Lenders use the credit score as a tool to determine the likelihood that you, the customer, will repay or default on a debt. Higher credit scores are associated with a track record of borrowing responsibly to meet life’s needs, paying bills on time and keeping debt to a manageable level. Lower credit scores point to a habit of paying late, excessive debt, lack of credit diversity, credit immaturity or lack of experience with credit products.

The range on a FICO score (the score used by most mortgage lenders) is 300 to 850. VantageScore’s most current version uses the same numerical range. Most mortgage lenders look at FICO scores generated by all three of the major credit reporting agencies (Equifax, Experian and TransUnion).

Each lender sets its own criteria for what it considers a “good” or “bad” score. Most create categories that look something like this:

<500 Bad

501-600 Poor

601-680 Fair

681-760 Good

761-850 Excellent

(Actual cut-off points vary.)

Loan eligibility

The first way in which a credit score impacts a home purchase is the mortgage lender’s minimum score for loan eligibility. If your score isn’t at least 620, many mortgage lenders simply won’t consider your application at all.

Note: although it’s technically possible to get an FHA loan with a score as low as 500, you’ll have to jump through quite a few hoops:

- Find a lender who participates in bad credit loan programs

- Meet other eligibility requirements

- Pay much higher costs

Interest rates

Another way in which the credit score influences a home purchase is in the interest rate. After you meet minimum eligibility requirements, available loan products get progressively better as your credit score goes up. Lenders typically offer several interest rate categories to accommodate borrowers in different credit score ranges.

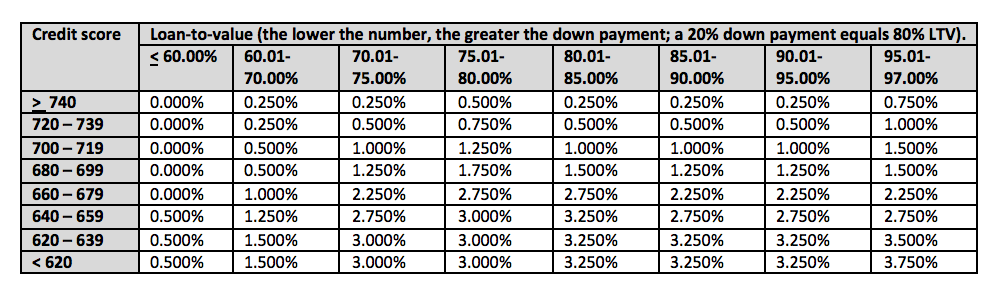

Fannie Mae’s loan-level pricing adjustments give us an idea of how lenders adjust rates for borrowers with different credit scores. (You should also understand that besides credit score, the other factor that most heavily influences mortgage interest rates is the size of the down payment.) For loans made after September 1, 2015, borrowers with excellent credit (740 or higher) and who can make a substantial down payment get the strongest advantage in the form of the lowest penalty.

Indeed, any borrower who can make a 40% down payment will be considered for the most advantageous loans. A borrower with excellent credit is presented with the most advantageous terms even when the down payment is just 3% or 5% of the purchase price. By contrast, a borrower who makes a 3% down payment and has a poor credit score (659 or lower) will face higher costs for the life of the loan.

The following matrix shows how loan cost is inversely proportional to borrower qualifications:

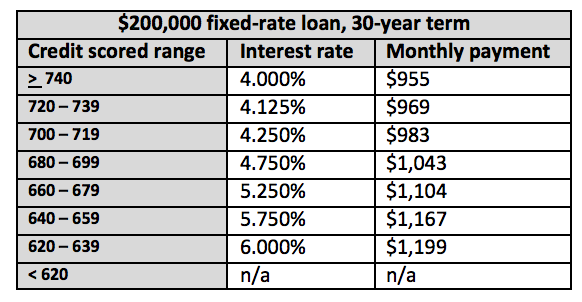

For illustration, let’s look at the actual numbers a borrower might face. Our hypothetical applicant can’t afford to spend more than $1,000 per month on the mortgage payment. The current average rate on a fixed-rate, 30-year traditional mortgage is around 4% (give or take a few thousandths of a percent, depending on the lender). Our borrower wants a $200,000 loan.

Result A: bad credit results in smaller home buying budget

If our applicant’s credit score is below 700, he may not be able to buy the home he wants because the higher interest rate will eat into his monthly budget. To stay under $1,000 per month, the maximum he can borrow with a score of 699 is $191,700. With a score of 639, he can only borrow $166,800.

Result B: bad credit leads to higher monthly homeownership costs

For a borrower who is willing and able to stretch his budget, credit score variations get expensive. Fifty dollars a month may not seem like much, but it could just as easily cover some other homeowner expense, like a utility bill, perhaps. When we look at the lifetime cost, the numbers are impressive (and not in a good way). A borrower with a credit score of 740 will pay $143,739 in interest over the thirty year life of the loan. When the score drops to 719, the interest goes up to $154,197. The cost of going from “excellent” to “good” in this case is $10,458.

The applicant with a score of 639 or lower feels much greater pain. The $200,000 loan will cost nearly $3,000 extra per year, money that could surely be put to good use elsewhere. Over the life of the loan, the extra interest charges add up to almost a quarter million dollars ($231,677)! That’s about 61% more than what the borrower with excellent credit will pay, and more than enough to put a child or two through college.

The bottom line

Home buying power pivots on credit. Borrowers with poor credit have to work harder to get through the application process and may be forced to take smaller loans because of the additional monthly cost. Raising your credit score even one category can easily result in a five-figure cost savings over the life of the loan, and reaching “excellent” status opens the door to buy the best home you can afford by applying the funds to the purchase price rather than the loan costs.

Learn how you can start repairing your credit here, and carry on the conversation on our social media platforms. Like and follow us on Facebook and leave us a tweet on Twitter.

Questions about credit repair?

Chat with an expert: 1-800-255-0263