Note: This article is intended as an informational overview only. If you have any questions about your specific circumstances, please contact a tax professional.

Tax deductions, tax credits, tax exemptions—oh my. There are a lot of terms to keep track of when you’re preparing your taxes, and if you’re not careful, you could miss out on some benefits that could reduce your tax bill (and maybe even score you a refund).

What’s a Tax Break?

The term “tax break” can be used to describe anything that decreases how much you owe in taxes—that includes deductions, credits, exemptions and other incentives. Sometimes it also refers to when the government gives certain organizations or people of a certain income level a better deal on taxes.

Everything we’re going to cover here is under the “tax break” umbrella. Now that we’ve established that, let’s dive in.

What’s a Tax Deduction?

A tax deduction is something that lowers your taxable income, which in turn lowers your tax bill. For example, if your annual gross income (AGI) is $50,000 and you get a $5,000 tax deduction, you will be taxed on $45,000.

Almost everyone gets at least one tax deduction, but you have to choose whether you want to take the standard deduction or itemize your deductions.

The standard deduction is a set amount, determined by the government, that you can decrease your AGI by. Your filing status determines how much it will be worth for you. For example, CNBC estimates that if you’re single when you file your 2020 taxes, your standard tax deduction will be $12,400. But if you’re married and filing jointly, it will be $24,800. There are also different amounts for taxpayers who fit into any of these categories:

- Married and filing separately

- Head of household

- Over the age of 65

- Blind

Not everyone can take the standard deduction, so make sure that you can before you decide to rely on it.

Itemizing deductions lets you pick and choose which specific deductions you want to claim out of the hundreds available to you. It will take more work (and more paperwork too), but it might be worth it. The trick is, you need to figure out if itemizing your deductions could save you more money than just taking the standard deduction.

If you’re married and filing jointly, for example, add up all the deductions you think you can take and see if they’re worth more than $24,800. If they are, itemizing is probably the way to go. If they aren’t, it may be best to stick with the standard deduction.

Keep in mind that you should always be prepared to provide proof (e.g., documentation) that you qualify for any tax breaks you claim, just in case you’re audited.

Popular Tax Deductions

If you’re considering itemizing your tax deductions, here are some popular ones that you might want to look into:

- Medical and dental expenses: You can deduct qualified medical expenses that are worth more than 7.5% of your AGI.

- Student loan interest: You can deduct up to $2,500 if you paid interest on your student loans (and this can be done without itemizing).

- Home mortgage interest: This deduction can be more complex, your mortgage servicer should send you a form showing the amount of interest you can claim.

- Charitable donations: If you make any charitable donations, you might be able to deduct their value from your AGI—up to 50%—but limitations may apply.

In addition to these well-known deductions, you can also look into deductions for gambling losses, IRA and 401(k) contributions, self-employment and more.

What’s a Tax Credit?

Unlike a deduction, a tax credit is a dollar-for-dollar decrease in your tax bill, which means it can potentially have a bigger effect on your bill. You can benefit from both deductions and credits at the same time, though, so luckily you don’t have to choose between them.

If you get a refundable credit, you might get money back on your taxes. For example, if you owe $1,000 but you get a credit for $1,500, you can get a $500 refund. However, most credits aren’t refundable.

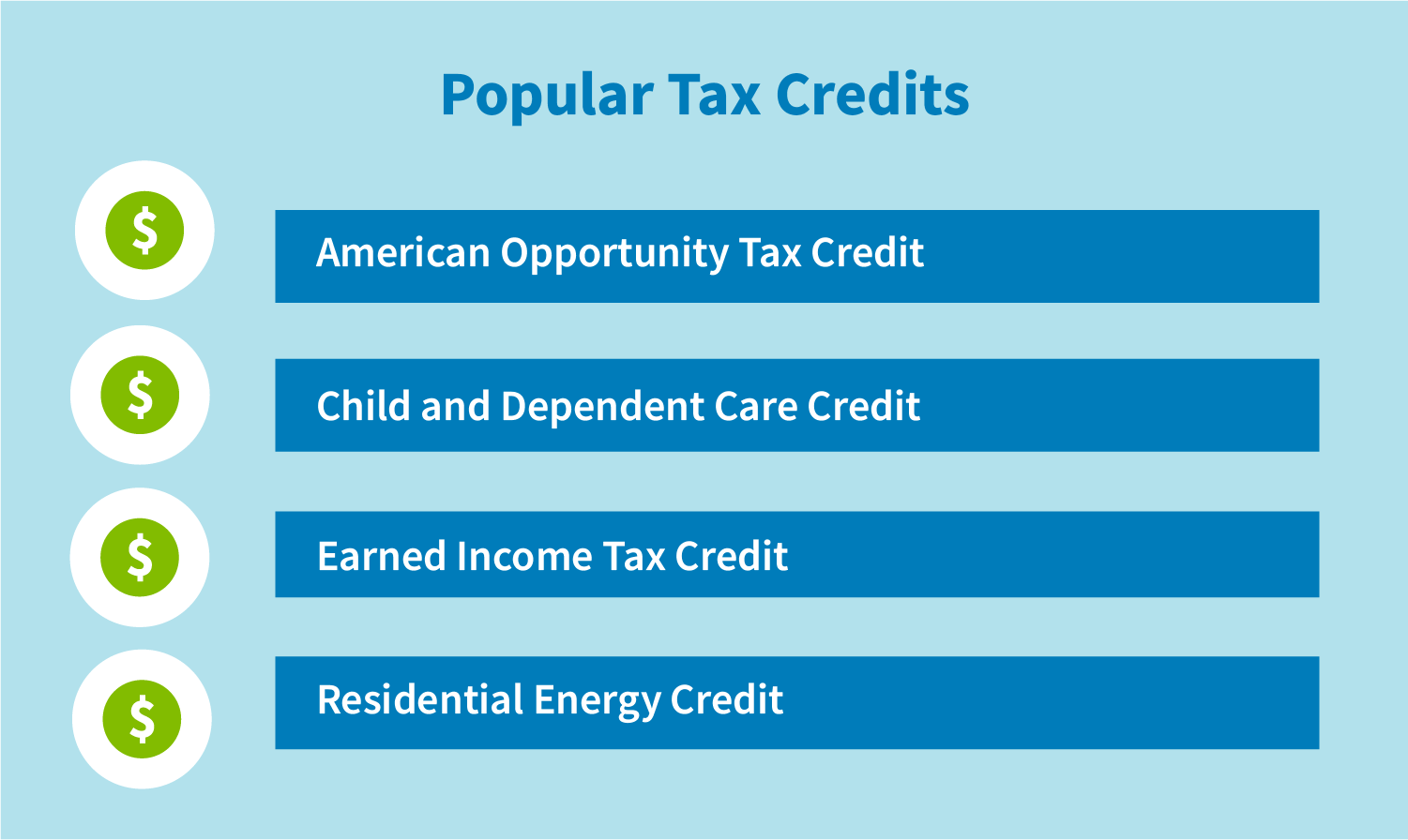

Popular Tax Credits

Check out these popular tax credits—do you qualify for any of them?

- American opportunity tax credit (AOTC): This credit is worth up to $2,500 for education expenses for eligible students, and it’s refundable up to $1,000.

- Child and dependent care credit: Depending on your specific situation, if you’re paying for the care of any children or other dependents you have, you can get your tax bill lowered by a certain amount. The child tax credit or the adoption tax credit may also apply to you.

- Earned income tax credit (EITC): If you have a low to moderate income, you could use this refundable credit to get between $538 and $6,660 on your 2020 taxes.

- Residential energy credit: This credit benefits people who have made their homes more energy efficient by installing things like solar panels and small wind turbines. If you do this, you can get up to 30% of the installation costs back.

Other credits available include the saver’s credit, the lifetime learning credit (LLC) and the premium tax credit (PTC).

What’s a Tax Exemption?

Before the 2017 Tax Cuts and Jobs Act (TCJA) was passed, tax exemptions were basically deductions that allowed you to reduce your AGI just for existing and having dependents. Now that the TCJA is in effect and exemptions are discontinued at least until 2025, other deductions and credits have been increased to compensate. (The standard deduction is worth more now, for instance.)

You may still see people referring to tax exemptions, but unless you’re doing pre-2018 taxes, exemptions probably aren’t relevant to you.

Staying on Top of Your Taxes

Hopefully you can take advantage of some of the tax breaks we’ve covered, but if you have any questions, talk to a tax professional. And no matter what you think your tax bill will be, always make sure to file your taxes and arrange to pay them, whether you do it in one lump sum or through something like a payment plan. Otherwise, you might have to deal with fees and levies—and you can’t escape those by going somewhere over the rainbow.

If you have any questions about current items on your credit report and need help understanding how they affect your credit score, feel free to jump on a phone call with one of our credit advisors.