Disclosure regarding our editorial content standards.

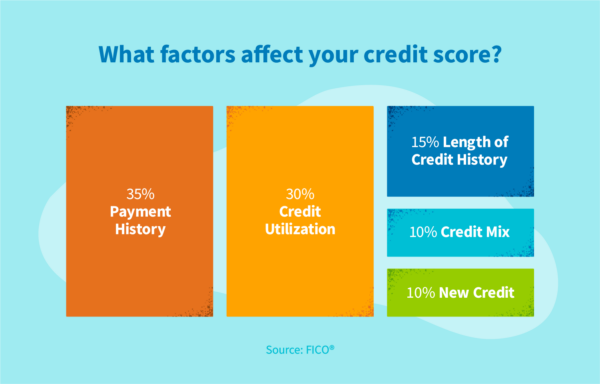

The five factors that impact your credit score the most are payment history, credit utilization, length of your credit history, your credit mix and any new lines of credit.

Many people have an idea about how credit scores work, but there are also quite a few myths, misconceptions and misunderstandings out there.

Read on to learn more about the five most important factors—all of which are within your control. We’ll also cover the accounts that are important for your scores as well as the ones that aren’t. Finally, we’ve got a few tips for how to improve your score and where to begin if you don’t have a credit score yet.

5 key factors that make up your credit score

Most lenders use the credit scoring model from FICO®, which provides a score from 300 to 850. That number changes all the time based on a variety of credit score factors—in other words, your score is a changing reflection of how you use credit.

These are the five most important factors in determining your credit score (in order of importance):

- Payment history

- Credit utilization

- Length of credit history

- Credit mix

- New line of credit

Below, you can see the relative weight of the five key scoring factors.

Together, these aspects of your credit usage reflect how risky you are for potential creditors. The higher your score, the more likely you are to repay (in their eyes). With a high credit score lenders are also more likely to offer you new lines of credit.

Payment history (35 percent of score)

Your payment history is the most important factor in determining your credit score. Put simply, payment history is a reflection of how often you make on-time payments for lines of credit, including credit cards and installment loans.

Late payments are recorded on your credit report, and a series of late payments could signal to lenders that you’re at risk of not repaying your debts.

Why it’s important: Creditors want to make sure that they’re paid back for what you borrow, and payment history is the clearest indicator to them that you’re likely to repay.

Account balances and credit utilization (30 percent of score)

Your account balances and credit utilization represent the second most important factor in calculating your score. Account balances vary significantly between people, so lenders look most closely at credit utilization. Here’s how to calculate utilization:

- Step 1: Add up the total balance of all of your credit accounts.

- Step 2: Add up the total credit limit of all of your credit accounts.

- Step 3: Divide your total balance by your total limit, then multiply by 100.

You’ll end up with a percentage that represents how much of your total credit you’re currently using.

For example, if you have a $500 balance and a $2,500 limit across all of your credit accounts, your credit utilization would be 20 percent.

Why it’s important: Keeping your utilization low demonstrates that you don’t need all of your available credit to keep afloat, so lenders will be less concerned about your ability to take on another account.

Length of credit history (15 percent of score)

The length of your credit history also plays a role in your credit score. Generally, you can think of your credit history in terms of average age in months or years.

Here’s how to calculate your average account age:

- Step 1: Add up the number of years that each of your accounts have been open. (For accounts opened for less than a year, you can use decimals. Example: Six months is 0.5 years.)

- Step 2: Divide the total number of years by your total number of accounts.

For example, imagine you have three credit accounts with the following ages: six months, three years and eight years. We divide the total number of years (11.5) by the total number of accounts (3) and get an average account age of 3.8 years.

Why it’s important: The longer you’ve been using credit responsibly, the more likely it is that you’ll continue to do so. Those with higher average account ages are less risky for lenders.

Credit mix (10 percent of score)

Your credit mix represents the different types of credit accounts you have listed on your credit report. For example, you may have one or more credit cards, student loans, a car loan and a mortgage listed on the report.

Using a variety of accounts responsibly is important to maintaining a high credit score, but there’s no need to open an account just to improve your credit mix.

Why it’s important: Managing multiple types of credit is a positive sign that you’re likely to only take on credit that you can handle.

New line of credit (10 percent of score)

When you apply for credit, your lender has to make a hard inquiry on your credit report before deciding whether to extend a new loan or credit card. This hard inquiry, as well as the new account itself, can temporarily bring down your credit score. However, after a new account has matured a bit, your score will recover from the hard inquiry—as long as you use the credit responsibly.

Why it’s important: Opening too many new accounts around the same time can demonstrate that you will have a lot of debt to pay down at once, so lenders see it as a risk. Try to space out the hard inquiries from lenders so your credit score doesn’t dip.

Checking for errors on your credit report

It is possible for errors to end up on your credit report, which could mean that your score is lowered incorrectly. Credit bureaus report on information passed along to them by lenders, and these lenders occasionally make mistakes in communicating information about your accounts and balances.

When reviewing your credit report, look out for any of the following potential problems:

- New accounts that you did not open. Activity on these accounts will be tied to your credit file, and they may have been fraudulently opened or mistakenly attached to your identity.

- Incorrect balances. An account that lists an incorrect balance—like a credit card you already paid off, for instance—will affect scoring factors. That said, credit bureaus do not receive information every day, so if you just paid off your bill, it may take a few days or weeks to reflect that.

- Missing payments. If you’ve made payments on your accounts that are showing up as late or missing, you’ll want to contact your lender to make sure that this information is reported accurately.

Fortunately, if an error isn’t removed from your credit report, there is a process to file a dispute with the credit bureaus. After submitting your evidence and having it reviewed, the error is likely to be removed, potentially leading to a score improvement.

Accounts that count toward your credit score

Your credit score is calculated using information about various accounts listed on your credit report. Three credit bureaus—TransUnion®, Experian® and Equifax®—keep a record of your accounts, balances and payments. However, not every financial account that you have is listed on your credit report.

Your report will include information about your installment and revolving credit as well as any accounts in collections—and all of these accounts combined help determine your score.

- Installment credit includes debts for a fixed amount paid back on a set schedule according to the interest rate. For example, student loans, car loans and mortgages are forms of installment credit.

- Revolving credit includes debts that enable spending up to a certain limit with varying payments each month. For example, credit cards and other lines of credit are common types of revolving credit.

- Collections accounts are unpaid debts that are usually at least 180 days behind on payments. In addition to installment and revolving credit, medical bills can also end up in collections, which lands the debt on your credit report.

All of the accounts that are on your credit report have an effect on your score, though the exact effect may vary based on how long the account has been open, how frequently you pay on time, what the account’s balance is and other factors.

What does not affect your credit score?

In addition to installment credit and revolving credit, you likely have many other financial accounts and obligations. In most cases, these accounts will have no bearing on your credit score.

Here are a few things that do not directly affect your credit score:

- Checking your credit score. You can check your own credit score, which is considered a soft inquiry, without affecting it.

- Getting a copy of your credit report. Each of the three credit bureaus allows you to get a free copy of your credit report annually without any effect on your score.

- Checking, savings and investment accounts. While having access to more money can indirectly improve your score, these accounts do not directly show up on your report.

- Rent, utilities and cell phone payments. Consistently paying all of these accounts is a smart financial move, but none of them have a bearing on your credit score. (Rent can potentially show up on your credit score, but only if you opt in to rent reporting service. Otherwise it doesn’t affect your credit score, and this isn’t typical.)

- Income. Though a higher income may make it easier to pay down your debt, your income is not a direct factor in determining your credit score.

Even though these accounts and actions don’t directly affect your score, having good financial habits in one area tends to help out in others as well.

What negatively affects credit score?

A number of actions can negatively affect your credit score, from making late payments to filing bankruptcy. Notes on your credit report called negative items keep track of the actions that are likely decreasing your score.

Here are examples of negative items that could be bringing down your score:

- Late payments on any of your credit accounts

- Repossession of a piece of property, like a vehicle, that was collateral for a loan

- Foreclosure of a property for which you had a mortgage

- Bankruptcy filing related to debts you are unable to pay

- Collections accounts for delinquent debt

Additionally, your score could be negatively affected by too many new credit accounts, a lack of credit history, a poor credit mix, an inadequate payment history or high credit utilization.

If your credit score is lower than you’d like it to be, it can often be helpful to work with a credit repair company. These companies specialize in helping you review your report, make a plan to improve your credit and file disputes with the credit bureaus, if necessary.

Best ways to improve your credit score

The best ways to improve your credit score all revolve around the five key scoring factors. Knowing these factors and acting accordingly will help you raise your credit score over time.

Here are a few key tips that you can apply consistently as you improve your score:

- Always pay your full balance on time. Whether you’re paying your credit card statement or making a loan payment, on-time payments for the full amount will help your payment history.

- Watch your utilization. Having credit is beneficial, but using everything available to you won’t help your score. Try to use one-third or less of your available credit limit across all cards.

- Avoid closing old accounts. In many cases, keeping your old accounts open will continue to have a positive effect on your score. This is because your average age of credit will stay higher if you don’t close older accounts.

With patience, anyone can have a strong credit score, which opens up the possibility for better interest rates and even an excellent mortgage.

How to start building credit if you don’t have a score

If you haven’t yet started using credit, you may not have a credit score at all. Credit bureaus can only report on your actual credit usage, so if you’re just entering the world of credit, your score may not yet exist.

Getting started isn’t difficult though: just taking out a loan or opening a credit card will be the beginning of your credit file. That said, getting a first line of credit can be difficult—since you don’t have a credit score, lenders don’t know how much of a credit risk you are.

There are three great options for building credit if you don’t have a score:

- Open a secured credit card. A secured credit card uses a deposit system to make sure that you’ll pay your full balance. Because these cards are low risk for lenders, you can usually get one without a credit score. Your activity is reported to the credit bureaus, which helps build your score.

- Get a co-signer on a loan. Someone else with an established credit score can help you secure a loan, and the payments you make can help you increase your score over time.

- Become an authorized user. If someone else—usually a family member or spouse—has a credit card and adds you as an authorized user, the account activity will be reported on your credit file as well.

As you begin your credit journey, be mindful to regularly check your credit report and credit score to see how you’re progressing.

No matter where you’re at with your credit, having a detailed understanding of what factors make up your score can help you make more informed choices with your finances. With time and responsible usage, a good credit score is within reach.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263