Disclosure regarding our editorial content standards

No matter how diligent you are with your finances, you might make less-than-ideal money choices sometimes. Maybe you can’t live without your daily Starbucks or you’re a sucker for meal delivery apps. But have you ever examined just how much you’re shelling out to fund your vices? If you did, you might be surprised to learn how much they’re actually costing you—and the potential harm they can have on your credit.

What you might think of as a harmless daily coffee habit (or whatever your preferred vice may be) can actually be a huge drain on your wallet. Spending on different habits here and there can add up in big ways if you’re not careful—and could pose a threat to your credit if you use a credit card to fund them. Read on for a cost breakdown of some of the most popular expensive habits, plus some cheaper alternatives to consider if you find your eyes bulging when you realize how much they’re costing you.

1. Drinking

Americans spent an average of $579 per person on alcohol in 2019—but that’s just the average. The amount you spend on alcohol varies widely depending on what you drink, how often you drink and where you drink it. For example, say you only drink on the weekends with friends, but you do it at trendy bars and restaurants where a single cocktail might cost $12 or more. Having just two expensive drinks every weekend adds up to $96 a month. That’s a yearly tab of $1,152!

Total estimated yearly cost: $1,152

Saving tips

The easiest way to reduce your alcohol spending is to simply drink less, or order less expensive drinks. Consider replacing your weekend trips to the bar with something less costly, like hosting a game night at home. Opting to drink at home makes this easy—for example, picking up a $7 six-pack comes to $1.17 per drink. If you’re itching to go out, take advantage of happy hour deals.

2. Smoking

The average cost of a pack of cigarettes is $5.51, but the actual cost varies greatly depending on what state you live in (the $5.41 you’d pay for a pack in Wyoming more than doubles to $12.85 in New York, for example). If you smoke a pack a week, that’s an extra $286.52 spent per year. A pack-a-day habit sets you back around $165.30 per month, and a whopping $2,011.15 per year. Multiply that by five years and you hit $10,055.75—that’s enough for a down payment on a home.

Total estimated yearly cost: $2,011.15

Saving tips

The surefire way to cancel out smoking costs altogether is to quit. Of course, quitting this addictive habit is no easy task, so you might need to wean yourself off instead. Even reducing your pack-a-week cigarette intake to a pack every two weeks can cut your yearly cost in half to $143.26 per year.

If you’re struggling to quit, you might consider Nicotine Replacement Therapy (NRT), which uses nicotine-replacement products, like patches or gum, to reduce withdrawal symptoms. While you’ll still have to shell out cash for these products, you’ll ultimately save money in the long run if they help you kick the habit for good.

3. Eating out

Eating out might be one of the most universal habits, whether for the sake of convenience or because you love trying new restaurants with friends. Americans spent an average of $3,526 per year on food away from home in 2019. The average cost of a fast-food meal is $6 or less, which is fairly affordable for a one-time expense. But say you spend $6 on lunch Monday through Friday. You’re looking at $30 a week, $120 a month and $1,440 a year—that could be enough for two round-trip tickets to Europe!

Total estimated yearly cost: $1,440

Saving tips

While many people eat out for convenience, it’s also a favorite way for people to spend time together and socialize. That said, you don’t need to completely cut out this habit to save money. Finding ways to save in this area might just mean spending more time planning ahead.

If you love going on weekly or monthly dinner dates with friends or your partner, that’s fine—but maybe commit to making your own lunches during the week instead of hitting the drive-through. If you’re rushing out the door every morning and breakfast is the meal you often spend on, prepare some grab-and-go breakfast items throughout the week or meal prep freezer meals over the weekend. Saving on this habit comes down to determining what you are and aren’t willing to give up, and cutting back where you can so you can still enjoy your favorite restaurant.

4. Using online food delivery services

A hard-to-resist habit for lovers of convenience, companies like Uber Eats, Grubhub, Doordash and Postmates make it easy to have food delivered to our doorsteps at the touch of a button—and a hefty price tag. People spend around $36 per order when using any of the major food delivery apps. Sound expensive? That’s because in addition to paying for your food, you’re also paying a service fee, a delivery fee and a gratuity on top of that—which adds up fast. Even if you only use a meal delivery app twice a week, that amounts to $70 per week, $280 per month and $3,360 per year.

Total estimated yearly cost: $3,360

Saving tips

The only way to save money with this habit is to stop using food delivery apps altogether, or at least reduce how often you use them. It might feel tough to let go of the convenience these services provide, but it’s ultimately more of a “nice to have” than a “need to have” expenditure. Even splurging on food delivery once a week adds up to $1,680 a year—not a small chunk of change.

If you can, try and determine the main reason you use food delivery apps. Is it because you’re crunched for time when lunch rolls around and don’t have time to go pick something up? Consider packing a lunch instead. Make it simple by packing leftovers from dinner, or meal prepping your lunches on Sunday so you don’t have to think twice about them during the week.

5. Buying coffee

Whether you can’t live without your daily caffeine fix or you just love a good cup of joe, it’s easy to turn a blind eye to $5 here and there at your favorite coffee shop. But repeat those small transactions enough and they can quickly do a number on your wallet if you aren’t careful. For example, a grande (16-ounce) cup of coffee from Starbucks costs about $2—which sounds harmless enough. But if you buy one every morning, you’ll be out $730 over the course of a year.

If you prefer a fancier drink, you might shell out anywhere between $4 and $7. Do this enough times throughout the week and your coffee habit quickly becomes expensive. Even if you only buy a $7 coffee twice a week, that’s an extra $56 a month. Considering the global coffee market is worth hundreds of billions of dollars, there are plenty of people who spend far more than that every week.

Total estimated yearly cost: $730

Saving tips

To cut back on this habit, first figure out why it exists. If your coffee-buying habit is driven by a need for caffeine, making an effort to get more sleep each night might help curb your need for it and help you buy it less often. If you just love the taste of coffee and the morning ritual that goes with it, you can indulge much more cheaply by brewing your own at home. A $9 pound of good coffee can yield around 40 cups, which costs less than a quarter per cup.

6. Wasting food

The average U.S. household wastes 31.9 percent of the food it buys, and we spend a collective $240 billion on that waste every year. That’s $1,866 per household! Wasting food is one of the worst habits to fall into, since you’re literally throwing your hard-earned cash into the trash. However, it’s also one of the more sneaky costly habits that can be easy to ignore. Since we don’t directly see the cost deducted from our bank account—just our usual budgeted grocery transaction—this bad habit can rob us of our dollars without us ever really noticing.

Total estimated yearly cost: $1,866

Saving tips

Falling into this habit is almost always an issue of poor planning and organization. To combat this, take some time to plan what days you’ll cook and at what time. Maybe you simply don’t remember all the items in your fridge and they get forgotten. If that’s the case, keep a list of the food you have on hand that needs to be used that week. Challenge yourself to use everything up before you hit the grocery store again—you might even discover some new recipes you never would’ve thought to try.

7. Frequent beauty or personal care purchases

Trips to the nail salon or spending on your favorite skincare products might be a staple in your beauty maintenance routine, but it’s certainly not cheap: 1.68 million Americans spent $500 or more on skincare products within one quarter in 2020—that’s over $160 per month. Additionally, 31 percent of Americans spend between $26 and $50 monthly on personal care products.

If you can only go two weeks in between nail salon visits, you might be spending upwards of $115 per month on a manicure and pedicure (the average cost of a basic manicure is $22.75, and $35.56 for a pedicure). If you maintain this habit, that adds up to about $1,399.44 for the year! The costs of beauty treatments and personal care products can easily eat up your savings.

Total estimated yearly cost: $1,399.44

Saving tips

If you’re looking to cut back on your spending, assessing this area of your budget is a great place to start. While some spending on beauty and personal care is understandable—we all need haircuts, and taking care of your skin is important—it can be easy to spend too much on beauty products or treatments you want more than you need.

First, cut back on any frivolous spending. If your love for makeup has you impulsively buying every new product that hits the market, be honest with yourself about your habits and make a point to ask yourself if you actually need an item before purchasing it. Next, see where you can reduce the amount you spend on any treatments you get, such as your hair. Can you swap your trendy salon for a more affordable one, or find a place with hair stylists in training? This is one way to significantly reduce the cost of your usual treatment.

8. Retail therapy

We all respond to stress differently, and for some the preferred antidote is shopping. We aren’t talking about shopping for the essentials, which we all have to do to some extent—but rather the kind of shopping you do when you’re sad, stressed or just plain bored. Whatever the cause may be, shopping for things you don’t really need can get expensive fast: Americans spent around $155.03 per month on impulse buys in January 2020. In April of 2020, during the COVID-19 pandemic, that number jumped 18 percent to $182.98 per month.

That amounts to a yearly spend of $2,195.76—all on impulse purchases you likely could’ve done without.

Total estimated yearly cost: $2,195.76

Saving tips

To successfully mitigate a retail therapy habit, it helps to consider why you do it in the first place. Impulse shopping is often spurred by feelings of anxiety, sadness or stress, and these types of purchases can be a mood booster in the moment. One way to stop this habit from burning a hole in your wallet is to find a new, healthier habit to replace it with—preferably one that offers the mood-boosting effects you’re after.

Exercise is one way to increase your level of feel-good hormones, so maybe you can go for a walk outside when you start to feel the shopping itch. Or, if there’s something big you’re saving for—whether it’s a vacation, a new car or retirement fund contributions—motivate yourself to avoid impulse shopping by keeping your eye on the prize with the printable progress tracker below. When you feel the need to shop frivolously, look at your progress tracker and consider how that impulse buy would set you back from a more meaningful goal.

9. Guzzling gas

Gas for your car is a necessary expense. Unless you live in a big city where public transportation is more common than driving your own car, most of us use our cars to get almost everywhere.

On average, each American spends around $3,000 each year on gasoline, but the actual total cost varies depending on where you live. In Montana, gas goes for $2.73 a gallon, but it’s over a dollar more than that in California at $3.90 a gallon. The number will also change depending on how much and how far you drive. Someone who works from home probably fills up their gas tank less frequently than someone who commutes two hours to and from work each day.

But if you’ve never given a second thought to what you’re spending on gas, you might be spending more than you really need to. Someone who never thinks about the cost of gas probably doesn’t plan their driving strategically—that is, running all their weekly errands in one day, mapping out the shortest routes or taking care to avoid a second trip to the store in the middle of the week.

Total estimated yearly cost: $3,000

Saving tips

While you can’t completely eliminate this expense, there are things you can do to reduce it. As mentioned above, being strategic with your driving each week can help you avoid using more gas than necessary. With a little extra planning, you can find the quickest routes to your destinations or knock out all your errands in one day so you don’t have to take an unexpected trip to the store midweek.

In addition to being more thoughtful about how often you use your car, being aware of proper car care and maintenance can also help you use less gas. For example, did you know that underinflated tires significantly reduce your fuel efficiency? They’re the cause of over one billion gallons of wasted gasoline per year in the U.S. Speeding damages your fuel efficiency as well, which significantly decreases at speeds over 55 MPH, and simply lowering your speed from 75 MPH to 65 MPH could reduce your fuel costs by 13 percent.

10. Paying credit card bills late

Using a credit card comes with the responsibility of paying back what you borrow on time every month, and failing to do so can land you in trouble quickly. The ramifications are twofold: the late fees and interest charges that set you back financially, and the impact on your credit score.

On-time payments are the biggest factor affecting your credit score—35 percent—so even missing a single payment can do serious damage. Even if your credit report is spotless, a payment overdue by 30 days can knock 100 points off your credit score. The negative impact of that late payment can snowball the longer you wait to pay it, and the consequences only get worse if you rack up multiple late payments.

Total estimated yearly cost: Varies

Saving tips

There are various options available to help you stay on top of your credit card payments. Some credit card companies let you select your payment due dates—try aligning your payment dates with when you get your paycheck to ensure you always have the funds to pay on time. You can also set up text alerts or calendar reminders about upcoming bills.

Additionally, you can eliminate the possibility of a late payment by setting up automatic payments on your credit card account. This way, the minimum amount owed can be automatically deducted as soon as your bill is issued.

3 habits of frugal people

While taking stock of the habits mentioned above is a great step toward improving your financial habits—and, in turn, your credit—understanding what frugal people do differently in their day-to-day lives can help you take your savings to the next level. It really is the small, daily habits accumulated over long periods of time that have the biggest impact. By implementing just one or two frugal habits into your lifestyle, you can save in big ways in the long term. Here are a few of the things frugal people do differently.

Buy in bulk

Whether it’s food or household products, it’s almost always far cheaper to buy in bulk. Frugal people are willing to sacrifice storage space and spend a little more up front in order to buy everyday items in bulk, ultimately saving money. Not only that, but buying in bulk also saves time and trips to the store. Frugal people know this, and they take advantage of these savings.

Shop for deals

Frugal people typically don’t buy the first thing they find when they have a purchase they need to make. Instead, they do their due diligence scouring different websites, companies and stores to compare prices or learn when the item might go on sale. Shopping around for deals takes time and effort, which is why most people don’t do it. While it requires a bit of initial legwork, hunting down the best deals can save you a lot of money over time.

Think long term

Frugal people are frugal for a reason—usually, it’s so they can attain financial freedom down the line. Frugal people know that their efforts in saving money now will set them up for success later, which is why they’re able to exercise the self-control required to live frugally. They budget carefully, allocate portions of their income to savings and investments and do their best not to exceed their spending limits. They do these things with the big picture in mind, which helps keep them focused and on track each step of the way.

Often the hardest part of changing our bad habits is taking an honest look at exactly what they’re costing us. Understanding how our spending habits are tied to our credit health can motivate us to get serious about our efforts in making more financially sound decisions in our everyday lives.

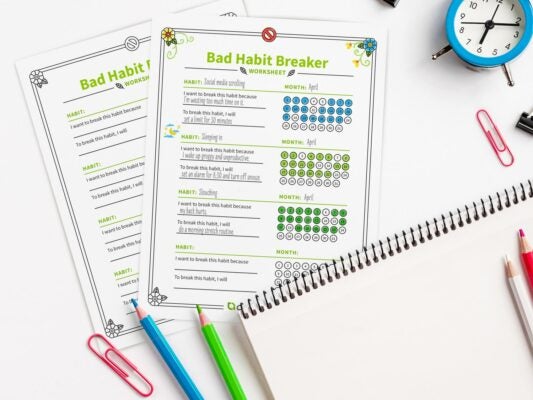

Maintaining a good credit score affects many major aspects of our lives—whether that’s a down payment on a home, financing a car or funding college tuition—and having the discipline to keep that score in good shape starts with cutting out the habit of spending where we don’t need to. To ensure you stay on track, these printables were designed to help you track your progress both toward breaking bad habits and creating consistency in the healthy habits you want to implement in your daily life.

For more guidance on your credit journey, the advisors at CreditRepair.com are available to walk you through all you need to know about the factors impacting your score. If you’re concerned about your credit or need some help repairing a low score, contact CreditRepair.com and begin to take control of your financial well-being.