Cash is becoming the less popular choice when it comes to payment. In 2012, 66% of non-cash retail transactions were made with a credit or debit card. In the past, in order to acquire a debit card, you had to have a traditional checking or savings bank account. More recently, prepaid debit cards have made the option of payment by plastic possible for those who could not qualify for a credit card or who could not or would not bank with traditional financial institutions. As we’ll see, there are significant downsides to going the unbanked route, but are there any cases where prepaid credit cards are a good idea?

There are certainly many choices in the American marketplace, and prepaid debit cards are rapidly becoming widespread. According to the December 2013 Federal Reserve Payments Study, payments from prepaid cards reached a total of 9.2 billion transactions in 2012. Prepaid cards made up 7% of all noncash payments in 2012.

If you’ve had problems with traditional banks, such as excessive unpaid overdrafts, you may get a negative entry in Chexsystems, a credit bureau storing information about checking and savings transactions. An entry in Chexsystems or any number of other similar databanks will render you unable to open a checking or savings account and receive the associated debit card.

Even if your name is not in Chexsystems, you may still get turned away from a bank due to bad credit. Not all banks pull your credit report during a checking account application, but if they do, you can be denied if you don’t meet their guidelines.

If you are unable to qualify for a credit card, you may find yourself researching secured credit cards, which allow people with bad credit to get a credit card. After doing a little digging, you may decide not to go the secured card route as they can have some hefty interest and fees. Interest rates on secured cards run as high as 32% and a typical annual fee is about $29. In addition, secured cards require you to pony up cash for a saving account, money you will not have access to for the life of your secured card.

What if you can qualify for a traditional debit or credit card, but you just don’t believe in banks, or prefer the anonymity of prepaid cards? It’s your choice, but it’s almost always more advantageous to use a traditional debit or credit card than a prepaid card.

However, prepaid cards aren’t all bad. There are some advantages to using one:

- Credit checks in traditional credit bureau and Chexsystems are not run. All you need “to qualify” are funds to deposit.

- You can “direct deposit” your paychecks, if your employer offers this benefit. As a matter of fact, your prepaid card fees may be reduced if you do.

- You can use a prepaid card almost anywhere credit and debit cards are accepted — with certain car rental companies notably excluded.

- Some prepaid card programs offer online bill pay services.

- Since you can never charge more than your available balance, you will usually avoid paying insufficient fund or overdraft fees. Beware: you can’t spend or withdraw more than your balance, but you can get a negative balance because of the fee schedule.

- You have access to funds at most ATM machines.

- Some people claim that prepaid cards help them to stay out of debt, since they can’t spend more money than they have available on the cards.

Let’s consider the disadvantages. The biggest one is the expense of the cards from fees.

There are many prepaid cards on the market, each one with different fee schedules. Some of the fees for prepaid cards include activation fees, monthly fees, point-of-sale (“POS”) transaction fees, cash withdrawal fees, balance inquiry fees, fees to receive a paper statement or for telephone customer service, bill payment fees, inactivity fees, and overdraft or “shortage” fees.

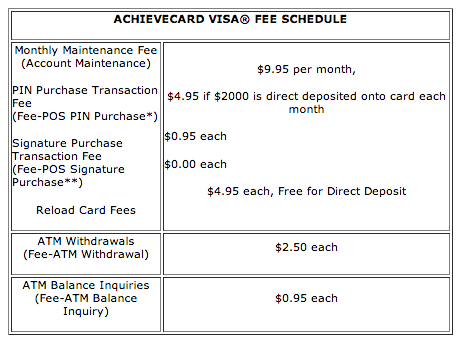

Bankcorp Bank was the biggest issuer of prepaid debit cards in the US for 2012, according to a June 2013 Nielson Report. To give you an idea of what fees look like, we will use the Bankcorp Bank AchieveCard’s published fee schedule (current as of May 10, 2014).

*PIN transactions are those run as a debit card and require your Personal Identification Number.

**Signature transactions do not require the entry of a PIN and are run as a credit transaction.

Prior to January 2013, AchieveCard even charged for paying their bill, but has since stopped the practice. In May 2013, they were ordered by the FDIC to pay restitution to any customer who paid a fee for any form of bill paying using the AchieveCard program. As you can imagine, no-fee bill payment is now standard in the industry.

AchieveCard also does not charge for customer service, direct deposit, automated phone system inquiries, live customer support, online account statements or SMS alerts, but these fees are not unknown in the industry. It’s important to do your homework and make sure the card you select does not charge you for these services.

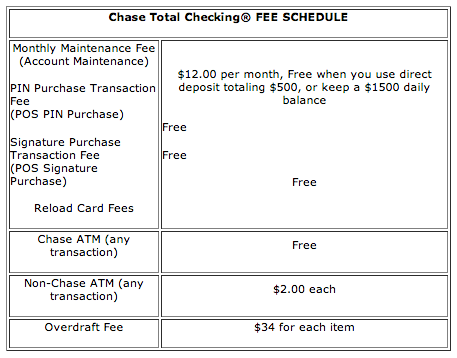

For comparison, we’ll look at what a traditional debit card will cost you. J.P. Morgan Chase is the largest bank in the US. Here are the Chase Total Checking® (which comes with a debit card) fees:

There are ways around fees charged by prepaid card programs:

- Shop around! There are all kinds of programs around which carry reasonable fees.

- Direct deposit your paycheck to avoid or lower monthly maintenance fees. In addition, some programs do not charge to reload your card if you use direct deposit.

- When making a purchase, choose credit over debit. Retailers pay higher fees for credit transactions to the prepaid card company, so prepaid card issuers charge you less when you specify that the card be processed as a credit card rather than as a debit card.

- Get cash back at stores, not ATMs. Supermarkets typically offer $100 cash back on debit cards.

In addition to significant fee traps, there are other disadvantages to prepaid debit cards:

- Prepaid cards don’t help to build credit. In actuality, no debit cards, prepaid or otherwise, help you build credit. Only payment histories for traditional credit cards are reported to credit bureaus. This is why paying extra fees for a secured card that reports your payment history may be worth it.

- You are limited to maximum amounts that can be spent on a card, and limited by a maximum number of transactions. You are also limited by the amount that can be loaded onto a card. Typical limits are $2500, or $10,000 for direct deposits.

- Limited protections. If your card is stolen, the money loaded on the card may be lost. Federal protections that apply to credit cards and debit cards do not apply to prepaid cards. Some cards do offer protections, though. Mastercard’s EveryDay Card is one prepaid card that offers zero liability protections in the case of fraud or unauthorized charges.

As you can see, there are both disadvantages and advantages to prepaid cards. If you really want plastic and can’t get it any other way, a prepaid card may be for you. Since some prepaid cards practically charge you for breathing, the main thing to watch are the fee schedules. Do your homework. If the fee schedule isn’t clearly posted on a company website, stay away. There are too many options out there to sign up with an unknown quantity.

Questions about credit repair?

Chat with an expert: 1-800-255-0263