Disclosure regarding our editorial content standards.

Zombie debt is settled debt—typically several years old or more—that’s been resurrected by a collection agency. This debt could be so old that you’re not even required to pay it anymore, but that may not stop collection agencies from contacting you about it.

So what is zombie debt like in practice, and how do you know if you really have to pay it? Even if it’s been years since you’ve been asked to make a payment, it’s best not to assume you’re off the hook—even if that is likely to be the case. Many cases of zombie debt are fraudulent, dishonest or erroneous, which could still leave you in need of credit repair.

Here’s how to know whether you’re still legally responsible for debts that have come back from the grave.

What is zombie debt, and what types of debts does it include?

While some debts are forgiven at death, others can come back from the dead to haunt you. There are several types of forgotten, forgiven or even fully paid debt that debt collectors can try to collect years after the fact. Frighteningly, these debts may even belong to someone else. Here are the most common types of zombie debts:

- Time-barred debts: These are unpaid debts that have passed the statute of limitations (which varies from state to state).

- Debts no longer on your credit report: Unpaid debts disappear from your credit report after seven years, but not from your lender’s ledgers.

- Settled debts: You and your lender agreed to settle through partial or full loan forgiveness, bankruptcy or another agreed-upon option.

- Debts incurred via identity theft: If your identity is stolen, it could be used for making purchases or taking out lines of credit without your consent or knowledge.

- Record-keeping errors: Creditors regularly buy and sell old debts. The more a debt changes hands, the more chances there are for records to get lost or mixed up.

- Debt buyer ploys: Debt buyers can purchase uncollected debts for cheap and try to collect or kick-start old payments from debtors.

- Forgotten debts: If you’ve moved, changed names, updated contact information or just plain lost track of payments, you could forget about a debt entirely.

The general theme here is that a zombie debt is a debt you either thought had been paid off or didn’t know about. Zombie debt is typically not something you should legally have to pay, but there are cases in which you could be responsible for past debts.

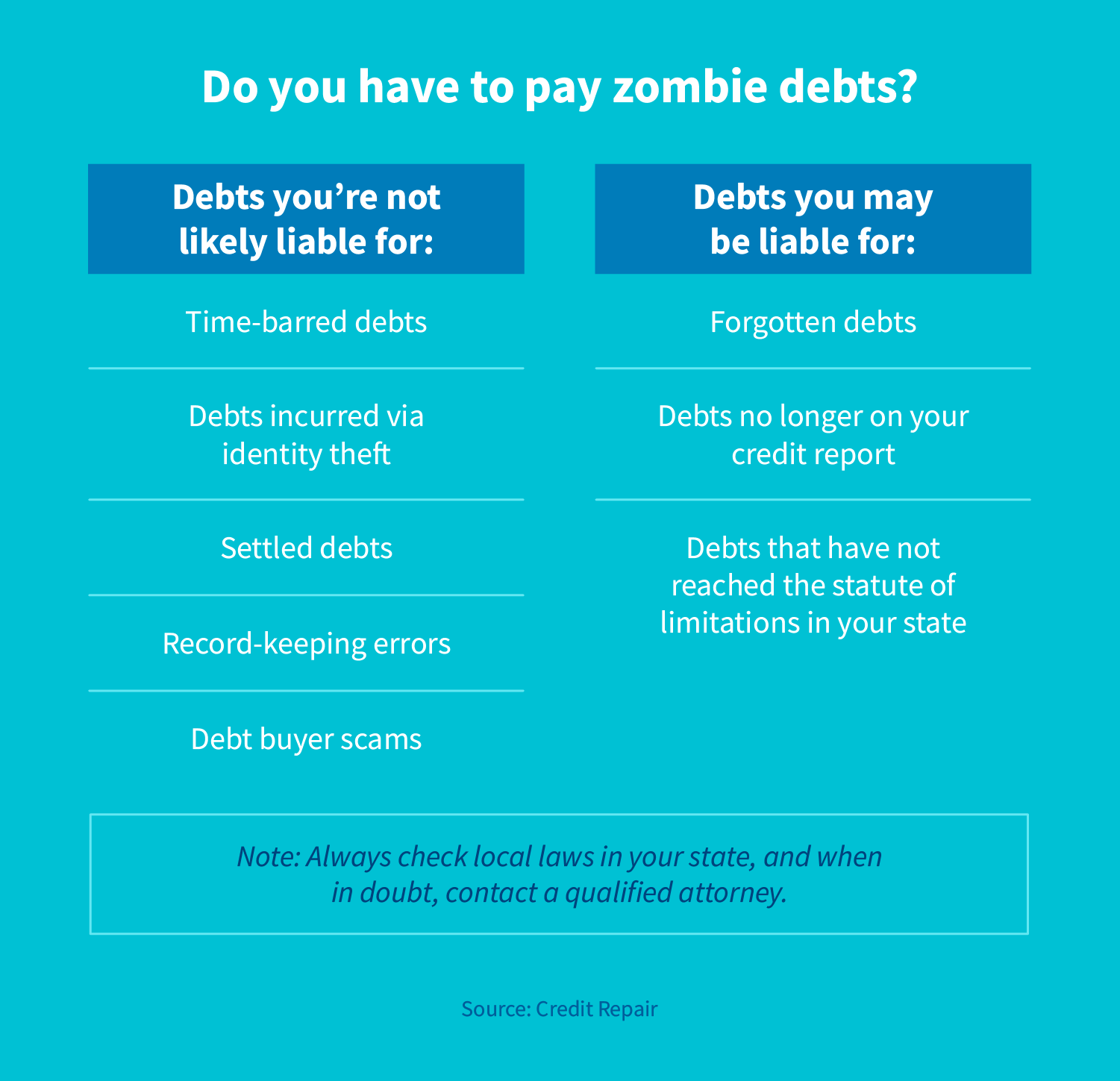

Do you have to pay zombie debt?

Unfortunately, there is no hard-and-fast rule when it comes to paying zombie debts. In many cases, these debts are no longer valid. But in some cases, you could still be on the hook for overdue payments. Here are a few general tips to consider:

- You are generally not liable for debts incurred illegally by identity theft.

- If you have legally settled a debt, you are not required to pay it outside of the terms set with that debt’s lender or collector.

- If a debt is assigned to you by error, you aren’t required to pay it.

- If your debt has exceeded your state’s statute of limitations (typically around three to six years), you can’t be sued for nonpayment.

- You may still be liable for old debts that haven’t been settled, paid or cleared by the statute of limitations.

So how do you know for sure if you have to pay a zombie debt? Here’s a visual guide to debt types and whether you could be held liable for them.

It’s important to note that these are general guidelines, not rules. Some cases can vary. If you’re not sure whether you’re legally responsible for a debt, consider reaching out to an attorney who specializes in debt collection.

How zombie debt works

There are two basic ways you can be hit by unexpected requests for debt repayment: as legitimate debt and as illegitimate debt. Debt collectors have a few tactics for collecting each type.

As legitimate debt

Zombie debts typically start out as funds you legitimately owed. If you settled a delinquent account, for example, a collection agency might still try to get you to continue payments. This could be because they bought your settled debt or because of incomplete records. In this case, you likely shouldn’t pay it because you’ve already settled that debt.

As illegitimate or fraudulent debt

Some zombie debt, on the other hand, comes about by error or as a malicious attempt to get you to pay debts you never owed to begin with. This could be caused by shoddy record-keeping or—as is all too often the case—by unscrupulous or even fraudulent debt collection tactics.

Is zombie debt legal?

You may be surprised to learn that zombie debt isn’t necessarily illegal. Even if you’re no longer liable for the debts in question, debt collectors are allowed to ask you to pay them—they just can’t sue you for them. Even if the debt was established through illegal means (like identity theft), a collection agency can still try to collect it.

If a collection agency is pestering you about debts you’re no longer liable for, however, the Fair Debt Collection Practices Act (FDCPA) has you covered. Under the FDCPA, agencies have to stop contacting you about time-barred, paid or otherwise settled debts if you tell them to stop.

When the statute of limitations applies

The statute of limitations is a big piece of the zombie debt puzzle. Essentially, if a debt has passed a certain time threshold, you’re no longer required to pay it. This length of time varies from state to state but is generally between three and six years. The shortest is two (for oral agreements in California), while the longest is 20 (for promissory notes in Maine).

If your debt has passed the statute of limitations, that doesn’t necessarily mean it’s been forgiven or erased. That just means you can’t be taken to court over it, meaning you’d have little incentive to continue paying. But if you make one single payment at that point, the timeline resets and you could then be taken to court over nonpayment.

How zombie debt affects your credit score

Missed payments hurt your credit score—and lots of missed payments can really hurt it. The good news is that your credit report only tracks debts for up to seven years. Once unpaid debts hit that mark, they’re no longer recorded. In the meantime, you can steadily rebuild your credit by settling debts, paying them off or committing to repayment plans like income-driven repayment.

How to protect yourself from zombie debt and collection tactics

By definition, zombie debt can be unexpected. To protect yourself from the threat of zombie debt, here are a few best practices.

Minimize debt

The best way to keep from being surprised by debt collectors is to accrue as little debt as possible. When you do need to pay for something on credit, establish a realistic payment plan and follow through with it until it’s paid in full.

Protect your personal information

As noted above, zombie debt can be caused by identity theft. Keep your personal information secure with tactics like two-factor authentication, randomized passwords or—at the very least—simply refusing to share it with people or websites you don’t trust.

Monitor your credit

Stay on top of inconsistencies in your credit report by checking it regularly. You could even enroll in credit monitoring services that automatically update you when your personal information is exposed or when your credit changes for any reason.

Keep a record of your debts

Whether you’re actively making payments or are having trouble keeping up, don’t let your debts slip away from you. Attempting to wait out the statute of limitations isn’t an effective strategy, so keeping a careful record of what you owe will help make sure you don’t get an unexpected call from a collection agency.

Be wary of debt collectors

If you’re contacted about a debt you’ve forgotten about—or didn’t even know about—don’t share any personal information. It could be a debt shark trying to get you to start paying zombie debts you’re not liable for. Legitimate collection agencies will have all your necessary information and shouldn’t have to ask you for it.

Creditors have contacted you about zombie debt—what now?

It can come as a shock to get an email, letter or phone call from a debt collector claiming you owe past due funds. If you do, first and foremost, don’t panic. If they’re trying to collect zombie debts, there’s a good chance you don’t need to do anything at all.

Remember to not communicate anything with debt collectors unless you’re absolutely sure the claims—and agency—are legitimate. Your next move will depend on whether you recognize the debt and, if so, whether you’ve already paid or settled it.

What to do if you recognize the debt but haven’t paid it

If you recognize the debt and it’s past your state’s statute of limitations, the collector may have no leverage to require you to pay. Consider reaching out to an attorney or other qualified professional to make sure. If you make a payment before reaching the statute of limitations, the timeline resets to put you back at day one, and they can then take you to court to collect.

What to do if you recognize the debt but have paid it

If you’re being contacted about a debt you’ve already paid off, under the FDCPA, the collector has to stop contacting you if you tell them to stop. Send them proof of your payment (if you have it) and ask them to stop calling or writing to you. If they continue, file a complaint with the Federal Trade Commission (FTC).

What to do if you don’t recognize the debt

If someone is trying to collect on a credit line you never took out, there’s a good chance it’s due to identity theft—or even a scam by the person contacting you. Check your credit report, close any accounts you didn’t open yourself and file a report with the FTC via IdentityTheft.gov. You may want to freeze your credit as well.

We know zombie debt can seem scary, but you can make sure it doesn’t turn your life into a horror movie by following the precautions above. In most cases, these debts are either no longer your responsibility or never were to begin with.

Now that you know what zombie debt is, you can make an informed action plan if a collection agency pops up asking for money. And if you have missed payments on the debt in question, it’s never too late to fix your credit.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263