Note: If you are interested in making investments with your money after reading this article, we recommend you check with a financial adviser who can provide you recommendations that fit your unique needs and advise you of any tax implications.

One of the tips almost everyone has heard about saving for retirement is that you need to diversify your portfolio, but what does that even mean? Put simply, it means having different types of investments to help you protect yourself financially.

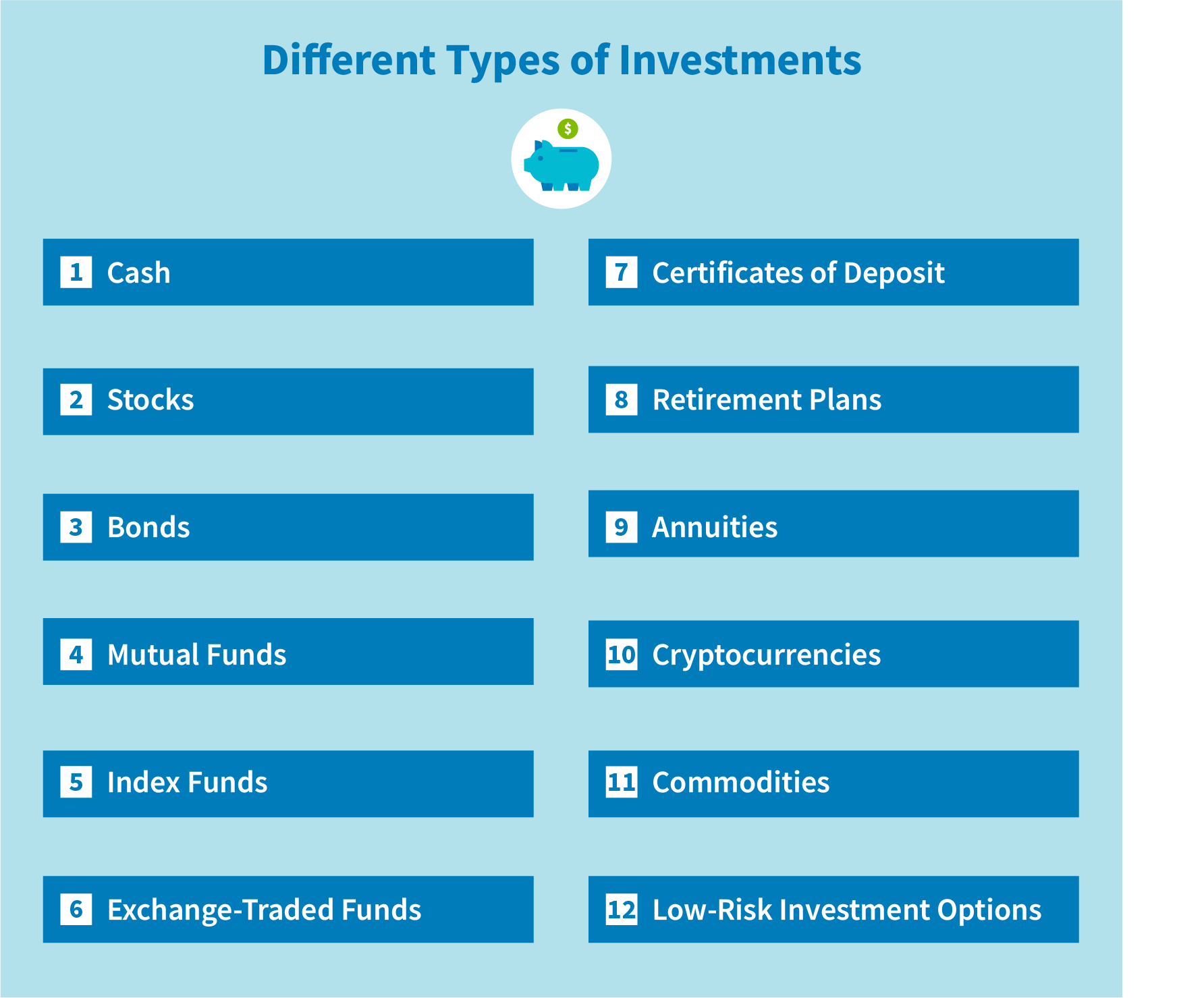

Having different types of investments helps ensure that at least some of them are performing well at any given time. This can help you build wealth in the long run and mitigate temporary losses in certain areas of your portfolio. Different investment types are also useful for different things. Check out 12 different investment types below to understand the pros and cons of each.

1. Cash

What is it? Cash investments aren’t bills in the mayo jar under your mattress. They’re low-risk investments such as money market accounts, certificates of deposit or even cash in your savings account.

Pros. Cash investments are easy to access or have short-term returns. That means the money is more likely to be available to you to use as needed for current expenses.

Cons. Cash investments typically don’t yield high returns. They’re generally better for short- or long-term savings to stabilize your finances rather than build your wealth.

2. Stocks

What is it? Stocks let you invest in specific companies and reap a share of their profits. You can earn money by selling the stock when the price goes up or by receiving dividends, which are a portion of the company’s profits paid to shareholders periodically. However, not all stocks pay dividends.

Pros. When you invest in a company that grows rapidly or sees great profits, you can make a lot of money, even in a short amount of time. A varied stock profile can help you make a good return over time.

Cons. The stock market is volatile, and there are no guarantees. You can also see large losses, especially in the short term.

3. Bonds

What is it? Bonds are investments that involve you lending money to a corporation or government entity. The entity agrees to pay the bond back upon the maturation date with extra interest so that you earn a profit.

Pros. You know how much your returns will be because the amounts are fixed, and bondholders are always paid before stockholders, which can help mitigate risks.

Cons. Bonds can take many years to mature, making them less liquid. You typically have to wait until the full maturation date, which can be as long as 30 years, to cash out bonds.

4. Mutual Funds

What is it? Mutual funds are investments in a variety of assets, including money market accounts, bonds and stocks. Many investors put money into the mutual funds, and each takes a return according to what they invested. Typically, these funds are managed by broker firms or financial advisers.

Pros. Mutual funds are a good way to diversify because they’re a diversified investment in themselves, which can also help mitigate the risk of loss. Some people also like that the funds are controlled by professionals.

Cons. You don’t have control of the mix of what’s in your mutual fund. You also pay fees for the management of the fund.

5. Index Funds

What is it? Index funds are a specific type of mutual fund that are designed to align with a specific market index such as the Dow Jones or the S&P.

Pros. You can easily understand how your investment is faring by following the rise and fall of the major index in the news. These also tend to be designed to create low-risk and long-term, steady gains.

Cons. You won’t make large short-term gains, and you may experience large short-term losses during periods of recession.

6. Exchange-Traded Funds

What is it? Exchange-traded funds (EFTs) are groupings of assets similar to mutual funds, but they’re traded more like stocks. They also follow one of the major indexes like index funds.

Pros. EFTs let you own a variety of stocks at a lower price point, and because one action buys and sells all stocks within the EFT, it can cut down on broker fees.

Cons. You don’t have as much liquidity and flexibility because you can’t buy or sell stocks that are part of an EFT without taking action on the entire investment.

7. Certificates of Deposit

What is it? CDs are offered by financial institutions such as banks. You agree to leave a sum of money in an account for a period of time, and the bank shares the interest rate it earns on that money with you once that time period is over. Typically, the periods last from three months to five years.

Pros. CDs are extremely low risk as there is a fixed and guaranteed return. They’re usually also FDIC-insured.

Cons. The rate of return is fairly low. You also can’t liquidate a CD before the maturity period is reached without paying penalties.

8. Retirement Plans

What is it? Retirement plans include 401(k)s, IRAs and pensions. Typically, these are plans you pay into out of pretax income during your life to save money specifically for use during your retirement years.

Pros. Retirement plan contributions are often pretax, which can reduce your current tax burden. If you have an employer-sponsored retirement plan, the employer might match your investment, which can help you save faster.

Cons. The IRS limits pretax contributions per year for all types of retirement plans. There are also steep tax penalties for withdrawing retirement savings early.

9. Annuities

What is it? Annuities are a type of insurance product. You make premium payments over a certain amount of time, and when the policy matures, cash payments are made to you. Cash payments might be made monthly, quarterly or annually, depending on how the annuity is structured.

Pros. Annuities can be fairly safe investments if the company is stable because they’re a written contract that if you make certain payments, you’ll get cash payouts in the future.

Cons. If you stop paying premiums for any reason, you can forgo all your investment. Annuities can also be complex and hard to understand, so it’s important to consult with an accountant or financial advisor before investing in one long-term.

10. Cryptocurrencies

What is it? Cryptocurrencies are digital currencies such as bitcoin. They are not tied to the performance of the dollar, and they’re mostly based on blockchain technology.

Pros. Because they aren’t linked to dollar performance, cryptocurrencies can continue to perform when other economic vehicles are failing. They’re also more difficult to track.

Cons. Cryptocurrency and cryptography can be a complex, difficult topic for people who are not well versed in it. You might also find that cryptocurrency is harder to spend, as many providers of goods or services have not yet caught up to this payment method.

11. Commodities

What is it? Commodities are goods such as livestock, energy or metal. You can invest in these things on the commodities market.

Pros. Commodities often react opposite to stocks and bonds, making them good for diversification. They also do well with inflation.

Cons. Commodities are extremely volatile, which means you could experience large gains or losses in the short term.

12. Low-Risk Investment Options

What is it? Low-risk investment options are those that almost certainly ensure a return on your investment. Savings accounts and CDs are examples of low-risk options.

Pros. It’s almost impossible to lose money with the lowest-risk investments. They also tend to be simple and easy to understand.

Cons. You won’t get a high rate of return, especially in the short term. For example, average savings accounts offer returns ranging from a fraction of a percent to around 2%.

Investment Resources

While there are websites and apps—such as Stash or Acorns – that can help you research investment options, the best step you can take is to contact an experienced financial advisor and create a plan of action that supports your goals and needs.