Disclosure regarding our editorial content standards.

Each year, millions of Americans are victimized by credit card fraud that often ends up costing them thousands of dollars. And that’s not to mention their carefully curated credit scores or even their identities. In a post-pandemic world, more consumers have made the switch to online and contactless forms of payment, with cybercriminals ramping up efforts and becoming more creative in stealing information.

If you own and regularly use a credit or debit card, there is a chance you may find yourself a victim of credit card fraud at some point in your financial lifetime. Here are 44 sobering credit card fraud statistics that can help you be better informed to protect yourself (and your credit) from future chances of fraud.

Table of contents

- What is credit card fraud?

- Key credit card fraud statistics

- Identity theft statistics

- Steps for reporting fraud

What is credit card fraud?

Credit card fraud is when someone who is not authorized to use your credit card or account information makes purchases you didn’t authorize. In the past, credit card fraud commonly happened as a result of stolen or misplaced cards. However, with a major shift to online purchases in recent years, online credit card fraud has become increasingly prevalent.

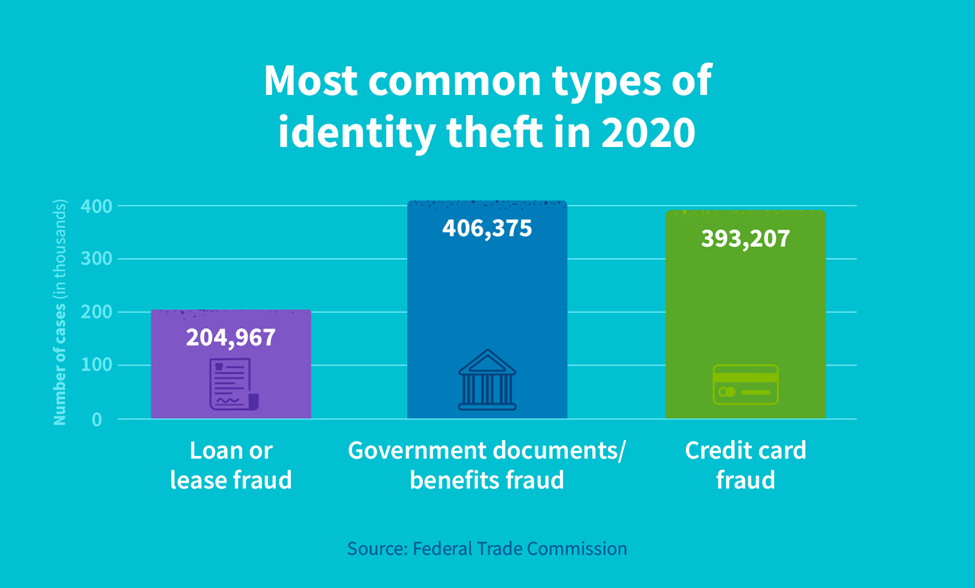

According to the Federal Trade Commission, credit card fraud represented the second most commonly reported type of identity theft in 2020. Read on to learn more about credit card fraud statistics.

Key credit card fraud statistics

Credit card fraud is more common than you may think. Below are statistics on just how prevalent this type of fraud is, followed by information on the most common types of credit card fraud reported and how much is typically lost in fraud.

1. There were over 459,297 reports of credit card fraud in 2020, which includes combined instances of credit card fraud and identity theft (Federal Trade Commission).

2. Research suggests that 86 percent of consumers were the victim of some sort of credit or debit card fraud, identity theft or data breach in 2020, up 6 percent from the previous year (J.P. Morgan).

3. 34 percent of all fraud reports in 2020 resulted in money lost (Federal Trade Commission).

4. In 2020, over 4.7 million reports of fraud were recorded, an increase from the number reported in 2019 (Federal Trade Commission).

5. There were 191,242 fraud reports related to COVID-19 and federal stimulus payments as of July 2020 (Federal Trade Commission).

6. People age 70 or older reported much higher median fraud losses than any other group in 2020 (Federal Trade Commission).

7. 77 percent of businesses reported being a victim of some type of fraud through digital payments (American Express Insights).

8. Reported credit card fraud to new accounts experienced a 48 percent increase from 2019 to 2020 (Federal Trade Commission).

9. In 2020, the states with the highest per capita rates of reported fraud were Delaware, Florida, Georgia, Maryland and Nevada (Federal Trade Commission).

Credit card fraud loss statistics

10. Credit card fraud losses in 2020 added up to a total of $149 million (Federal Trade Commission).

11. The median amount of money lost to credit card fraud in 2020 was $311 (Federal Trade Commission).

12. Worldwide, businesses are expected to lose $75 billion to e-commerce fraud from 2019 to 2023 (Cybersource).

13. Consumers in 2020 reported losing over $3.3 billion to fraud, an increase of $1.5 billion from 2019 (Federal Trade Commission).

14. Of those total fraud reports in 2020, only 373,423 cases had a clearly identified payment method (Federal Trade Commission).

15. Nearly $1.2 million was reported lost in imposter scams by consumers in 2020 (Federal Trade Commission).

16. The most commonly reported card fraud loss in 2020 was in the amounts of $1 to $100, with over 227,000 reports (Federal Trade Commission).

17. The total number of fraud incidents fell between 2019 and 2020, from 5.7 percent of consumers reporting fraud in 2019 to 5.1 reporting in 2020 (Javelin Strategy).

18. Consumers suffered an $850 median loss to imposter scams in 2020 (Federal Trade Commission).

19. The least commonly reported card fraud loss in 2020 was in the amounts of $8,001 to $9,000, with under 3,500 reports (Federal Trade Commission).

20. Each dollar of consumer fraud costs retailers $3.13 (Retail Dive).

Most common types of credit card fraud

21. Credit card fraud accounted for 1.4 percent of all fraud reported in 2020 (Federal Trade Commission).

22. In 2020, card-present fraud in the U.S. was down by 82 percent from 2019 (Cybersource).

23. 53 percent of consumers report that they have been fraud victims during digital payments (American Express Insights).

24. In 2020, new credit card accounts experienced the most fraud at 365,597 reports. Existing accounts only included 33,852 reports (Federal Trade Commission).

25. However, fraud on existing credit card accounts was also prevalent in 2020, with over 33,800 cases reported (Federal Trade Commission).

26. Telephone was the contact method for 31 percent of card fraud reports in 2020 that identified a contact method (Federal Trade Commission).

27. Bank transfers and payments accounted for the highest aggregate losses in 2020, at $314 million (Federal Trade Commission).

28. In 2020, credit cards were most frequently identified as the payment method in fraud reports (Federal Trade Commission).

Identity theft statistics

Credit card fraud is actually a subset of identity theft, and a popular one at that. To keep you educated on this serious topic, here are statistics related to the prevalence of identity theft.

29. Identity theft was the most common type of fraud reported in 2020, with over 1.4 million reports (Federal Trade Commission).

30. In fact, identity theft from credit card fraud spiked in 2020, up 44.6 percent compared to 2019 (Federal Trade Commission).

31. Identity theft was most commonly reported among adults ages 30-39 (Federal Trade Commission).

32. Older demographics, 80 years and older, reported the least amount of identity theft at only 9,915 reports (Federal Trade Commission).

33. Identity theft accounted for 29.4 percent of all fraud reports in 2020 (Federal Trade Commission).

34. Existing credit card accounts were a common target of identity theft with over 33,000 cases in 2020 (Federal Trade Commission).

35. Government documents or benefits fraud was the most common type of identity theft reported in 2020 (Federal Trade Commission).

36. The states with the highest identity theft reports in 2020 were California, Illinois, Texas, Florida and Georgia (Federal Trade Commission).

37. The top metropolitan areas for identity theft in 2020 included: Topeka, Kansas; Lawrence, Kansas; Wichita, Kansas; Manhattan, Kansas; and Tuscaloosa, Alabama (Federal Trade Commission).

38. Approximately 7 to 10 percent of people in the U.S. are victims of identity theft each year (National Center for Victim Research).

39. There were over 737,000 more reported cases of identity theft in 2020 than in 2019, an over 200 percent increase (Federal Trade Commission).

40. The top five reported types of identity theft are government documents or benefits fraud, credit card fraud, other identity theft, loan or lease fraud and employment or tax-related fraud (Federal Trade Commission).

41. Approximately 19 percent of U.S. residents will experience at least one incident of identity theft in their lifetime (Center for Victim Research).

42. Bank fraud was the least commonly reported type of identity theft in 2020 (Federal Trade Commission).

Steps for reporting fraud

As you can see from the above statistics, credit card fraud and identity theft can be both prevalent and devastating. It’s important to arm yourself with knowledge so you can better protect yourself and your loved ones from potential fraud and losses.

1. Alert your credit card company

Your first step should always be to alert the credit card company that you hold the card with, which can easily be done by calling your credit card’s fraud department and explaining the situation. This should be done as soon as you suspect fraud so the credit card company can freeze your account and prevent any further charges.

2. Report fraud to the FTC

Credit card fraud and identity theft reports can be filed online with the FTC. Formally reporting fraud with the FTC establishes proof that you’re a victim and allows you certain rights. When filing fraud with the FTC, you’ll also be given a recovery plan, so it’s important to be as detailed as possible in your fraud or identity theft report.

3. Notify the authorities of identity theft

In addition to filing a report with the FTC, it can also be helpful for your case to file a report with your local police department. When reporting identity theft to the police, you’ll need to bring a government-issued ID, proof of address, a copy of your report with the FTC and proof of theft.

4. Set up fraud alerts

Even if you don’t suspect credit card fraud, you should have fraud alerts set up on all your credit card accounts as a precautionary method. This not only gives you peace of mind but it requires that potential creditors take extra precautions to verify your identity when extending your credit limits.

To learn more about how to keep your hard-earned money in your wallet where it belongs, check out these additional resources on financial safety:

- How to report identity theft

- How to file a TransUnion® dispute

- How to cancel a credit card

- How to dispute a credit report

- How to freeze your credit report

- How to dispute a medical bill

- What is credit insurance and how does it work?

Credit card fraud and identity theft can not only be time-consuming problems to fix, but they can also be dangerous for the potential repercussions down the road.

In addition to lost money and a messed up credit score, your overall safety and security are threatened. Doing what you can to arm yourself with knowledge and security measures is important to make sure the safety of both your information and your money.

Note: The information provided on CreditRepair.com does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only.

Questions about credit repair?

Chat with an expert: 1-800-255-0263