Disclosure regarding our editorial content standards.

If you’ve ever taken out a loan, you may have considered altering your loan agreement at some point to reduce your payments or lower interest rates. This is a very common process known as “refinancing.” There are several reasons to refinance a loan, but it can be a daunting process if your credit isn’t quite up to par.

Borrowers can refinance most loans, including mortgages, student loans and car loans. Experts typically recommend working on improving your credit score before refinancing, but sometimes borrowers need to revise the terms of their loan on a shorter timeline. Read on for tips about how to make refinancing work for you, despite a poor credit history.

What is refinancing?

Refinancing is when you update a loan agreement to replace and amend the terms of your original loan. This can involve drawing up entirely new terms for your loan, or even combining two separate loans into one consolidated agreement.

Borrowers tend to refinance when they find it difficult to meet their payment obligations each month or are dealing with sky-high interest rates. Your lender can help you determine whether refinancing is right for you by analyzing your credit history, your debt and other aspects of your finances.

There are a variety of reasons that people decide to refinance their loans. Some borrowers seek to shorten or extend the payment period off their loans, while others do so to avoid certain interest rates (like switching to a fixed-rate mortgage). Sometimes refinancing can provide a short-term cash flow in the event of a major life change, such as a divorce or needing to remove a cosigner due to a layoff in the household.

How to refinance with bad credit

If you want to refinance a loan but don’t feel that your credit is sufficient, don’t be discouraged! Although it’s tricky, several borrowers have found success in restructuring their home, auto and other personal loans despite lower credit scores.

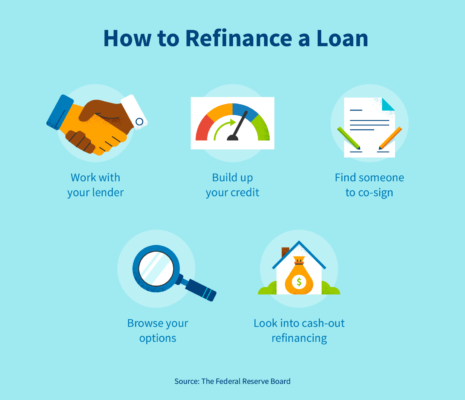

To find success in spite of a poor credit situation, you need to have a strong understanding of the refinancing process and know how to choose the best lender for your situation. Consider these tips and you might even be able to use refinancing to improve some of the conditions of your credit.

1. Talk to your lender

If you don’t quite know where to start your refinancing journey, your current lender is typically the best starting point. They’ll know you better than potential new lenders, and sometimes banks will even make certain exceptions for borrowers they have good relationships with.

Though a less-than-desirable credit history may seem like a red flag, flexible lenders appreciate loyal clients and likely aim to retain their business. As long as your loan agreement is on the newer side, they may be able to help you find an ideal refinancing deal and improve your credit along the way.

“If you’ve had a late payment here and there, that’s fine. Lenders can look past that and take a holistic approach to who you are as an individual rather than just your credit score.”

-Luke Smith, We Buy Property In Kentucky

2. Work on your credit first

While there are many ways to revise loans with bad credit, it might be a better idea to hold off on refinancing until you’ve improved your credit history. Payment problems, repossession and countless other financial issues can lower your credit score and make it harder to build back a stronger credit report.

If you’re considering refinancing your loan, start by making sure you’re paying bills and expenses on time, and understand your limitations when it comes to spending. You might even consider applying for a secured credit card, which halts overspending by requiring a security deposit when you open your account to cover any short or missed payments.

3. Find a cosigner

When applying to refinance a loan, having someone cosign with you could greatly increase your chances of approval. A cosigner is a secondary party who consents to paying back a loan in tandem with you, the primary borrower. This can often come in the form of making up for parts or full amounts of payments that you may miss.

Some lenders favor borrowers with cosigners because it can further convince them that you will be able to pay the loan off, which can be a plus if you have a poor credit history. However, make sure you and your cosigner understand the potential risks that payment issues can present to the cosigner’s credit.

4. Shop around for the best deal

Whether you’re refinancing an auto loan, a student loan or a mortgage, it’s important to explore the options out there so you can make the best decision for yourself. This is especially important for those with a substandard credit history, since refinancing can be an opportunity for improvement.

Weighing the pros and cons of different loan options could end up being a major money-saver, given the constantly changing terms and interest rates of different loan agreements. Explore different lenders and offers using the Internet and local news sources, but be wary of solicitors and advertisements that seem too good to be true, as they could be scams.

5. Consider a cash-out refinance

Cash-out refinancing, usually used for mortgages, allows you to take out a new loan worth more than the amount of your initial loan. As you pay off your initial loan, you receive the difference in cash, but the equity in your home decreases depending on the amount.

The payment received through a cash-out refinance can be used for several purposes, including paying off credit card debts. This could be a great way to improve your credit and more easily refinance other loans in the future. Talk to your financial advisor to make sure the risks of cash-out refinancing your loan won’t outweigh the benefits.

Refinancing different loans with bad credit

Although the general process for refinancing is fairly standardized, there are some key procedural differences among the many types of refinanceable loans. An auto loan agreement won’t have the same terms and conditions as a mortgage loan, and a student loan is not refinanced in the same way as a personal loan.

Understanding the differences between the processes for various loans is crucial for successfully refinancing, especially if you don’t have an ideal credit history to back you up. Take note of what qualifications you must meet outside of your credit report in order for a much smoother refinancing process.

Here are some examples of different types of loans and tips for refinancing:

- Auto loans: Since your goal is to decrease the amount you owe on your car each month, be mindful of lenders that impose high interest rates, as these loans often cost a lot more due to high annual percentage rates.

- Student loans: Most student loan refinancing organizations allow you to cosign on your loans with a parent or another trusted party, which could be helpful because most younger students don’t have much of a credit history yet.

- Home loans or mortgages: In order to refinance a mortgage with bad credit, it’s important to ask your lender, mortgage broker and other experts a lot of questions to avoid making a decision that could worsen your credit.

- Others include personal loans, small business loans and credit cards.

“Even if you have poor credit, you’ll often still have the potential to save money on your monthly payment, even with a slightly higher interest rate. Currently, with interest rates at historic lows, it’s quite possible to save hundreds per month by refinancing with poor credit.”

-Forrest McCall, Don’t Work Another Day

Being as informed as possible can help you make progress toward better credit, rather than away from it. The key is to make sure each loan is right for you at that time and that it will pay off on your credit report in the long run.

Government options for refinancing a mortgage with bad credit

If you don’t find success consulting your current lender or through a cash-out refinance, consider exploring the following government agencies that offer refinancing options for mortgage loans.

The Federal Housing Administration (FHA)

This agency offers three different refinancing programs:

- Streamline refinance: Lowers monthly installments with less paperwork for those who have been making payments on time.

- Rate-and-term refinance: Adjusts the term and the interest rates of a standard loan to create a new FHA loan that requires confirmation of income and credit.

- Cash-out refinance: Standard cash-out refinancing process for those who have been making their mortgage payments on time for at least a year and maintain 20 percent home equity.

The United States Department of Agriculture (USDA)

The USDA also offers a streamline refinance program for lower-income individuals with USDA loans. Like other government programs, you have to provide evidence of yearlong on-time mortgage payments, but there is no examination of credit history.

The United States Department of Veterans Affairs

Those with a VA loan and a low credit score can avoid extensive appraisals or credit examinations with a VA interest rate reduction refinance loan. This program allows the borrower to refinance their mortgage loan without out-of-pocket payments, which are included in the standard loan installments.

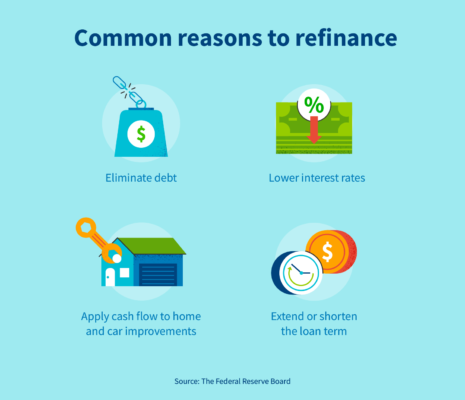

Common reasons to refinance

Refinancing a loan can present an exciting opportunity to improve your credit. There are several specific reasons a borrower may decide to refinance their loans, but it always depends on the person and their specific situation.

Borrowers tend to refinance when they’re dealing with a less-than-favorable financial situation, but experts usually say it’s not wise to refinance right after a major financial purchase like a house or a car. Here are some of the most common motives that drive borrowers to refinance.

Change the loan term

One of the most typical reasons borrowers refinance a loan is to modify the length of their loan agreement. When you increase or decrease the term of your loan, you are also adjusting the amount you will have to pay in monthly installments, as well as the interest rates you will face.

When you decrease your loan’s term, you can pay it off sooner while having to make higher payments each month. Extending the length of your loan could have the opposite effect, where you’d be paying less each month but making payments for much longer. Deciding between these options will depend heavily on your long-term financial goals and where you are in your credit history.

Pay lower interest rate

Refinancing is often sought after because it can lower the interest rates you encounter while paying off your loan. Interest typically adjusts in tandem with your monthly installments. If those rates are lowered, your payments should fall as well.

According to the Consumer Financial Protection Bureau, this should be a good thing if you’re dealing with bad credit, since those in your situation don’t usually qualify for lower interest rates on loans. Borrowers usually decide when to refinance loans based on when market conditions are showing very low interest rates.

Fund improvements

Using your payments from a cash-out refinancing, you can put money back into the house, car or whatever else your loan covers. However, for mortgage loans, this could reduce your home equity, so keep in mind that less money will likely end up going to you if you were to sell your property. For those with a poor credit history, consulting a financial expert or exploring other options, such as a home equity loan, might be a good idea.

Pay off debt

Credit issues often go hand in hand with debt obligations, and refinancing can provide an opportunity to help those struggling to pay off certain debts. Debt management can get kind of messy, but many refinance the various amounts they owe into a single loan through debt consolidation. Falling interest rates that come with refinancing a loan can also ease the process of paying off those debts.

“If you have high consumer debt which caused you to have bad credit, some credit counseling agencies can help you renegotiate the balance and repayment plan.”

-May Jiang, Offit Advisors

Even though many lenders look for a strong credit report when refinancing, don’t let that stop you from progressing toward the loan that works best for you. Ultimately, it’s important to follow the correct refinancing procedures and make it clear that lenders can always trust you to work toward a better credit report. Once you have successfully refinanced, use it as an opportunity to build back your credit and set yourself up for future borrowing success.