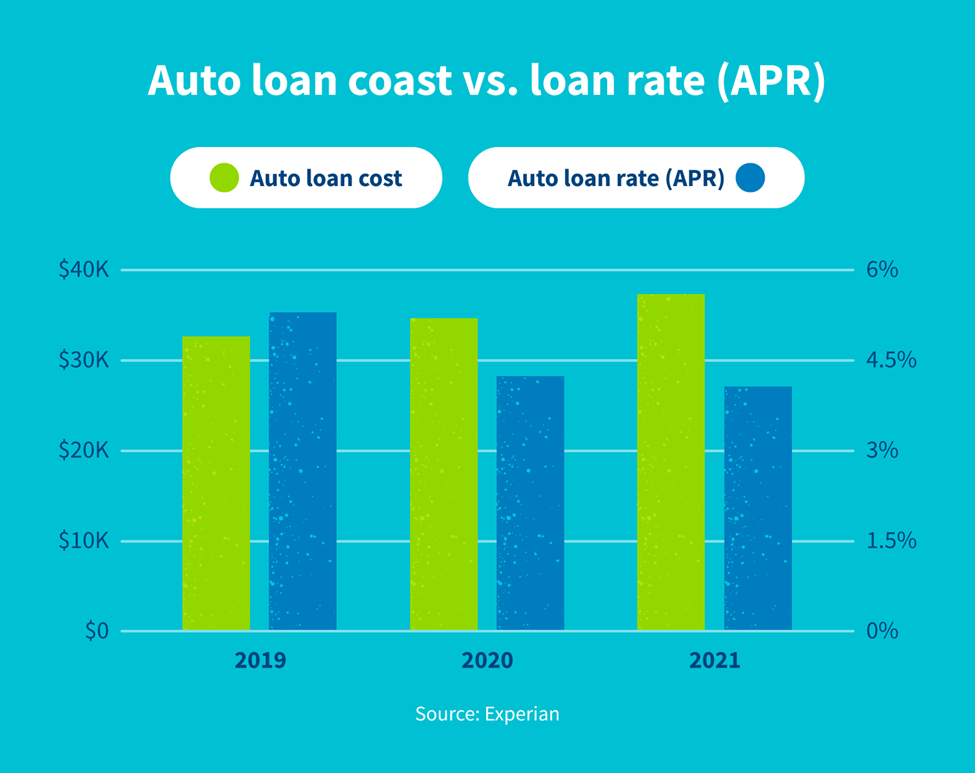

Auto loan rates

While average auto loan interest rates have declined over the last few years, the average size of the loan has steadily increased in the same period of time.

23. Borrowers with high credit scores had an average APR of 7.88 percent in 2021. [U.S. News]

24. Borrowers with low credit scores had an average APR of 16.18 percent in 2021. [U.S. News]

25. Car loan interest rates were under four percent in December 2021. [Statista]

26. Interest rates on five-year car loans have steadily fallen since reaching a high of 4.96 percent in 2018. [Statista]

27. The average cost for a new auto loan increased by 8.55 percent between 2020 and 2021. [Experian]

28. The average cost of an auto loan was $37,280 in 2021. [Experian]

29. The average cost of an auto loan was $32,575 in 2019. [Experian]

30. The average cost of an auto loan was $34,682 in 2020. [Experian]

31. The average auto loan rate was 4.05 percent in 2021. [Experian]

32. The average auto loan rate was 4.23 percent in 2020. [Experian]

33. The average auto loan rate was 5.28 percent in 2019. [Experian]

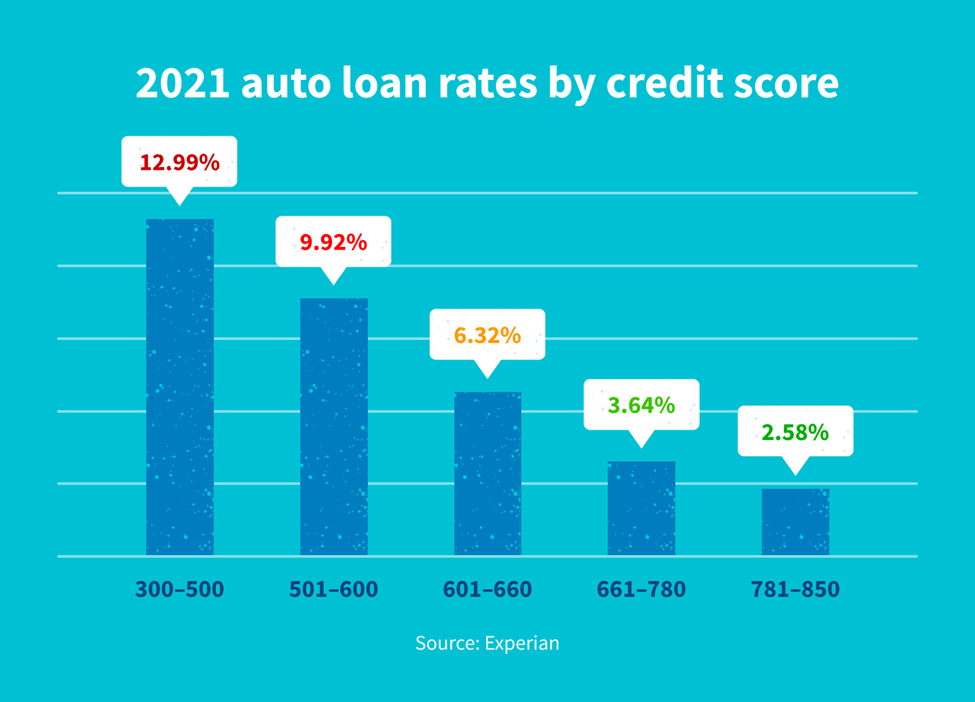

Auto loans by credit score

Lenders have varying criteria for how they measure a credit score, and one category measures your score based on your likelihood of approval for credit cards and loans, including auto loans. This designation is known as prime vs. subprime—subprime encompasses bad, fair or poor credit, and prime covers good to excellent credit. Here’s a breakdown of these credit score groups:

- Deep subprime: 300–500

- Subprime: 501–600

- Nonprime: 601–660

- Prime: 661–780

- Super prime: 781–850

Consumers with prime and super prime credit ranges accounted for the majority of total auto financing in 2021, while subprime and deep subprime groups saw a decrease in new auto financing. Auto financing for subprime consumers declined at a faster pace in 2021 than in previous years, which might be attributed to the impact of COVID-19 on this consumer category.

34. Consumers who purchased new vehicles in 2021 had an average credit score of 733. [Experian]

35. Consumers who purchased used vehicles in 2021 had an average credit score of 675. [Experian]

36. The credit score of consumers who purchased a new vehicle in 2021 was one point higher on average than those who purchased a new vehicle in 2020. [Experian]

37. The credit score of consumers who purchased a used vehicle in 2021 was nine points higher on average than those who purchased a used vehicle in 2020. [Experian]

38. The average loan rate for super prime consumers was 2.58 percent in 2021. [Experian]

39. The average loan rate for prime consumers was 3.64 percent in 2021. [Experian]

40. The average loan rate for near prime consumers was 6.32 percent in 2021. [Experian]

41. The average loan rate for subprime consumers was 9.92 percent in 2021. [Experian]

42. The average loan rate for deep subprime consumers was 12.99 percent in 2021. [Experian]

43. 19.7 percent of total auto financing was attributed to super prime consumers in 2021. [Experian]

44. 46.66 percent of total auto financing was attributed to prime consumers in 2021. [Experian]

45. 18.4 percent of total auto financing was attributed to near prime consumers in 2021. [Experian]

46. 13.66 percent of total auto financing was attributed to subprime consumers in 2021. [Experian]

47. 1.58 percent of total auto financing was attributed to deep subprime consumers in 2021. [Experian]

48. Electric vehicles have purchasers with the highest credit scores out of all fuel types. [Experian]

Individual Auto Loan Debt by Credit Score

test

| Auto loan debt by credit score | |

|---|---|

| Credit score | Average auto loan debt |

| 300–579: Very poor | $28,252 |

| 580–669: Fair | $35,092 |

| 670–739: Good | $39,310 |

| 740–799: Very good | $38,896 |

| 800–850: Exceptional | $33,915 |

Source: Experian

Auto loans by age

Similar to other types of debt, the youngest adult consumers have historically seen the biggest increases in auto loans year over year. For example, generation Z (ages 18–23) saw an increase in auto debt by 12 percent in 2020. That’s nearly six times as much as the silent generation (ages 75–93). [Experian]

49. Generation Xers are the most likely to have an auto loan. [Annual Update for Controllers]

50. Gen X carries the highest auto loan balance, with a median of $19,313. [Annual Update for Controllers]

51. Auto loans made up roughly 18 percent of the total consumer debt for 18- to 29-year-olds in 2021—higher than any other age group. [New York Federal Reserve]

52. Auto loans made up roughly 10 percent of the total consumer debt for 30- to 39-year-olds in 2021. [New York Federal Reserve]

53. Auto loans made up roughly 9 percent of the total consumer debt for the 40–49, 50–59 and 60–69 age groups in 2021. [New York Federal Reserve]

54. Roughly 2.9 percent of the combined auto loan balance for borrowers between the ages of 18 to 29 transitioned into serious delinquency (90 or more days late) in 2021. [New York Federal Reserve]

55. Roughly 2 percent of the combined auto loan balance for borrowers between the ages of 30 to 39 transitioned into serious delinquency in 2021. [New York Federal Reserve]

56. Borrowers between the ages of 50 and 59 saw the lowest amount of loan transitions to serious delinquency in 2021 at just below 1 percent. [New York Federal Reserve]

Auto Loan Debt by Generation

| Auto loan debt by generation | |

|---|---|

| Generation | Average auto loan debt |

| Generation Z (18–23) | $15,943 |

| Millenials (24–39) | $19,268 |

| Generation X (40–55) | $22,512 |

| Baby Boomers (56–74) | $19,377 |

| Silent Generation (75+) | $14,760 |

Source: Experian

While the current state of auto loan debt has nearly doubled in the last decade, 2021 showed a more modest increase compared to other types of household debt. Even so, automobile spending will likely continue to steadily increase in 2022, with the majority of new and used cars being purchased in the form of a loan.

From a long-term perspective, it’s safe to say that auto loan prices will likely fluctuate along with the U.S. economy. The higher your credit score the more likely you are to secure better loan rates and terms and ultimately save money in the long run. If you’re struggling with a poor credit score, you don’t have to figure it out alone—contact the professionals at CreditRepair.com for expertise on how you can work on your credit.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263