Disclosure regarding our editorial content standards.

So you’ve come into some extra cash, and are considering using it to pay off your car loan early. Before you jump all in and start spending your money getting your loan balance down to $0, there are a few things to consider about your car loan and the potential ramifications of paying it off early. Read on to learn more about the potential impacts on your credit and finances.

What to consider beforehand

It may seem like paying off your car loan early is a slam dunk, but there are several other factors to consider before you go all in to pay down your loan.

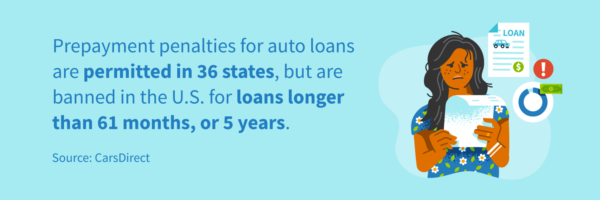

Potential repayment penalties

Some car loans come with prepayment penalties, or fees charged if you pay off your loan early, to deter you from doing so. Not every loan agreement comes with these fees, so be sure to carefully review the terms of your loan and decide if paying off your loan early makes these extra fees worthwhile.

test

Other debt appraisal

Think critically: do you have other debt that should be attended to before your auto loan? If you have other loans or credit card debt with a higher interest rate or annual percentage rate (APR) than your car loan, it may make more sense to pay off that debt first to save yourself from paying additional accrued interest.

Budget flexibility

When considering covering the costs of your auto loan, especially in full, reflect on your monthly budget and other payments you make each month, such as your rent or credit card bill. If paying your loan off early would stretch your budget too thin or render you unable to cover your other monthly payments, then you may want to reconsider paying your bill in full—though you could increase your monthly payments (more on that later).

Advantages of paying off car loans early

It’s important to know what the upsides are when deciding whether or not to pay off your loan early, like how much you may save on interest and the money you’ll have freed up for other expenses.

Save on interest

Your monthly auto loan payments are composed of both the principal amount (the amount you initially borrowed) and the interest and fees (the cost of borrowing from a lender). While no auto loan will look exactly the same, it may save you long-term money on interest if you pay off your principal amount ahead of schedule.

The exact amount (if any) you’ll save on interest will depend on the terms of your loan and whether you have a precomputed or simple interest loan. Review the terms of your loan and talk to your lender if you have any questions.

Take on full ownership sooner

While you may be the one driving the car and footing the bill for gas and repairs, the lender technically owns your car while you’re making payments. Once you’ve paid the loan off, the car’s title gets switched over to your name—which comes in handy if you want to sell or trade the vehicle down the road.

More money for additional expenses

If you have a high monthly payment, then paying your loan off early means that money gets freed up to use for additional expenses. It may make sense for you to pay off your auto loan so you can focus on putting more money into your other loans or mortgage, or to build up your sinking fund.

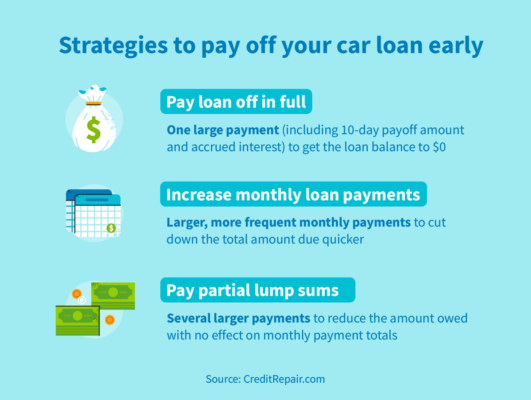

3 strategies to pay off your car loan early

Once you’ve considered your financial situation and decided that paying off your car loan early is a good move, you may be wondering how to do so. You generally have three options for paying off your car loan (or any loan) early: paying in full, increasing monthly payments or paying in partial lump sums.

Pay off in full

If you have the money, making one lump-sum payment in full is the simplest way to pay off your car loan early. You’ll need the 10-day payoff amount (including accrued interest since the last monthly payment) to make the full payment, which you can send as a check or pay online. Be sure to double-check that your account reflects $0 before moving on.

Increase monthly payments

One way to pay off your car loan sooner without making huge payments is to make more frequent payments each month. This allows you flexibility in how much and how often you’ll pay, plus it helps save you both money and time down the road.

Pay partial lump sums

If you have some money to make a dent in your car payment, then you can make a large payment to reduce how much you owe. While this won’t have any effect on your monthly payment, it can dramatically cut down how long you’ll be making payments.

How paying off your car loan early affects your credit

Any sort of major change to your credit history, including paying off a loan, may cause your credit score to decrease slightly. Luckily, if you have a positive credit history with no derogatory marks, this drop should be temporary and you should see your score rise again after a month or two.

However, if you have poor credit or no credit score, then it may make more sense to keep your car loan open, as this could help your credit more than paying it off. This is because a car loan is a line of credit that is reflected in the total number of accounts you have, which helps build your credit history. Loans of all kinds also help improve your credit mix by showing you have a diverse borrowing history.

Keep in mind that once your car loan is paid off (whether early or on time), it will remain on your credit report for up to 10 years. As long as your payments were made on time while you were still paying the loan off, the loan will reflect positively on your credit report and score.

None of this means you definitively should (or should not) pay off your car loan early. It’s all about what works best for you and your current financial situation, so be sure to consult with your financial advisor if you’re on the fence. No matter what you decide, check your credit beforehand to ensure you’re making the right credit decisions.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263