Disclosure regarding our editorial content standards

You go to pay for your drink at a gas station or check out some books at the library, but your hand closes around empty space instead of your trusty wallet. You dig around your bag or pocket, until your heart sinks as you realize that it’s happened to you: your wallet is lost.

Having a lost or stolen wallet can have some serious long-term consequences when it comes to your credit and financial security. Before panic sets in, here are some steps to take to help you locate your wallet.

1. Stay calm

To stay grounded before your search, take a few deep breaths in through your nose and out through your mouth. This can help ease your mind and give you something to focus on other than the stressful situation at hand. With a refreshed mind, you can begin the search for your wallet with a fresh perspective and, hopefully, less panic than before.

Try: Taking three deep breaths, 10 seconds each, in through your nose and out through your mouth.

2. Retrace your steps

Before you panic that your wallet is gone forever, it’s important to think carefully. Try to put your last moments before realizing your wallet was gone into context: You paid your bill at a restaurant for lunch and had your wallet; could you have left it on the table? This will help identify your last steps before your wallet disappeared and narrow down the search radius.

Try: Making a mental list of the last three places you know you had your wallet within the last few hours.

3. Check where it’s likely

It can be tempting to look everywhere and leave no stone unturned when searching for your wallet. However, it’s more likely to be somewhere that you leave it every day (like in your glove compartment under old paperwork) than somewhere you’ve never left it before (like the fruit bowl in your kitchen).

Check the most common places it’s usually kept—like a hallway table, a coat pocket, another purse or your glove compartment.

Try: Searching in and around the three most common areas where you usually leave your wallet.

4. Search without destroying

When looking for your wallet, keep in mind that you should be searching the surrounding areas for it, not destroying them. As tempting as it can be, don’t rip apart the inside of your car or your living room looking for it. This can often just make the situation more stressful when you have to clean and reorganize an entire room that you tore apart.

Try: Remaining level-headed and carefully searching a spot before moving on.

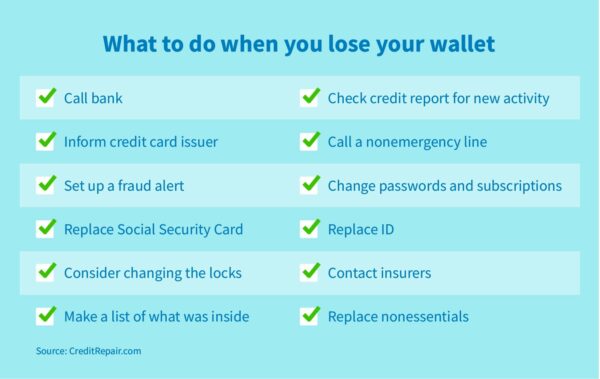

What to do when your wallet is gone

Once you’ve searched in all the usual spots and still turned up nothing, it’s likely time to accept the fact that at least for right now, your wallet is lost. To mitigate this situation and keep it from getting worse, here are the steps to take when your wallet is gone.

1. Call your bank

After the initial panic wears off, you should call your bank and report your debit cards as lost or stolen. This will pause the cards that were in your wallet and render them unusable, and a new one will be shipped to the address they have on file.

This is vital to do ASAP, because if someone uses your cards before you’ve reported them as missing, getting the money they spent back can be hard (if not impossible). The sooner you report your cards as stolen, the easier it will be to dispute the charges the thief made and get your money back.

If you end up recovering your wallet after you’ve notified your bank, then you’ll need to wait until your new cards come and destroy the old ones.

2. Inform your credit card company

After your bank, you should make a call to your credit card company and do the same thing. You’ll want to be sure to tell your credit card issuer that you want to report your card as lost and freeze your card, not cancel it.

This will freeze your credit card so it can’t be used, and your issuer will send you a new one. However, canceling a credit card is a completely different process and could end up harming your credit score, so you’ll want to be sure to tell your card issuer the right thing.

3. Set up a fraud alert

Once your cards have been paused and aren’t able to be used, it’s recommended to set up a fraud alert with one of the three credit reporting agencies—Equifax®, TransUnion® or Experian®—so no one can open a new line of credit using your information. You’ll only need to alert one of the credit bureaus, and that bureau will report the fraud alert to the other two so they can open their own fraud alerts.

Fraud alerts remain in place for 90 days and require new lines of credit to be verified with additional identity checks. This means that if someone attempts to take out a loan or open a new credit card with your information, the lender will call the number on file for you to verify the request.

4. Replace your Social Security card

If you made the mistake of keeping your Social Security card in your wallet, then you’ll need to issue a credit freeze with the three major credit bureaus. This prevents new lines of credit (like credit cards or loans) from being opened in your name until you remove the freeze yourself. Issuing and removing a freeze will usually cost you anywhere from $2 to$10.

Once you’ve frozen your credit, you’ll need to contact the Social Security Administration for a new card.

5. Consider changing the locks

If you keep a spare key in your wallet or have identification with your address on it, it may be a good idea to change your locks. A thief may have the key to your home, your address and plenty of other personal information about you from your wallet. Even if it’s just for peace of mind, it’s better to be safe than sorry when your wallet can contain so much sensitive material.

6. Create a list of what was in your wallet

After you’ve canceled the big items in your wallet, you should make a list of everything else you remember being in your wallet. Sit down and think hard about it, and don’t think any detail is too trivial to write down.

If you end up filing a police report, then every detail about what it looked like and what was inside can help them identify your stolen wallet if it gets turned in.

In the future, it’s a good idea to keep digital scans of all your important cards and documents (such as your license, Social Security card and membership cards) in case something happens.

7. Check your credit report for new activity

Even if you get your cards canceled right away and it doesn’t look like any fraudulent purchases were made, it’s still recommended to monitor for any fraudulent activity and check your credit reports.

You’re eligible to request one free credit report per year from each of the three credit reporting agencies. You should do this after your wallet and cards have been reported as lost or stolen and scan the reports for any activity you don’t recognize. If anyone made a purchase or opened up a new line of credit using your name, you may need to dispute your credit report with the credit agency in question.

8. Call a nonemergency line

Even if your wallet just fell out of your pocket at the park, you should still consider calling a nonemergency police line to alert them. They’ll keep a description of your wallet on file in case it gets turned in, or in case a thief is apprehended and it’s on their person.

9. Change passwords and subscriptions

After you’ve done what you can to locate and report your wallet as missing, you should update any subscription services you have so you don’t get charged any monthly fees to your missing cards. Remember to update the card you get charged to as soon as your replacement arrives so you don’t get charged a late fee.

Though you hopefully don’t carry around an index card with your passwords on it in your wallet, it’s still recommended to change your passwords after losing your wallet. This is a breach of your personal sense of security, so even if it’s for your own peace of mind, you should update passwords to your banking accounts and any other personal accounts.

10. Replace your ID

Replacing your ID or license is one of the more frustrating aspects of getting your wallet replaced. As soon as you can, you should call or visit your local DMV to get a replacement license, as driving without proper identification is illegal in most states.

Check the requirements for your state to ensure you have the proper materials needed to verify your identity and get a replacement issued. Most often, you’ll need proof of residency in the state (like a utility bill to your address and in your name), your birth certificate and your Social Security card.

11. Contact your insurers

If your insurance cards were in your wallet, it’s recommended to contact your insurer and let them know. They can send you new insurance cards, as well as set up an alert so your missing IDs don’t get used. Many insurance cards have built-in fraud detection through identity verification, but this can help prevent future fraudulent claims.

12. Replace nonessential items

Once you’ve taken care of the more important aspects of losing a wallet, then you can turn your attention to replacing the other items in your wallet that were less important. This can include nonessentials, like:

- Library card

- Gym membership ID

- Any cash

- The wallet itself

Tips for keeping your wallet secure

To keep from losing your wallet in the first place, there are several things you can do to keep your wallet secure.

One important tip is to keep your wallet in a secure, zipped location, like a purse or jacket pocket. Though it may be more convenient to keep it in an easier-to-reach location, like your back pocket, this spot is more vulnerable to pickpockets and may fall out.

Another way to keep your wallet safe is to invest in a tracking system that you can operate from your phone or computer. This involves placing a tracking chip on things you want to keep track of, such as your wallet, and helps you locate them via GPS.

Losing a wallet is no fun, and can be even more headache-inducing when you realize how many phone calls you have to make and cards to get reissued. Luckily, you can go out with confidence knowing exactly what to do if you happen to lose your wallet to keep your credit from needing to be fixed down the line.