Disclosure regarding our editorial content standards.

You’re probably familiar with how many choices you have when it comes to money: save or spend, invest in stocks or a mutual fund, use a credit card or a debit card—the list goes on. Beyond all of those choices, you also have numerous options when it comes to where to put your money. We don’t recommend sticking it under your mattress anymore, as there are far more secure options that can benefit you in the long run.

Whether you’re just starting out on your financial education journey or you’ve been in the game for a while, you’ve probably wondered at least once: Bank or credit union? How do they work and how do you choose one?

We’ll go over the main differences between a bank and a credit union, how to pick which one is best for you and the pros and cons of each.

Banks vs. credit unions

There are some core characteristics of banks and credit unions that we’ll highlight below, as well as their main differences. First and foremost, though, it’s worth noting that in the big picture, banks and credit unions do many of the same things. They typically have similar offerings and services. These can vary by location and branch, and can include but are not limited to:

- Checking and savings accounts

- Loans (mortgages, auto, etc.)

- Financial advising services

- Check and debit card distribution

- ATMs

- Mobile app services (account management, mobile check deposit, etc.)

The main distinction between a bank and a credit union is how they operate and their profit status: Banks are for-profit institutions, which means they operate either privately or publicly. Credit unions, on the other hand are nonprofit and are owned by members, set up as cooperatives. Banks typically operate on a national level, while credit unions are usually locally operated.

How do banks work?

Money in, money out, right? In some ways, yes, in others, no—let’s dive into the basics of how banks operate and what they mean for your money.

As we mentioned, a bank is a for-profit business. It operates by moving money around from customers’ deposits and, in turn, giving customers a small amount in return. It’s more than just a place to save your money, manage your finances and maybe take out a loan—the bank is looking to make money off of its customers. As long as you don’t have a negative banking history, banks are open to any and all consumers.

Let’s look at this example: You open an account at a bank to manage your finances and notice you have an “interest rate” assigned to your account, known as an annual percentage yield (APY). No, you don’t pay interest on your own money—that’s the amount the bank will pay you for putting your money in their accounts on a yearly basis.

The bank is then able to lend your money to other customers in the form of loans. Say you also apply and get approved for a loan. The interest you pay the bank on that loan will allow them to make a profit in return. In order to make money, the bank keeps the difference in interest, and the cycle continues. Banks also make money on various fees, such as overdraft fees, late payment fees, penalties and ATM fees.

Many banks also offer various credit card options, loans and financial advising services. These services may seem “free” at first, but the various amounts in interest you’ll pay over time and the money you put into your accounts will even things out overall. Banks also must pay federal and state taxes. Most banks are operated on a national scale, and with various technology offerings—like mobile apps—it’s easy to manage your money on the go.

How Do Credit Unions Work?

Credit unions operate a little differently than banks. As we mentioned, they’re nonprofit, member-owned financial institutions. Their overall goal is to serve members and offer them a well-rounded financial experience instead of to make money off of their members. When it comes to the basics, credit unions do many of the same things that banks do—hold your money, distribute loans, provide ATMs and offer various financial and investment services.

As nonprofit organizations, credit unions are membership-based. This cooperative model puts members first, versus putting profits first, like banks. As a result, credit unions invest any profits into the organization or divvy them out to members in the form of a dividend. Members typically share a common interest, which is supported by the membership initiation process.

They’re typically based around communities, careers or other notable factors, like military members, alumni of various universities and so on.

Membership is accepted on an applicant basis, so it’s a little bit trickier to become a member at a credit union than it is at a bank. As a result, credit unions typically offer fewer services than banks. Plus, they’re based locally, so it can be tricky to access any services you may need while out of town.

FDIC vs. NCUA

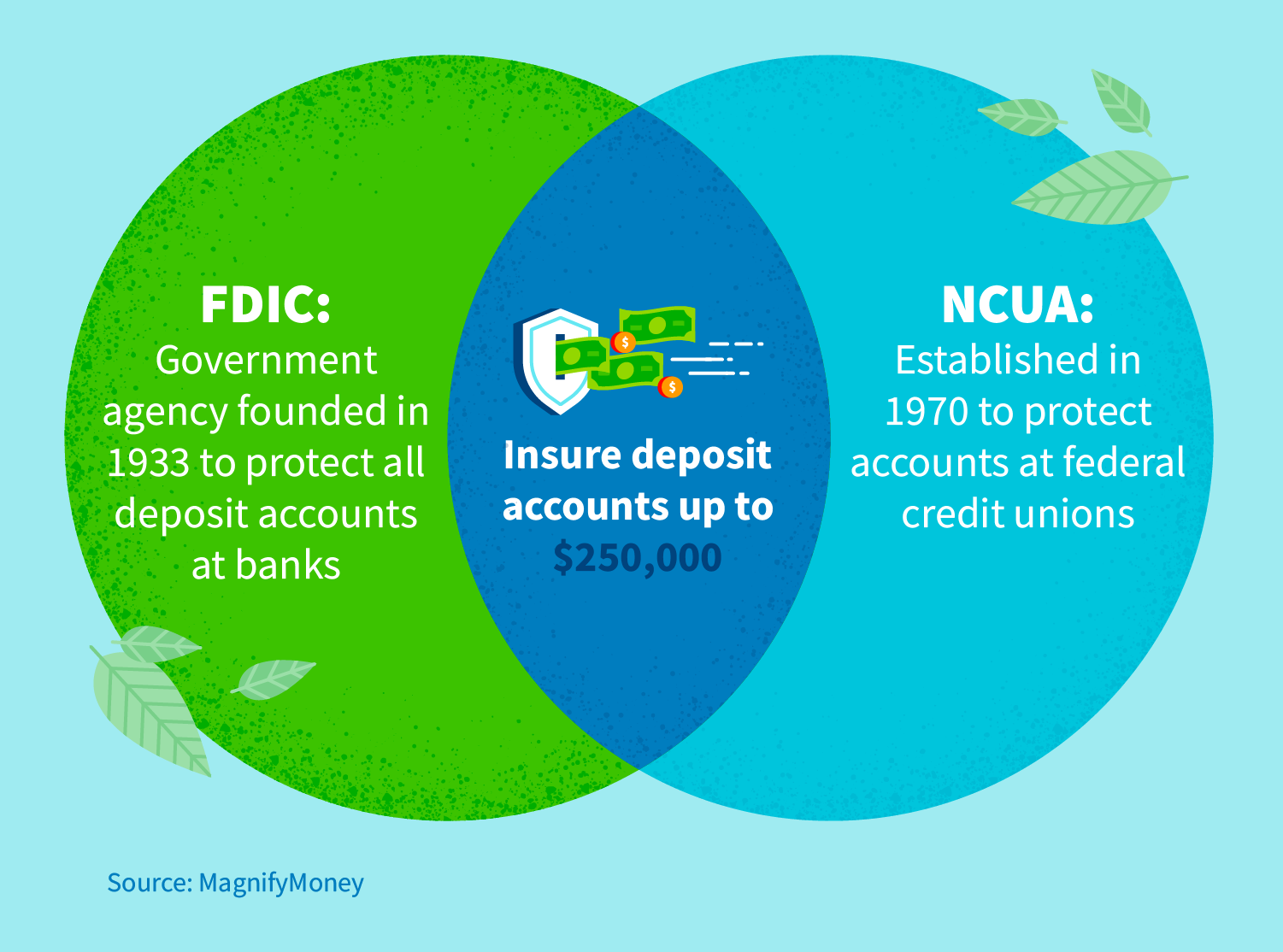

Both banks and credit unions are insured, meaning your money is safe whichever route you choose to take. They’re just insured differently.

Banks are insured by the Federal Deposit Insurance Corporation (FDIC). In the unfortunate event that your bank goes under (i.e., runs out of money or fails in its operation), you’d be paid by the FDIC the amount you had in your individual accounts, up to $250,000. Established in 1933, its longstanding history has helped regulate banks and their financial practices.

Credit unions are insured by the National Credit Union Administration (NCUA). Formed in 1970 by the U.S. government to act similarly to the FDIC, it serves to regulate U.S. federal credit unions and put in place various rules of operation. All individual and joint accounts at credit unions are insured by the NCUA up to $250,000; there’s also a cap on interest rates for various loans.

This doesn’t mean that the NCUA sets interest rates, though—that’s up to the individual credit unions. The NCUA just prevents them from going over a certain amount.

Both the FDIC and NCUA, though run and executed for different things, serve relatively the same purpose: to protect consumers from fraudulent or questionable practices by financial institutions.

How do you choose?

Okay, now you know the basics of banks and credit unions. But how do you choose which one is right for you? There are a few things to consider, including how they’re insured and their basic pros and cons. We’ll go over these details below.

Pros and cons of banks

If you want to be able to use your bank’s services nationwide and have easy accessibility to mobile banking services, various products and financial services, a bank may be the best fit for you. Check out the main pros and cons below to better understand this option.

Pros:

- There are typically more branches, ATMs and product offerings for more convenience. It may also be easier to manage your money internationally.

- Accounts are insured by the FDIC up to $250,000.

- Advanced technology and mobile apps make it easier to manage your money on the go.

Cons:

- Loans have higher interest rates in order to make the bank profitable.

- Fees and penalties may sneak up on you and cost you a lot over time.

- There are low interest rates on savings accounts.

Pros and cons of credit unions

If you’re looking for more of a community feel and fewer fees, a credit union may be the best fit for your financial needs. Here are the main pros and cons to consider.

Pros:

- Credit unions are member-owned with a focus on the community. This is also represented in customer service and ample financial education services.

- It’s easier to find loans with lower interest rates.

- You’re less likely to get pinned with high fees and penalties.

- Accounts up to $250,000 are insured by the NCUA.

- You will typically get higher APYs at credit unions than at banks.

Cons:

- Since they typically operate locally, it may be harder to find branches and ATMs.

- They typically offer fewer products than banks.

- You must meet certain eligibility requirements in order to become a member.

- Less advanced financial technology means you may have a harder time with mobile banking.

Bank vs. credit union: what’s the best option for your credit?

When it comes to managing your credit health, both banks and credit unions are great options. If you’re super confident with managing your finances and savvy when it comes to credit, you’d probably be perfectly happy with a bank. On the other hand, if you like a more hands-on approach to finances and appreciate a little extra TLC, a credit union may be the best way to go.

Most importantly, though, how you manage your money—not the financial institution you choose—will have the strongest impact on your credit. Wondering how to take your credit health to the next level? Whether you need help disputing inaccurate items on your credit report or could stand to brush up on your financial education, our team has your back.